Aktualności firmowe

E-Malt news

Argentina: Both malting and feed barley prices unchanged

Argentina: Barley crop 2025 development supported by favourable weather

Australia: Barley crop 2025 currently forecast at 15.8 mln tonnes with potential for further increase

Canada: Barley crop 2025 forecast at 9 mln tonnes still slightly above official estimates, analysts say

Nasze słody

Nasze chmiele

New Hops

Nasze drożdże

Nasze przyprawy

Nasze cukry

Nasze kapsle

-

Kapsle 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Dodaj do koszyka

-

Kapsle 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

-

Kegcaps 69 mm, Błękitny 141 Grundey G-type (850/box)

Dodaj do koszyka

Kegcaps 69 mm, Błękitny 141 Grundey G-type (850/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Certyfikaty

-

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

-

Charles Faram Hops, HACCP Plan QA38, EN 2022

Charles Faram Hops, HACCP Plan QA38, EN 2022

-

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

-

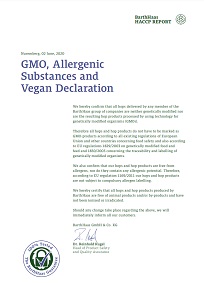

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

-

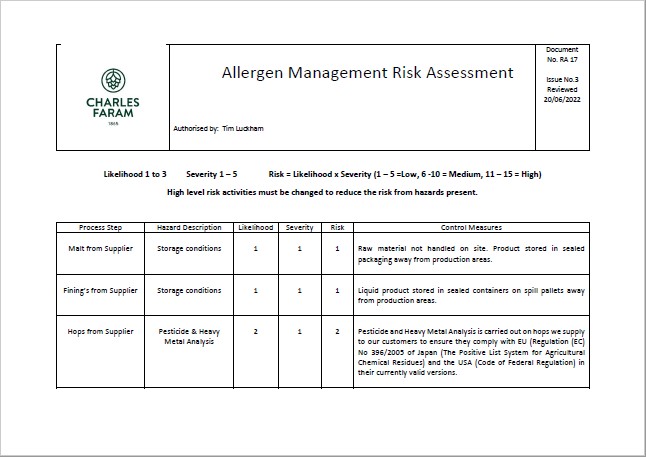

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

Sugestia

Canada: Malting barley prices - The real story

Canada: Malting barley prices - The real story

David Anderson, Parliamentary Secretary to the Minister for the Canadian Wheat Board, claimed Feb. 14 in the House of Commons that western Canadian producers are receiving $1 per bushel less for malting barley than U.S. producers, according to CWB’s news room. The Feb. 2 issue of Barley Country, published by the Alberta Barley Commission, makes similar price comparisons.

In fact, this is not the case. About 75 per cent of the malting barley in the U.S. is contracted before seeding. This means that the vast majority of American malting barley producers are not benefiting from current higher prices for malting barley.

As well, Mr. Anderson’s price comparison relates a spot price to a pool value. This is not a valid comparison. A pool value is an average of prices achieved over an entire crop year, while a spot price is a price on a particular day. In a rising market, a spot price is by definition higher than a pooled price.

The relevant question is whether the CWB is capturing the current higher spot prices for malting barley. The answer is yes. Recent higher-priced malting barley sales will be reflected in the 2007-08 pool. In its first Pool Return Outlook for 2007-08, the CWB predicts returns to farmers of $35 per tonne higher than the current malting barley PRO for 2006-07.

Wstecz