Votre panier

Nouvelles de la société

Actualités de l'industrie

Ireland: Drinks Ireland research shows sector is vital to local economies

USA, AL: Red Clay Brewing Co. to end operations in March

USA, MO: Minglewood Brewery to close for good on January 18

Brazil: Brazil becomes second-largest market for Johnie Walker whiskey

Nos malts

Nos houblons

Nouveaux houblons

Nos levures

Nos épices

Nos sucres

Nos capsules

-

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

-

Capsules 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/boîte)

Ajouter au panier

-

CC29mm TFS-PVC Free, Vert avec j.abs.oxygene (6500/boîte)

Ajouter au panier

CC29mm TFS-PVC Free, Vert avec j.abs.oxygene (6500/boîte)

Ajouter au panier

-

Crown Caps 26 mm TFS-PVC Free, Noir col. 2439 (10000/boîte)

Ajouter au panier

Crown Caps 26 mm TFS-PVC Free, Noir col. 2439 (10000/boîte)

Ajouter au panier

-

Kegcaps 74 mm, Rouge 102 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Rouge 102 Flatfitting A-type (700/boîte)

Ajouter au panier

Recettes de Bière

Certificats

Suggestion

India: Beer output is on rise

India: Beer output is on rise

Beer is not especially popular in India, but growth is expected to accelerate as the market opens up and an affluent, young, consumer-oriented middle class expands. There are 36 breweries in India, and domestic consumption was an estimated 600m litres in 2002/03. The industry exported 7m litres of beer in 2002/03, and imported 4.4m litres. United Breweries (UB) is Indias leading brewer, with around 33% of the market. Its leading brand is Kingfisher, which alone accounts for one-quarter of the market. In January 2005 Scottish & Newcastle of the UK agreed to pay Rs4.66bn (US$106.5m) for 37.5% of UB, which is controlled by an Indian tycoon, Vijay Mallya. Beer consumption in India was valued at Rs12.7bn (US$273.4m) in 2003 by CMIE.

The Indian wine and spirits industry is much largerIndia, for example, is the worlds biggest market for whisky in overall volume terms. McDowell, with 18% of the market, and Shaw Wallace Distilleries, with 11.2%, are the leading local players. In January 2005, UB emerged as the leading bidder for Shaw Wallace; if the acquisition goes through, the combined company will be the worlds second-largest spirits company. In general, consumption of all alcoholic beverages in India is minuscule compared with that in other emerging markets: a sales volume of around 1bn litres in 2002 was a small fraction of Chinas 21bn litres. Alcoholic beverages (including spirits) carry a high tax burden and are a major source of tax revenue for state governments.

Revenir

Top Hop - Variety Certificate 2021

Top Hop - Variety Certificate 2021

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

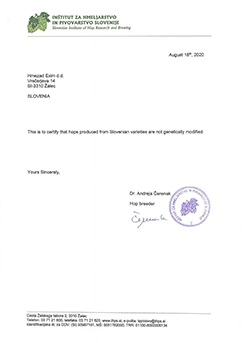

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

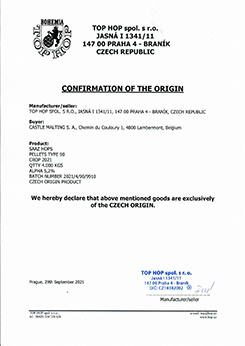

Top Hop - Confirmation of the Origin 2021

Top Hop - Confirmation of the Origin 2021

Crown Caps Finnkorkki Statement

Crown Caps Finnkorkki Statement