Coșul tău

Noutățile companiei

Noutăți E-Malt

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Kegcaps 74 mm, Verde 147 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Verde 147 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Green Transparent col. 2722 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Green Transparent col. 2722 (10000/cutie)

Adaugă în coş

-

Kegcaps 64 mm, Rosu 150 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Rosu 150 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

-

Kegcaps 74 mm, Albe 86 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Albe 86 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/cutie)

Adaugă în coş

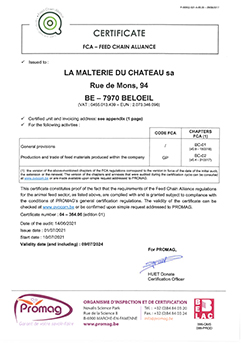

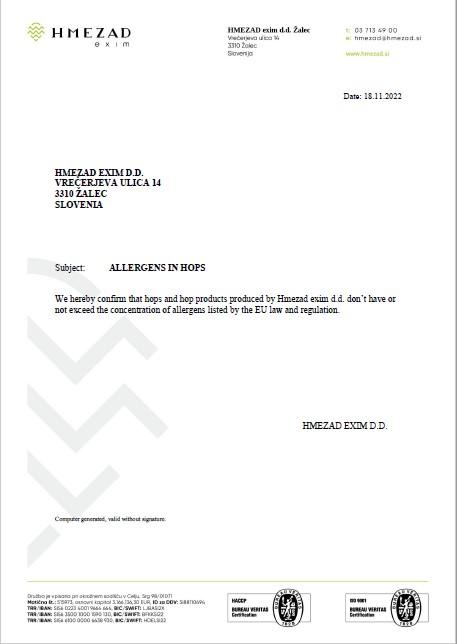

Certificate

Sugestie

Canada: Sleeman Breweries for sale

Canada: Sleeman Breweries for sale

Sleeman Breweries Ltd., the biggest beermaker based in Canada, said that it may sell itself after the chief executive officer of bigger rival InBev NV said the Ontario brewer is examining a transaction, Bloomberg announced May 12.

The brewer, based in Guelph, Ontario, "believes it is appropriate to undertake a comprehensive review of all our strategic and financial options," Chief Executive Officer John Sleeman said in a statement. There is no guarantee of a transaction, which may include a sale or merger, the brewer said.

The company's shares rose 15 percent, the most in almost seven years, before being halted May 12 after InBev CEO Carlos Brito said “Sleeman is putting the company for sale'' during a conference call for InBev's first-quarter results. Sleeman has a market value of about C$195 million ($176 million), based on yesterday's closing stock price.

Christopher Fernyc, who holds about 830,000 Sleeman shares among the equivalent of $1.08 billion he oversees at Bissett Investment Management in Calgary, said before Sleeman's announcement that a sale “wouldn't surprise'' him.

"They are getting squeezed on both sides" by competition from smaller discount brewers such as Lakeport Brewing Income Fund and larger companies including Molson Coors Brewing Co., Fernyc said in a telephone interview. “Maybe it's time'' for a sale.

BMO Nesbitt Burns, the investment banking arm of Bank of Montreal, was hired to assist in the review for Sleeman, according to the company's statement, released after the markets closed.

Takeover

Comments by Brito and other InBev executives on Sleeman's plans indicate “an increase in the probability we assess to a takeover,'' TD Newcrest analyst Michael Van Aelst said in a report earlier May 12.

Sleeman reported a first-quarter loss of C$813,000, or 5 cents a share, compared with net income of C$1.6 million, or 10 cents, a year earlier.

The brewer is an "attractive target for Molson, Labatt or SABMiller Plc" because Sleeman gets 6 percent of the beer sales in Canada, said Durran, who rates the shares "underperform."

Înapoi

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

ChF - Hops Kosher Certificate 2022-2023

ChF - Hops Kosher Certificate 2022-2023

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

HMEZAD Hops - Certificate allergens in hops 2022

HMEZAD Hops - Certificate allergens in hops 2022