Twój koszyk

Aktualności firmowe

E-Malt news

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

Nasze słody

-

CHÂTEAU CHIT BARLEY MALT FLAKES EKOLOGICZNY (CHIT BARLEY NATURE MALT FLAKES®)

Dodaj do koszyka

CHÂTEAU CHIT BARLEY MALT FLAKES EKOLOGICZNY (CHIT BARLEY NATURE MALT FLAKES®)

Dodaj do koszyka

-

CHÂTEAU CHOCOLAT EKOLOGICZNY (CHOCOLAT NATURE)

Dodaj do koszyka

CHÂTEAU CHOCOLAT EKOLOGICZNY (CHOCOLAT NATURE)

Dodaj do koszyka

-

CHÂTEAU CHIT WHEAT NATURE MALT FLAKES® (EKOLOGICZNY)

Dodaj do koszyka

CHÂTEAU CHIT WHEAT NATURE MALT FLAKES® (EKOLOGICZNY)

Dodaj do koszyka

-

CHÂTEAU BLACK NATURE (SŁÓD EKOLOGICZNY)

Dodaj do koszyka

CHÂTEAU BLACK NATURE (SŁÓD EKOLOGICZNY)

Dodaj do koszyka

-

CHÂTEAU WHEAT CHOCOLAT NATURE (EKOLOGICZNY)

Dodaj do koszyka

CHÂTEAU WHEAT CHOCOLAT NATURE (EKOLOGICZNY)

Dodaj do koszyka

Nasze chmiele

New Hops

Nasze drożdże

Nasze przyprawy

Nasze cukry

Nasze kapsle

-

Kegcaps 74 mm, Czerwony 102 Flatfitting A-type (700/box)

Dodaj do koszyka

Kegcaps 74 mm, Czerwony 102 Flatfitting A-type (700/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

-

CC29mm TFS-PVC Free, Zielony with oxygen scav.(6500/box)

Dodaj do koszyka

CC29mm TFS-PVC Free, Zielony with oxygen scav.(6500/box)

Dodaj do koszyka

-

Kegcaps 69 mm, White 86 Grundey G-type (850/box)

Dodaj do koszyka

Kegcaps 69 mm, White 86 Grundey G-type (850/box)

Dodaj do koszyka

-

CC29mm TFS-PVC Freel, Błękitny without oxygen scav.(7500/box)

Dodaj do koszyka

CC29mm TFS-PVC Freel, Błękitny without oxygen scav.(7500/box)

Dodaj do koszyka

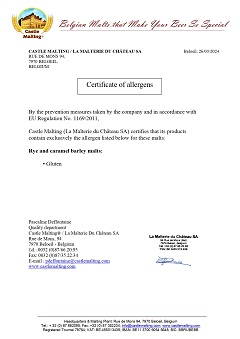

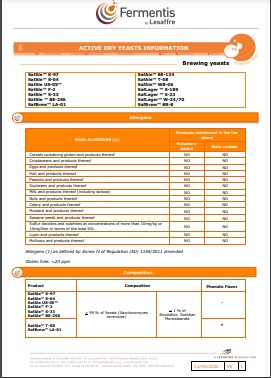

Certyfikaty

Sugestia

Argentina: Barley crop estimate steady at 4.75 mln tonnes

Argentina: Barley crop estimate steady at 4.75 mln tonnes

Hot weather was becoming a dryness concern for corn and soybeans in Argentina and added to the already growing farmer reluctance to sell barley (and wheat). However, recent rains have provided short-term relief, but farmer selling still remains well behind previous years, RMI Analytics said in their latest report earlier this month.

The analysts’ production estimate for Argentina remains steady at 4.75 mln tonnes, with a range of quality results across Buenos Aires province and further north towards Santa Fe and Cordoba. Overall the quality on average is manageable. For example, higher proteins (up to 12%) in the Bahia Blanca area may fulfil some special export malting barley demand.

Ending stocks have rebounded slightly from crop 2022 levels but the current slow export pace is well below the past two years. The trade continues to await news from the new government on potentially major changes to export regimes for agricultural goods, including barley.

Amidst a very quiet market, FOB prices continue to slide lower, and prices for both malting and feed barley are staying competitive in a global context. A recent global malting barley tender provided some much needed demand but the result was reportedly awarded to other origins (e.g. France). However, demand remains present in the market for specific quality, for both immediate and deferred shipping periods which validates that positions remain open. Farmer prices continue to be based upon a blend of official/unofficial (80/20%) exchange rates. Potential alteration to export tax rates, and/or a further peso devaluation could dramatically change the involvement of Argentina in export channels.

Wstecz

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

Malt GMO-Free Certificate 2025

Malt GMO-Free Certificate 2025

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2