Coșul tău

Noutățile companiei

Noutăți E-Malt

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Kegcaps 64 mm, Maro 154 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Maro 154 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

-

CC29mm TFS-PVC Free, Galben with oxygen scav.(6500/cutie)

Adaugă în coş

CC29mm TFS-PVC Free, Galben with oxygen scav.(6500/cutie)

Adaugă în coş

-

Kegcaps 64 mm, Rosu 150 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Rosu 150 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

-

Kegcaps 74 mm, Negru 91 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Negru 91 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Kegcaps 69 mm, Rosu 102 Grundey G-type (850/cutie)

Adaugă în coş

Kegcaps 69 mm, Rosu 102 Grundey G-type (850/cutie)

Adaugă în coş

Certificate

Sugestie

World: Barley crop forecast reduced by 1.3 mln tonnes

World: Barley crop forecast reduced by 1.3 mln tonnes

The critical harvest period has now arrived in Europe and clarity to yield and quality results with it. RMI Analytics’ global barley crop forecast is reduced by 1.3 mln tonnes to 145.2 mln, with Ukraine up 0.3 mln, offset by: EU27+UK minus 0.3 mln tonnes (including Spain up 0.8 mln but France/Germany down); Canada down 0.3 mln tonnes (on lower planted area), Russia minus 0.5 mln tonnes and ‘rest of world’ down 0.5 mln tonnes.

In a long-term perspective, a global barley crop at ~145 mln tonnes is below the 5-year and 10-year averages, the analysts said.

Crop problems in Russia began the decline in production and sparked a major market rally in wheat markets. As harvest advances across Russia’s key growing regions, the results are mixed, with certain regions reporting better than expected yields, while other regions are reporting disappointing results. Clearly, Russia’s grain production is reduced, including barley. Black Sea crop’23 exports finished strong but drop in crop’24 due to the smaller crop.

Market focus remains on the crop harvest in Europe, while demand recovery still remains a question. China’s imported barley tonnage has doubled over the crop’22 volumes. In addition, there are small signs of improving brewing malt demand in parts of the world. In total, some optimism is starting to appear for a malt demand recovery.

As global barley production shrinks, the market appears to be caught between the fundamental barley story and outside forces like wheat, which have been weighing on barley prices. Lower French yields push prices up, but an improving global picture leaves the market at an important junction. Outside markets (corn and wheat) will undoubtedly continue to influence barley prices, but at some stage our expectation remain that barley fundamentals will ultimately come back into play, RMI Analytics said.

Înapoi

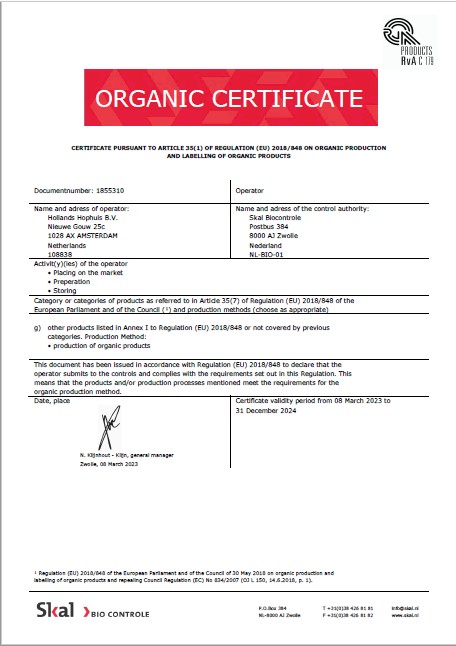

Hollands Hophuis, Organic Production and Labelling 2023-2024

Hollands Hophuis, Organic Production and Labelling 2023-2024

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Fermentis - Spirit Dry Yeast Information 2023

Fermentis - Spirit Dry Yeast Information 2023