Coșul tău

Noutățile companiei

Noutăți E-Malt

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Kegcaps 64 mm, Rosu 1485 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Rosu 1485 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

-

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Crown Caps 26 mm TFS-PVC Free, Negru col. 2217 Beer Season (10000/cutie)*

Adaugă în coş

Crown Caps 26 mm TFS-PVC Free, Negru col. 2217 Beer Season (10000/cutie)*

Adaugă în coş

-

Kegcaps 69 mm, Maro 141 Grundey G-type (850/cutie)

Adaugă în coş

Kegcaps 69 mm, Maro 141 Grundey G-type (850/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/cutie)

Adaugă în coş

Certificate

Sugestie

World: Risk of an ever growing demand for grain remains for future years beyond 2021/22

World: Risk of an ever growing demand for grain remains for future years beyond 2021/22

World grain markets exploded into a new price range, without China buying in April. H. M. Gauger GmbH said in their May report.

Markets were volatile, of course, but the bull trend could not be broken. It seems that the majority of agri-experts - trade, industry, banks - have been convinced by now that market fundamentals require the present price levels - for demand destruction (a strange word for non-professionals).

Population growth and higher standards of living, a larger quality food (meat) consumption required an ever growing amount of agricultural produce. A huge part of the corn and soybean crops ends up in the production of crude oil replacement. Chinese purchases started the bull market. After selling much of their corn and wheat reserves, Chinese imports have grown excessively: soybeans to 100 mln tonnes per year, and grains to 50 – 60 tonnes.

Trade and industry are nervous: we need good supplies from Argentina and Brazil, but drought problems have reduced their corn and soybean crops, particularly corn in Brazil^ Safra reduced its crop estimate to 104.1 mln tonnes from 112.8 mln last month; private estimates are even below 100 mln tonnes.

In the northern hemisphere frost and drought problems threaten crop results anywhere from the Canadian Prairies to the Russian Black Earth regions. The S/D problem concerns first of all the years 2021/22, but the risk of an ever growing demand remains for future years.

Înapoi

Malt GMO-Free Certificate 2025

Malt GMO-Free Certificate 2025

Top Hop - ISO Certificate 2021-2024

Top Hop - ISO Certificate 2021-2024

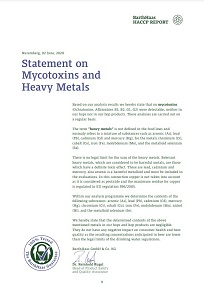

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

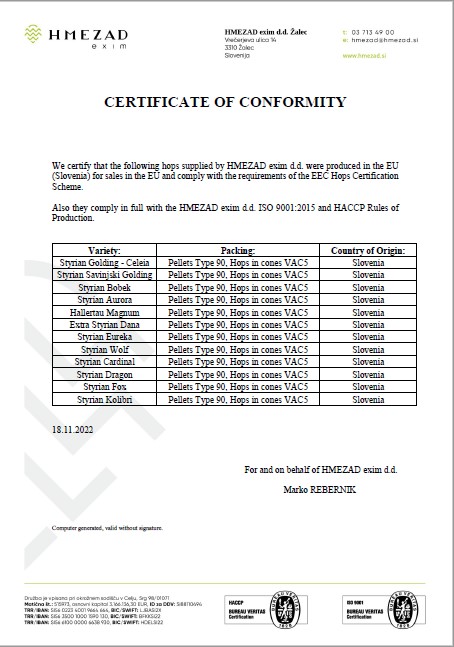

HMEZAD Hops - Certificate of conformity 2022

HMEZAD Hops - Certificate of conformity 2022

Belgosuc Sugar, GMO-Free Certificate 2019

Belgosuc Sugar, GMO-Free Certificate 2019