Seu carrinho

Novidades da empresa

E-Malt news

Ireland: Drinks Ireland research shows sector is vital to local economies

USA, AL: Red Clay Brewing Co. to end operations in March

USA, MO: Minglewood Brewery to close for good on January 18

Brazil: Brazil becomes second-largest market for Johnie Walker whiskey

Nossos maltes

Nossos lúpulos

New Hops

Nossos fermentos

Nossas especiarias

Nossos candy sugars

Nossas tampinhas

-

Kegcaps 64 mm, Azuis 141 Sankey S-type (EU) (1000/caixa)

Adicionar

Kegcaps 64 mm, Azuis 141 Sankey S-type (EU) (1000/caixa)

Adicionar

-

Kegcaps 64 mm, Amarelas 4 Sankey S-type (EU) (1000/caixa)

Adicionar

Kegcaps 64 mm, Amarelas 4 Sankey S-type (EU) (1000/caixa)

Adicionar

-

Kegcaps 69 mm, Orange 43 Grundey G-type (850/caixa)

Adicionar

Kegcaps 69 mm, Orange 43 Grundey G-type (850/caixa)

Adicionar

-

Crown Caps 26mm TFS-PVC Free, Douradas col. 2311 (10000/caixa)

Adicionar

Crown Caps 26mm TFS-PVC Free, Douradas col. 2311 (10000/caixa)

Adicionar

-

CC29mm TFS-PVC Free, Vermelhas with oxygen scav.(7000/caixa)

Adicionar

CC29mm TFS-PVC Free, Vermelhas with oxygen scav.(7000/caixa)

Adicionar

Receitas de cerveja e uísque

Certificados

Sugestão

USA: AB InBev reacquires stake in US container plant

USA: AB InBev reacquires stake in US container plant

Anheuser-Busch InBev SA/NV will reacquire a 49.9% stake in its US metal container plants from a consortium of institutional investors led and advised by Apollo Global Management Inc. in a deal estimated to be around $3 billion, Bloomberg reported on January 6.

The metal container plant operations include seven facilities across six states and form a strategic component of the company’s supply chain in the US, AB InBev said in a statement. The maker of Stella Artois and Budweiser beer will fund the purchase with cash on hand.

The world’s largest brewer previously sold the stake to Apollo for $3 billion in 2020 in a deal aimed at helping it pay down debt, which ballooned following the takeover of rival SABMiller in 2016.

Shares of AB InBev fell a little over 1% in early trading. The stock rose nearly 14% in 2025.

Brewers are facing challenging conditions across all markets at the moment as consumers rein in spending and as the effect of tariffs take effect. Last year US President Donald Trump imposed steep tariffs on steel and aluminum and said the measures were intended to secure the future of the American steel industry.

On January 6, AB InBev said by regaining full control of its plants it would ensure “quality, cost efficiency, speed of innovation and supply security for our brands, while providing industry-leading manufacturing jobs and driving economic growth in communities across the US.”

“AB InBev is securing the quality of key packaging assets in the US likely as a result of aluminum tariffs,” according to Duncan Fox, a Bloomberg Intelligence senior industry analyst.

The deal is more akin to a “debt repurchase,” according to Trevor Stirling, an analyst at Bernstein, who added that it was also a “mark of confidence in the company’s underlying cash flow and deleveraging.”

Last year, AB InBev kicked off a $6 billion share buyback program even as it faced a challenging third quarter marked a lower-than-expected beer sales.

The metal containers deal is expected to close in the first quarter this year.

Voltar

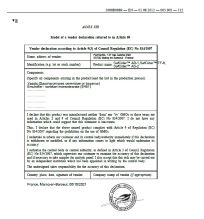

Fermentis Yeast- Non GMO declaration SafCider range

Fermentis Yeast- Non GMO declaration SafCider range

Hops Hopfenveredlung St.Johann, Certificate ISO 14001:2015 2022-2025

Hops Hopfenveredlung St.Johann, Certificate ISO 14001:2015 2022-2025

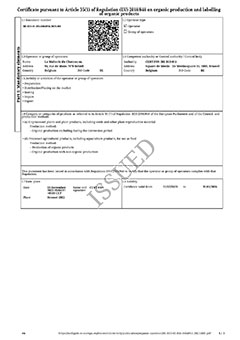

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Dec 2023-Mar 2026

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Dec 2023-Mar 2026

SAS Biohop Organic certificate 2023-2025

SAS Biohop Organic certificate 2023-2025