Ваша корзина

Новости компании

E-Malt news

UK & South Korea: New UK-South Korea deal to benefit exports of Guinness, cars, Scottish salmon

UK: UK brewers facing �heavy headwinds� from increased taxation, other issues

Japan: Kirin set to ramp up beer development via proprietary AI

Norway & Sweden: Olvi Group acquires majority share in Brewery International group

Наш солод

Наш хмель

-

AMARILLO (DE) Pellets T90 (5KG)

Добавить в корзину

AMARILLO (DE) Pellets T90 (5KG)

Добавить в корзину

-

TETTNANG ОРГАНИЧЕСКИЙ (DE) Pellets T90 (5KG)

Добавить в корзину

TETTNANG ОРГАНИЧЕСКИЙ (DE) Pellets T90 (5KG)

Добавить в корзину

-

HALLERTAU SMARAGD ОРГАНИЧЕСКИЙ (DE) Pellets T90 (5KG)

Добавить в корзину

HALLERTAU SMARAGD ОРГАНИЧЕСКИЙ (DE) Pellets T90 (5KG)

Добавить в корзину

-

NUGGET (BE) Pellets T90 (5KG)

Добавить в корзину

NUGGET (BE) Pellets T90 (5KG)

Добавить в корзину

-

HALLERTAU TRADITION ОРГАНИЧЕСКИЙ (DE) Pellets T90 (5KG)

Добавить в корзину

HALLERTAU TRADITION ОРГАНИЧЕСКИЙ (DE) Pellets T90 (5KG)

Добавить в корзину

Новый хмель

Наши дрожжи

Наши специи

Наш сахар

Наши крышки

-

Крышки 26mm TFS-PVC Free, Green Transparent col. 2722 (10000/коробка)

Добавить в корзину

Крышки 26mm TFS-PVC Free, Green Transparent col. 2722 (10000/коробка)

Добавить в корзину

-

Крышки 26mm TFS-PVC Free, Red Neu col. 2151 (10000/коробка)

Добавить в корзину

Крышки 26mm TFS-PVC Free, Red Neu col. 2151 (10000/коробка)

Добавить в корзину

-

Крышки для кег 64мм, Красные 102 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Красные 102 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

-

Крышки для кег 74 мм, Оранжевые 43 Flatfitting A-тип (700/коробка)

Добавить в корзину

Крышки для кег 74 мм, Оранжевые 43 Flatfitting A-тип (700/коробка)

Добавить в корзину

-

Крышки 26mm TFS-PVC Free, Bordeaux Red col. 20025 (10000/коробка)

Добавить в корзину

Крышки 26mm TFS-PVC Free, Bordeaux Red col. 20025 (10000/коробка)

Добавить в корзину

Рецепты пива

Сертификаты

Предложения по поиску

China & UK: Scottish & Newcastle plans building new breweries for expansion in China

China & UK: Scottish & Newcastle plans building new breweries for expansion in China

Scottish & Newcastle makes an investment of £30 million to build three breweries in China as it plans to expand into the Chinese beer market. S&N's director for Asia, John Hunt, announced last week that the Edinburgh-based group's Chongqing Breweries joint venture in China would open the three plants over the coming year. He added that S&N would consider buying state-owned brewers if, as the company expects, the Chinese government put them up for sale.

The planned breweries will produce 264 million pints of beer yearly , compared with Chongqing's present output of two billion pints. While that increase may look modest, Hunt said S&N could easily double its production of beer in China.

According to Hunt’s statement S&N's joint venture addressed a potential market of between 20% and 40% of China's population, roughly the same as Western Europe. The company's beer is sold around the cities of Chongqing and Chengdu, and in the provinces surrounding Shanghai.

S&N purchased a 19.5% stake in Chongqing, China's fifth-biggest brewer, for £35m in November. It has an option to increase its shareholding in the brewer, whose biggest brand is Shancheng, to 25%. Chongqing holds about 4% of China's beer market, which is set to grow by an average of 6% per year until 2010, the drinks analysis firm.

Some of that competition will come from S&N's global rivals. Last week Carlsberg, the ninth-biggest brewery in China, said it planned to be the fifth-biggest by 2010. Anheuser-Busch and Heineken acquired breweries in China last year. Anheuser-Busch, famous for its Budweiser beer, has a 10% stake in Tsingtao, the Chinese market leader, which sells six billion pints a year.

Обратно

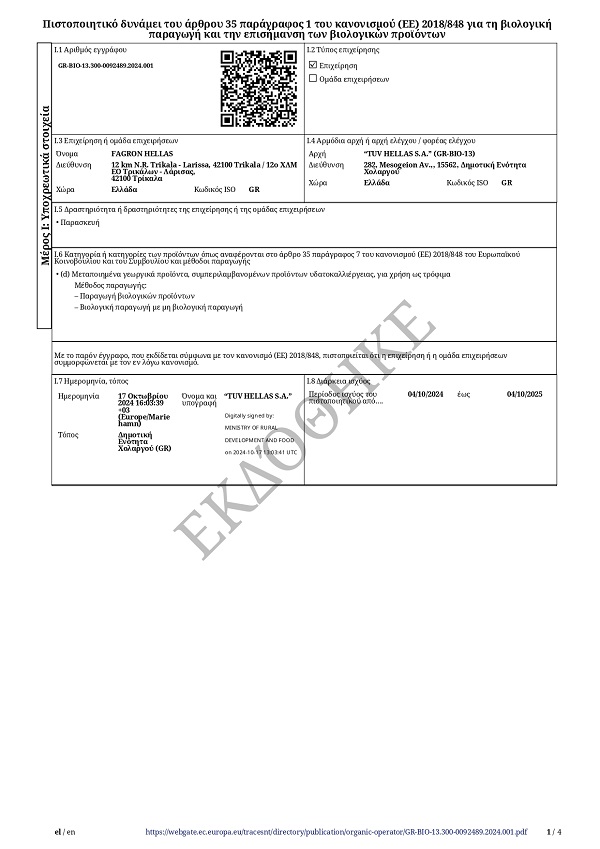

Fagron Spices, Organic Certificate 2024 - 2025

Fagron Spices, Organic Certificate 2024 - 2025

Bio-Zertifikat DE - Juli 2025-März 2028

Bio-Zertifikat DE - Juli 2025-März 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

ChF Hops GMO-free Certificate

ChF Hops GMO-free Certificate