Ваш кошик

Новини компанії

E-Malt news

UK & South Korea: New UK-South Korea deal to benefit exports of Guinness, cars, Scottish salmon

UK: UK brewers facing �heavy headwinds� from increased taxation, other issues

Japan: Kirin set to ramp up beer development via proprietary AI

Norway & Sweden: Olvi Group acquires majority share in Brewery International group

Наш солод

Наш хміль

New Hops

Наші дріжджі

Наші спеції

Наш цукор

Наші кришки

-

Кришки 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/Коробка)

Додати до кошика

Кришки 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/Коробка)

Додати до кошика

-

Crown Caps 26 mm TFS-PVC Free, Чорні col. 2439 (10000/Коробка)

Додати до кошика

Crown Caps 26 mm TFS-PVC Free, Чорні col. 2439 (10000/Коробка)

Додати до кошика

-

CC29mm TFS-PVC Free, Білі with oxygen scav.(7000/Коробка)

Додати до кошика

CC29mm TFS-PVC Free, Білі with oxygen scav.(7000/Коробка)

Додати до кошика

-

Кришки для кег 74 мм, Чорний 91 Flatfitting A-тип (700/Коробка)

Додати до кошика

Кришки для кег 74 мм, Чорний 91 Flatfitting A-тип (700/Коробка)

Додати до кошика

-

Кришки 26mm TFS-PVC Free, Green Transparent col. 2722 (10000/Коробка)

Додати до кошика

Кришки 26mm TFS-PVC Free, Green Transparent col. 2722 (10000/Коробка)

