Aktualności firmowe

E-Malt news

Argentina: Both malting and feed barley prices unchanged

Argentina: Barley crop 2025 development supported by favourable weather

Australia: Barley crop 2025 currently forecast at 15.8 mln tonnes with potential for further increase

Canada: Barley crop 2025 forecast at 9 mln tonnes still slightly above official estimates, analysts say

Nasze słody

Nasze chmiele

New Hops

Nasze drożdże

Nasze przyprawy

Nasze cukry

Nasze kapsle

-

Kapsle 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Dodaj do koszyka

-

Kapsle 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

-

Kegcaps 69 mm, Błękitny 141 Grundey G-type (850/box)

Dodaj do koszyka

Kegcaps 69 mm, Błękitny 141 Grundey G-type (850/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Certyfikaty

-

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

-

Charles Faram Hops, HACCP Plan QA38, EN 2022

Charles Faram Hops, HACCP Plan QA38, EN 2022

-

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

-

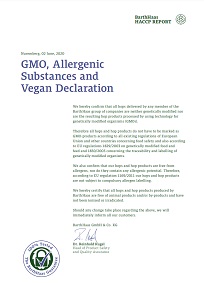

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

-

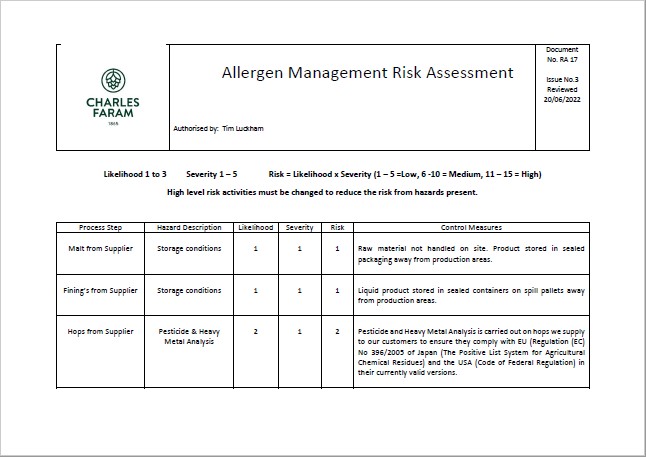

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

Sugestia

Canada: Lower area and yields drop barley production by 12% for the 2006/07 crop year

Canada: Lower area and yields drop barley production by 12% for the 2006/07 crop year

Agriculture and Agri-Food Canada (AAFC) has released June 27 its Grain and Oilseed outlook. Accordingly, barley production is forecasted to decrease by 12% due to lower area and yields. Lower carryin stocks will also contribute to a 13% decrease in supply. Exports are forecast to decrease by 19%, as lower feed barley exports are only partially offset by higher exports of malting barley.

Despite lower exports and domestic feed use, carry-out stocks are forecast to fall significantly. The average off-Board feed barley price (No.1 CW, instore Lethbridge) is forecast to increase by $20/t from 2005-06 to $130/t (all figures in CA$). The CWB PRO for No. 1 CW feed barley for Pool A in 2006-07 is $113/t, vs. $122/t for Pool B in 2005-06. The CWB PRO for SS2R malting barley is $161/t vs. $170/t for 2005-06, due to strong export competition from Australia.

AAFC forecasts that total production of grains and oilseeds in Canada will decline by 6% from 2005-06, to 63 million t (Mt), above the 10-year average of about 60 Mt. In western Canada, production is forecast to decline by 7%, to 47.3 Mt, with eastern Canadian production down by 2%, at 15.5 Mt. Exports and domestic use are expected to increase in 2006-07. Non-durum wheat, canola, feed barley and corn prices are expected to increase from 2005-06, while durum, oat, flaxseed and soybean prices are expected to decrease. Prices will continue to be pressured by the strong Canadian dollar. The major factors to watch are: growing conditions in the US corn belt, US and Canadian spring wheat crop conditions, the biofuel market, ocean freight rates and the Canada/US exchange rate.

Wstecz