Votre panier

Nouvelles de la société

Actualités de l'industrie

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nos malts

Nos houblons

Nouveaux houblons

Nos levures

Nos épices

Nos sucres

Nos capsules

-

Capsules 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/boîte)

Ajouter au panier

-

Crown Caps 26 mm TFS-PVC Free, Noir col. 2439 (10000/boîte)

Ajouter au panier

Crown Caps 26 mm TFS-PVC Free, Noir col. 2439 (10000/boîte)

Ajouter au panier

-

CC29mm TFS-PVC Free, Rouge,avec j.abs.oxygene (7000/boîte)

Ajouter au panier

CC29mm TFS-PVC Free, Rouge,avec j.abs.oxygene (7000/boîte)

Ajouter au panier

-

Kegcaps 74 mm, Rouge 102 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Rouge 102 Flatfitting A-type (700/boîte)

Ajouter au panier

-

Kegcaps 69 mm, Orange 43 Grundey G-type (850/boîte)

Ajouter au panier

Kegcaps 69 mm, Orange 43 Grundey G-type (850/boîte)

Ajouter au panier

Recettes de Bière

Certificats

Suggestion

World: Five malting groups dominate global commercial malting capacity

World: Five malting groups dominate global commercial malting capacity

Global commercial malting capacity consists of five malting groups, each controlling 1 mln tonnes or more of malt output, plus a long tail of independent commercial maltsters, RMI Analytics said in their latest report.

From a market share perspective, the commercial industry is led by Boortmalt, at just over 3 mln tonnes, followed by Soufflet (2.33 mln), Malteurop (2.29 mln), United Malt Group (1.4 mln), and Supertime (1.18 mln tonnes). All of these malting groups have a global footprint, except Supertime, which is solely China-based.

The regional malting capacity breakdown is led by Western Europe, at 7.48 mln tonnes. Taking into account Central and Eastern Europe places the wider European total at nearly 11 mln tonnes (including Russia and Ukraine). In total, European capacity stands at nearly 11 mln tonnes – 52% of all commercial capacity and 41% of all malting capacity, including vertical brewer/distiller holdings.

Asia Pacific is next at 24%, dominated by China, followed by North America, Latin America, Australia, and Africa.

Revenir

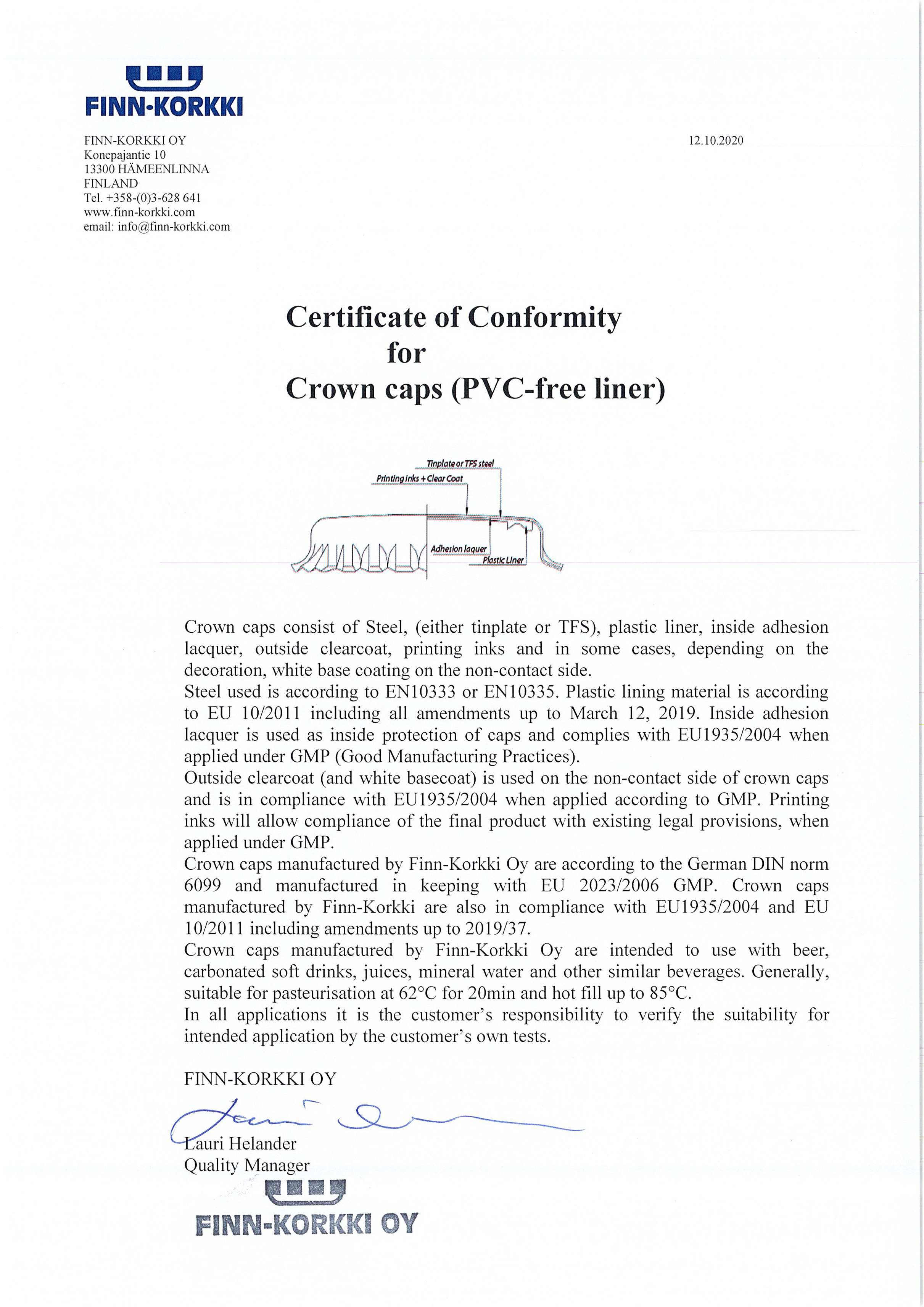

Fermentis Yeast Food Safety Certificate

Fermentis Yeast Food Safety Certificate

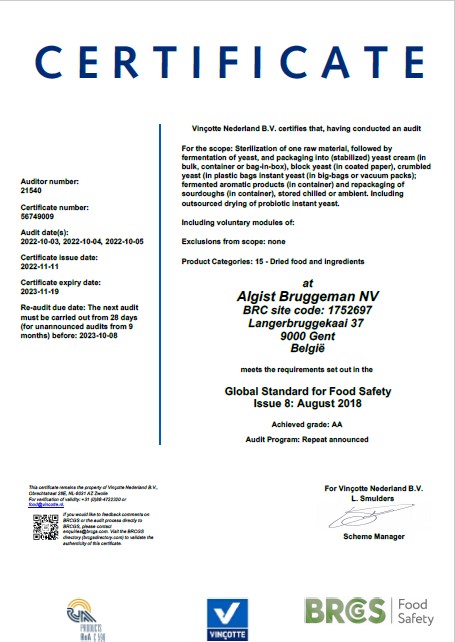

Crown Caps Finnkorkki PVC-free liner

Crown Caps Finnkorkki PVC-free liner

Fagron Spices, IFSFood Certificate 16089, FR 2024

Fagron Spices, IFSFood Certificate 16089, FR 2024

Fermentis GMO-free Declaration

Fermentis GMO-free Declaration

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022