Coșul tău

Noutățile companiei

Noutăți E-Malt

France: Beer and wine conglomerate Castel Group facing internal turmoil

UK: Spring barley area forecast to drop by 15% in 2026

Australia: Barley prices beginning to stabilize after four years of declines

EU: Early barley crop 2026 picture remains good, forecast for 2025 boosted by 0.2 mln tonnes

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Crown Caps 26 mm TFS-PVC Free, Negru col. 2217 Beer Season (10000/cutie)*

Adaugă în coş

Crown Caps 26 mm TFS-PVC Free, Negru col. 2217 Beer Season (10000/cutie)*

Adaugă în coş

-

Kegcaps 64 mm, Maro 153 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Maro 153 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

-

CC29mm TFS-PVC Free, Albastru without oxygen scav.(7500/cutie)

Adaugă în coş

CC29mm TFS-PVC Free, Albastru without oxygen scav.(7500/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Bordeaux Red col. 20025 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Bordeaux Red col. 20025 (10000/cutie)

Adaugă în coş

-

CC29mm TFS-PVC Free, Rosu with oxygen scav.(7000/cutie)

Adaugă în coş

CC29mm TFS-PVC Free, Rosu with oxygen scav.(7000/cutie)

Adaugă în coş

Certificate

Sugestie

Australia, Melbourne: Australia's Southcorp Ltd. posted on March 8 it was worth up to 44 % more than Foster's Group Ltd.'s takeover bid and proposed the companies combine their wine businesses, but analysts said it was a tactic to flush out a higher offer. Southcorp, which has repeatedly said it was not for sale, said on Tuesday, March 8, it wanted to resolve a likely deadlock over Foster's hostile A$2.5 billion ($1.9 billion) bid, according to Reuters.

"At first pass, I can't see why Foster's would be interested in taking a smaller chunk of something they clearly wanted, at a price that doesn't look particularly compelling," said ABN AMRO Asset Management analyst Matthew Hoult. "This is just a sort of ambit claim to get Foster's to hike the price," he said.

Foster's was unimpressed with the wine merger offer and the valuation Southcorp's independent expert put on the company, but said it would study Southcorp's proposal, which they had discussed before.

Analysts said Southcorp had caved in to investor pressure to come up with an independent valuation and was effectively setting a target price for Foster's to meet.

A Foster's takeover, or Southcorp's proposed merger, would create the world's second-largest wine group after Constellation Brands Inc. (STZ.N: Quote, Profile, Research) , with Southcorp's Penfolds, Lindemans and Rosemount wines and Foster's Wolf Blass and Beringer wines. After the markets closed, the country's competition watchdog, the Australian Competition and Consumer Commission, said it would not oppose Foster's bid if it were to proceed because it would not lessen competition.

Investors pushed Southcorp shares up 3 percent to A$4.44, expecting Foster's to come back with a counter-bid. The shares are above Foster's A$4.14 a share bid but well below the independent expert's valuation on Southcorp.

Shares in Foster's rose 0.8 percent to A$5.30 in a broader market up 0.1 percent. Foster's bought an 18.8 percent stake in Southcorp in January from the Oatley family, the founders of the Rosemount brand, before launching its bid.

"We owe it to our shareholders to have a look," Foster's spokeswoman Lisa Keenan said of the Southcorp proposal. "But our preliminary view is it is not as compelling an offer as the proposal we put forward."

Southcorp said the independent expert's report valued the company at A$4.57 to A$4.80 a share. However, including cost savings which Foster's could extract from Southcorp, the report commissioned from Lonergan Edwards and Associates said it was worth A$5.84 to A$5.97 a share to the bidder.

Southcorp had previously refused to include its own or an independent valuation in its official rejection of Foster's bid.

The company has said it is turning around after a profit slump caused by previous management's failed UK price discounting strategy and has argued the industry is recovering from a California grape glut.

Înapoi

Certificate Bio Cambie Hop VOF 2024-2025

Certificate Bio Cambie Hop VOF 2024-2025

Belgosuc sugar, Management System Certificate 2022 (English)

Belgosuc sugar, Management System Certificate 2022 (English)

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

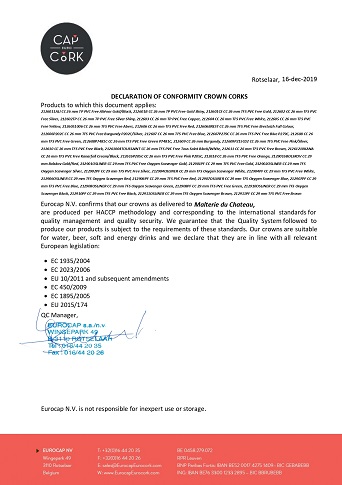

Crown Cork EUROCAP Conformity Certificate 2019

Crown Cork EUROCAP Conformity Certificate 2019

Fagron Spices, IFSFood Certificate 16089, EN 2024

Fagron Spices, IFSFood Certificate 16089, EN 2024