Coșul tău

Noutățile companiei

Noutăți E-Malt

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Kegcaps 74 mm, Albe 86 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Albe 86 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Purple Opaque col. 2274 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Purple Opaque col. 2274 (10000/cutie)

Adaugă în coş

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

-

Kegcaps 74 mm, Negru 91 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Negru 91 Flatfitting A-type (700/cutie)

Adaugă în coş

-

CC29mm TFS-PVC Free, Albastru without oxygen scav.(7500/cutie)

Adaugă în coş

CC29mm TFS-PVC Free, Albastru without oxygen scav.(7500/cutie)

Adaugă în coş

Certificate

Sugestie

Hong Kong: Trading in the shares of Kingway Brewery Holdings Ltd., which has been in talks on a possible takeover by Dutch giant Heineken NV, was suspended on Wednesday, 26 January 2005. Officials at both companies declined comment. The shares were halted pending the announcement of what may be price-sensitive information, the Hong Kong stock exchange said.

Reuters reported this week that Heineken was in talks to lift its 21 percent stake in Kingway to 50 percent in a step toward a possible takeover of the firm, which is controlled by the government of Guangdong province, one of China's wealthiest regions.

In recent years, global beermakers have flooded into China, where rising incomes have made the country the largest beer market in the world by volume. "Heineken is a latecomer and they need to catch up. Heineken already lags behind Anheuser-Busch, SAB Miller and InBev," said Fan Cheuk Wan, analyst at ABN Amro.

Shares of Kingway finished at HK$3.075 on Tuesday and have leapt by 40 percent since last Thursday on expectations that Heineken, the world's fourth-largest beer maker by sales, will boost its holding in the firm.

Kingway, which does not rank among China's ten largest brewers but is seen as an attractive takeover candidate because of its strong position in the southern boomtown of Shenzhen, has a market capitalization of US$550 million.

A source familiar with the situation told Reuters on Monday that the two companies were discussing a deal priced between HK$3.50 and HK$4.00 per Kingway share.

About a year ago, Heineken paid US$71 million, or HK$1.85 a share, for a 21 percent stake in Kingway. Under Hong Kong listing rules, an investor must make an offer for all of a company's shares if its holding reaches 30 percent.

Last year, Anheuser-Busch, the world's second-largest brewer by volume after InBev, took over China's Harbin Brewery Group Ltd. for US$692 million after a landmark takeover battle with arch-rival SABMiller.

Înapoi

Bio-Zertifikat DE - Juli 2025-März 2028

Bio-Zertifikat DE - Juli 2025-März 2028

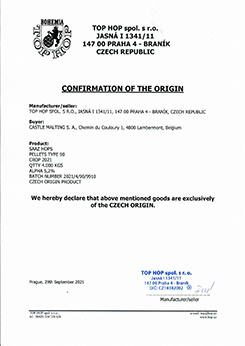

Top Hop - Confirmation of the Origin 2021

Top Hop - Confirmation of the Origin 2021

Fermentis GMO-free Declaration

Fermentis GMO-free Declaration

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

SAS Biohop Organic certificate 2023-2025

SAS Biohop Organic certificate 2023-2025