Votre panier

Nouvelles de la société

Actualités de l'industrie

India: Pernod Ricard retains position as Indiaís largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Breweryís time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nos malts

Nos houblons

Nouveaux houblons

Nos levures

Nos épices

Nos sucres

Nos capsules

-

Kegcaps 64 mm, Jaune 4 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

Kegcaps 64 mm, Jaune 4 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

-

Kegcaps 74 mm, Or 116 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Or 116 Flatfitting A-type (700/boîte)

Ajouter au panier

-

Kegcaps 74 mm, Marron 154 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Marron 154 Flatfitting A-type (700/boîte)

Ajouter au panier

-

Capsules 26mm TFS-PVC Free, Cyan Transparent col. 2892 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Cyan Transparent col. 2892 (10000/boîte)

Ajouter au panier

-

CC29mm TFS-PVC Free, Vert avec j.abs.oxygene (6500/boîte)

Ajouter au panier

CC29mm TFS-PVC Free, Vert avec j.abs.oxygene (6500/boîte)

Ajouter au panier

Recettes de Bière

Certificats

Suggestion

South Africa & USA: Anheuser-Busch attacks its rival SABMiller

South Africa & USA: Anheuser-Busch attacks its rival SABMiller

Anheuser-Busch, which brews Budweiser, told a New York investment conference that it believed it was close to securing sponsorship rights for the 2010 soccer World Cup in South Africa. Thus it has launched a stinging attack on its competitor Miller Brewing because its shareholders are South African, Business Report News posted on May 30.

The latest in what has become an extremely hostile marketing war between the two leading beer brands in the US sees Anheuser-Busch resorting to what appears to be crass racism to fend off the growing threat of a revived Miller.

Since SAB acquired Miller in 2002, the US-based beer company has managed to halt the decline that saw its market share fall to around 19 %. The former chief of SAB's South African beer division, Norman Adami, is regarded as the chief architect of Miller's revival.

That revival has seen Miller take a much more aggressive approach to the most powerful beer brand in the US, Budweiser. It compares starkly with the almost deferential approach that Miller previously took towards Budweiser.

As part of its campaign, and in a bid to encourage patriotic consumption of Budweiser over Miller, Anheuser-Busch tells US beer drinkers that the profit earned by Miller in the US goes to South Africa. In contrast, according to the campaign, "Anheuser-Busch is an American company whose profits stay in the US".

As part of Anheuser-Busch's campaign, a "Q&A" poses the question: "Isn't Miller brewed in Milwaukee?" The answer given is: "Yes, but 68 percent of the profits from the sale of an SABMiller product go to its foreign owners outside the United States. A majority of SABMiller's owners are South African."

The economic reality is that the flow of funds in the SABMiller group is significantly in favour of the US.

The latest results show that Miller contributed just 22 percent of the group's total earnings before interest, tax and amortisation, while US-based shareholders received over 40 percent of the total dividends paid by SABMiller.

The single largest shareholder in SABMiller is US group Altria, formerly Philip Morris, which sold the struggling Miller group to SAB in 2002. Altria has a 36 percent economic interest in SABMiller. Other US investors take the US holding in SABMiller to over 40 percent. Only one-third of the group's shareholders are based in South Africa.

At the other end of the spectrum, SABMiller bosses were rapped over the knuckles on Friday for their "sense of humour failure" by constitutional court judge Albie Sachs in the matter between the giant beer group and the tiny T-shirt company Laugh It Off.

The court overturned previous decisions by the Cape high court and the supreme court of appeal, stating that there was no evidence that SAB's Black Label brand had suffered economic harm from the "Black Labour" T-shirts.

Revenir

Malt Kosher Certificate July 2025-June 2026

Malt Kosher Certificate July 2025-June 2026

Top Hop - HACCP Certificate 2021-2024

Top Hop - HACCP Certificate 2021-2024

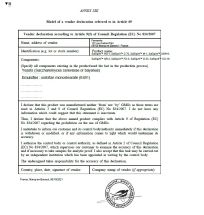

Fermentis Yeast- Non GMO declaration SafSpirit range

Fermentis Yeast- Non GMO declaration SafSpirit range

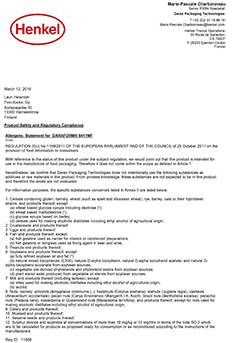

Crown Caps Finnkorkki Product Safety & Regulatory Compliance

Crown Caps Finnkorkki Product Safety & Regulatory Compliance

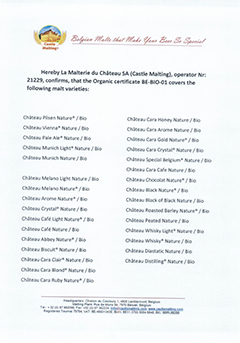

List of organic malts - Castle Malting

List of organic malts - Castle Malting