Noutățile companiei

Noutăți E-Malt

UK: Syngenta agrees to sell its malting barley seeds business

Germany & South Korea: Paulaner switches South Korea distribution to Heineken

Thailand: ThaiBev reports 7% fall in annual profit

USA, TX: Revolver Brewing to leave Granbury and move to Dallas-Fort Worth area

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Kegcaps 64 mm, Black 91 S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Black 91 S-type (EU) (1000/cutie)

Adaugă în coş

-

Kegcaps 69 mm, Galbene 4 Grundey G-type (850/cutie)

Adaugă în coş

Kegcaps 69 mm, Galbene 4 Grundey G-type (850/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/cutie)

Adaugă în coş

-

CC29mm TFS-PVC Free, Rosu with oxygen scav.(7000/cutie)

Adaugă în coş

CC29mm TFS-PVC Free, Rosu with oxygen scav.(7000/cutie)

Adaugă în coş

-

Crown Caps 26 mm TFS-PVC Free, Negru col. 2439 (10000/cutie)

Adaugă în coş

Crown Caps 26 mm TFS-PVC Free, Negru col. 2439 (10000/cutie)

Adaugă în coş

Certificate

Sugestie

North America: Dramatic increase in global barley prices could bring Canada back into export game

North America: Dramatic increase in global barley prices could bring Canada back into export game

As previously reported, Canada and the US barley prices have been tracking on an import parity pricing basis for several months. The global price shock triggered by the events in Ukraine is having a swift and dramatic impact on barley prices in North America, RMI Analytics said in their early March report.

For malting barley, the theoretical pricing approaches USD500/tonne and with no trade. It is expected that the dramatic increase in prices brings Canada back into the export game with the new crop, but, as mentioned, harvest is not until August and shipment availability is only around October-November 2022. Relief from Canada on a global basis should only be expected mostly in 2023 as the lineup for other crops (wheat, canola) will also be great in Q4 2022.

For feed barley, the current market is also moving up sharply with higher US corn futures making imported corn more expensive. Local feed barley in southern Alberta is CAD450/tonne, and US corn CAD460. A month ago, US corn was trading at a CAD25 discount to local barley but presently at a CAD10 premium, a dramatic and quick turnaround.

Înapoi

Top Hop - HACCP Certificate 2021-2024

Top Hop - HACCP Certificate 2021-2024

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

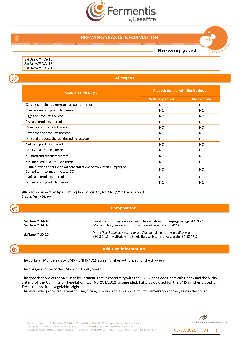

Fermentis - Brewing Yeasts Information ENG - HA-18,_DA-16, LD-20

Fermentis - Brewing Yeasts Information ENG - HA-18,_DA-16, LD-20

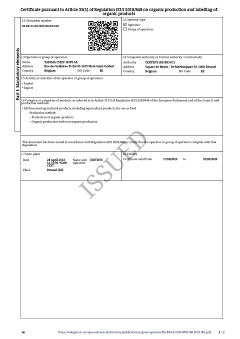

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

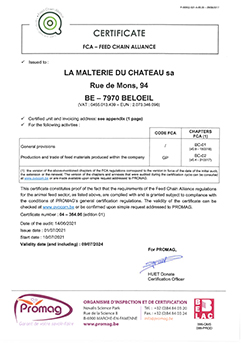

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)