Додати до кошика

Рецепти пива

Сертифікати

-

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

-

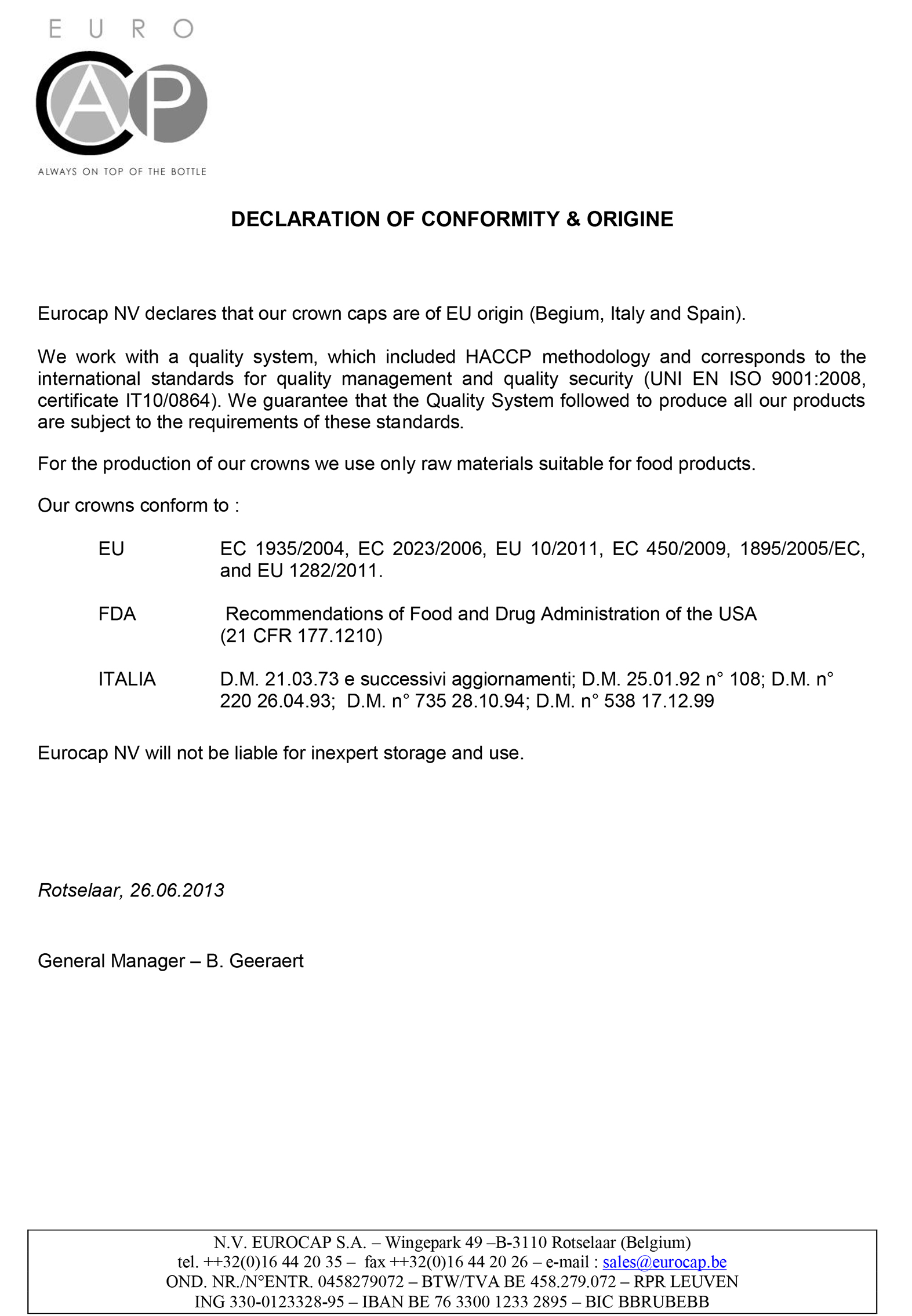

Crown Caps EUROCAP Conformity and Origin Certificate

Crown Caps EUROCAP Conformity and Origin Certificate

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

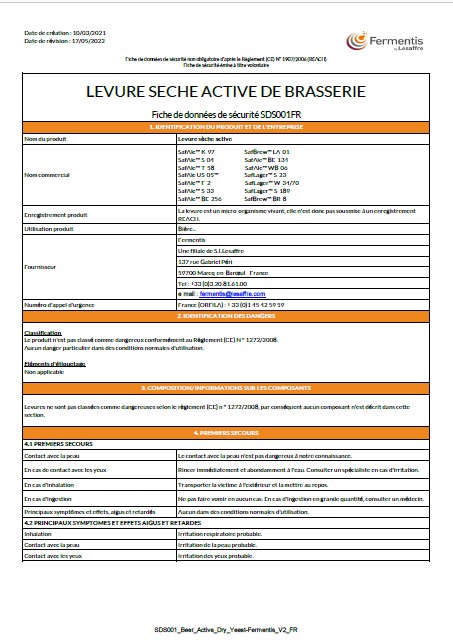

Fermentis - SDS001 Beer Active Dry Yeast Fermentis FR

Fermentis - SDS001 Beer Active Dry Yeast Fermentis FR

-

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

Suggestion

World: Further increase in barley crop forecast stretches more the already quite comfortable supply situation

World: Further increase in barley crop forecast stretches more the already quite comfortable supply situation

A further increase in the global barley crop’25 forecast of +2.4 mln tonnes to 148.7 mln tonnes, stretches further the already quite comfortable supply situation, RMI Analytics said in their latest report.

The total increase in production is the result of improved final yields in Europe (+1.3 mln tonnes), Russia (+0.4 mln tonnes), Ukraine (+0.2 mln tonnes), and an improved forecast for Australia’s crop (+0.5 mln tonnes). A consequence of this higher production is the ongoing need for increased feed usage, especially in light of the on-going constrained requirements for malt production. Still, even with higher feed usage, ending stocks are to climb by 1.5 mln tonnes to 20.8 mln tonnes by the end of crop’25.

Global barley trade is expected to increase during 2025/26, better than crop’24 but still trailing crop’23 levels.

The global balance of barley supply and demand is increasingly tilting towards a comfortable, or even oversupplied, situation. Until there is a resurgence in malting barley demand, a significant amount of quality malting barley will, regrettably, end up in feed barley channels.

The global trend for malting barley prices continues to decline, driven by a comfortable supply situation alongside falling beer volumes and reduced whisky production. Furthermore, the activities for crop’24 have largely wrapped up, with limited prospects in Australia and Argentina. Consequently, prices for crop’24 and crop’25 are aligning, leading to the disappearance of any previous premium associated with the old crop.

The competition for any emerging demand is anticipated to be fierce, as all origins have significant volumes still available for sale.

Назад