Nouvelles de la société

Actualités de l'industrie

USA, OH: Starflyer Brewing Co. ready to open its doors in Canton

Taiwan: Taiwan imposes anti-dumping duties on China-made beer and hot-rolled steel

Burkina Faso: Burkina Faso state brewery resumes operations after 17 years of inactivity

USA, FL: Scottyís Bierwerks in Cape Coral announces sudden closing

Nos malts

Nos houblons

Nouveaux houblons

Nos levures

Nos épices

Nos sucres

Nos capsules

-

Kegcaps 69 mm, Vert 147 Grundey G-type (850/boîte)

Ajouter au panier

Kegcaps 69 mm, Vert 147 Grundey G-type (850/boîte)

Ajouter au panier

-

Kegcaps 74 mm, Marron 154 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Marron 154 Flatfitting A-type (700/boîte)

Ajouter au panier

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

-

Crown Caps 29mm TP-PVC Free, Gold NEU col. 4310 (6500/box)

Ajouter au panier

Crown Caps 29mm TP-PVC Free, Gold NEU col. 4310 (6500/box)

Ajouter au panier

-

Capsules 26mm TFS-PVC Free, Purple Opaque col. 2274 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Purple Opaque col. 2274 (10000/boîte)

Ajouter au panier

Recettes de Bière

Certificats

Suggestion

Australia: Foster’s saw shares soaring after alleged takeover rumours

Australia: Foster’s saw shares soaring after alleged takeover rumours

Speculations that Australia's biggest brewer may become a takeover target of buyout funds or overseas beer makers saw Foster's Group shares soaring up 6% to a record high, The Sidney Morning Herald published November 23.

The stock had risen more than 5% to AU$5.87 at 3.10pm November 23, the biggest gains since the Herald reported in August this year that the world's two largest brewers, InBev and SABMiller, and a host of private equity groups were eyeing Foster's.

Foster's chief executive Trevor O'Hoy said at the time he had not "heard any specifics" about a potential bid. But he did little to quash the rumours.

"We could not be in a better place as a company goes, so that does not surprise me, that sort of interest," Mr O'Hoy said in August.

While Foster's raised almost AU$1 billion earlier this year selling its international brewing operations, rivals such as SABMiller and InBev have been driving the global consolidation of the global beer market.

The latest speculation follows a string of deals by private equity in the media space, and comes just one day after Qantas sent its shares to record highs after revealing it had been approached by a consortium lead by Macquarie Bank.

Revenir

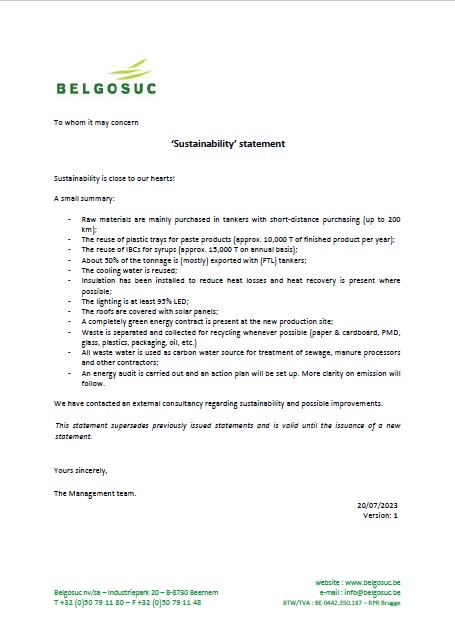

Belgosuc Sugar, Certificate of conformity (EN)

Belgosuc Sugar, Certificate of conformity (EN)

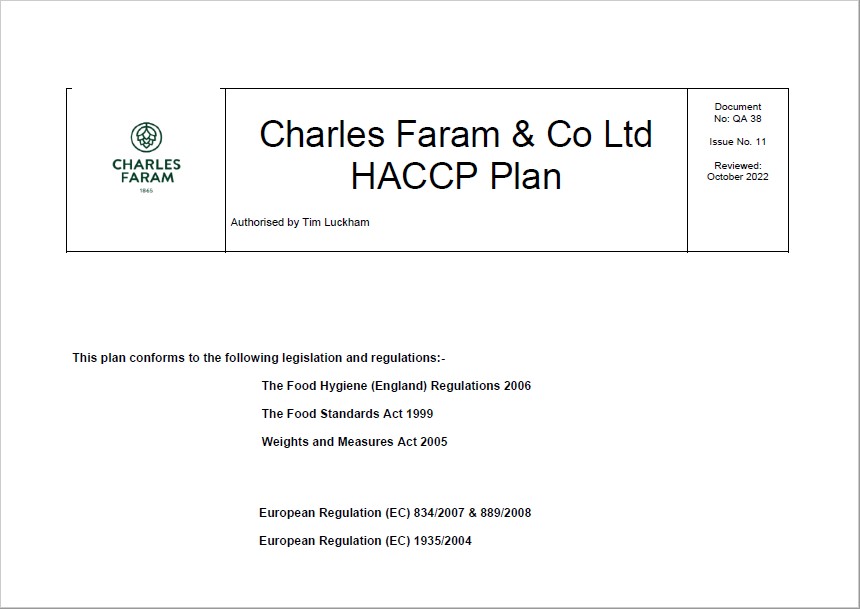

Charles Faram Hops, HACCP Plan QA38, EN 2022

Charles Faram Hops, HACCP Plan QA38, EN 2022

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

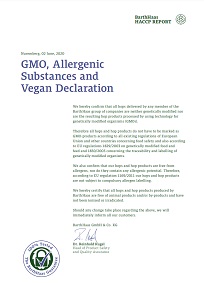

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Fagron Spices, IFSFood Certificate 16089, FR 2024

Fagron Spices, IFSFood Certificate 16089, FR 2024