Tu carrito

Noticias de Empresa

E-Malt news

Ireland: Drinks Ireland research shows sector is vital to local economies

USA, AL: Red Clay Brewing Co. to end operations in March

USA, MO: Minglewood Brewery to close for good on January 18

Brazil: Brazil becomes second-largest market for Johnie Walker whiskey

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Amarillas with oxygen scav.(6500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Amarillas with oxygen scav.(6500/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

-

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Verdes (10000/caja)

Añadir al carrito

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Verdes (10000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Canada: Brick Brewing reports reduced performance

Canada: Brick Brewing reports reduced performance

Brick Brewing Co. Limited released on December 13 its third quarter financial results for the quarter ended October 31, 2006.

"Our financial performance in the quarter was partially impacted negatively by one time costs associated with establishing a direct distribution network in Quebec," said Jim Brickman, Executive Chairman and Founder. "This one time expense related to a reduction of Quebec inventories, although we believe that this strategic investment will provide us with improved distribution capabilities for both Brick and partner brands in Quebec into the future" Brickman added.

"Our third quarter performance did not meet our expectations" said Doug Berchtold, President and CEO. "Our gross margins were also adversely affected by the changing package mix of our products and duplicate production overheads," he added. "We are taking more aggressive steps to fully complete our production transition to Kitchener by early in the new year. Both the Quebec distribution transition and the production transition remain fundamental to our overall strategy. We continue to believe that both initiatives will provide ongoing financial benefits in the future," he said.

Third Quarter Financial Highlights:

- Net revenue for the third quarter increased to $8.7 million compared to $8.6 million for the same period last year, an increase of 1%. Beer volumes and gross revenues each increased by 7% over the third quarter last year. Both revenues and volumes were adversely affected by the Quebec inventory adjustment (see below).

- Net income before taxes was $61 thousand compared to $1.0 million in the third quarter last year.

- Earnings before interest, taxes, depreciation and amortization (EBITDA) were $552 thousand compared to $1.39 million in the same quarter last year.

Third Quarter Operational Highlights:

- The Company recently received permits to distribute beer in the province of Quebec and in September began to distribute directly to retailers. Prior to that, the Company's products were distributed by a third party distributor. This transition caused a one-time reduction in field inventories as the third party distributor reduced its inventories on hand and Brick inventory deployment required only one central Quebec warehouse. Without the Quebec inventory adjustment, quarterly volumes would have increased by approximately 15%, net revenues would have increased by approximately 11% and gross margin would have increased by approximately $165 thousand.

- During the quarter, the Company's volumes shifted significantly to the lower margin 24 pack sizes, which also provide the Company with lower overall unit revenues and gross margins.

- During the quarter the new Kitchener packaging facility continued to gain improved efficiencies as daily output from one shift at the Kitchener facility reached levels equivalent to one shift production from the Formosa facility. Subsequent to the end of the quarter the second shift was eliminated at Formosa and by the end of this fiscal year, substantially all beer packaging is to be relocated to Kitchener, thereby continuing the Company's goal of reducing overheads and variable costs. The Company is actively seeking additional co-packing opportunities to supplement the future utilization of the Formosa packaging facility.

- Volumes of the Company's premium brands grew by 17% in the quarter over the same quarter last year, as the launch of the new "J.R. Brickman Founder's Series" of premium brands has been well received.

- The Company's per unit cost of producing beer increased by 9% or $673 thousand in the aggregate in the quarter compared to the third quarter of last year, which included increased warehousing costs increased by $230 thousand in the third quarter compared to the same period last year. The increased costs are primarily compensation for warehouse and customer service personnel in both Kitchener and the new warehouse in Quebec. Also included in the increased production costs in the quarter are higher manufacturing costs of $321 thousand compared to the same period last year, which resulted from duplicate production overheads at both Formosa and Kitchener and cost of goods increases which reflect higher material and other input costs of $122 thousand.

Regresar

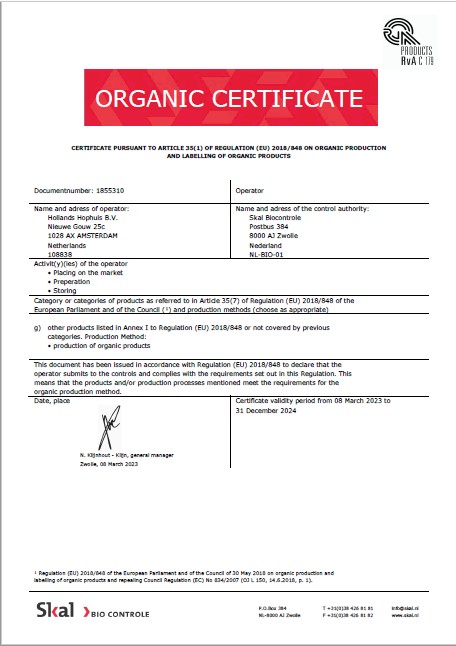

Hollands Hophuis, Organic Production and Labelling 2023-2024

Hollands Hophuis, Organic Production and Labelling 2023-2024

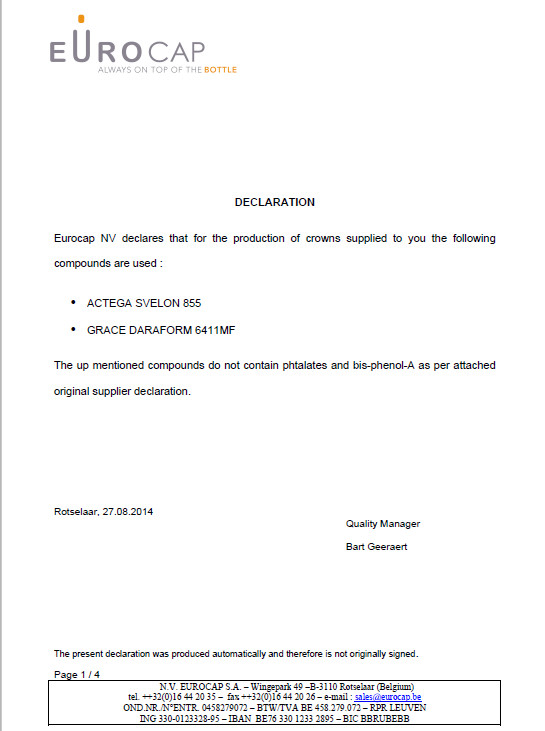

Crown Caps EUROCAP Bisphenol EN

Crown Caps EUROCAP Bisphenol EN

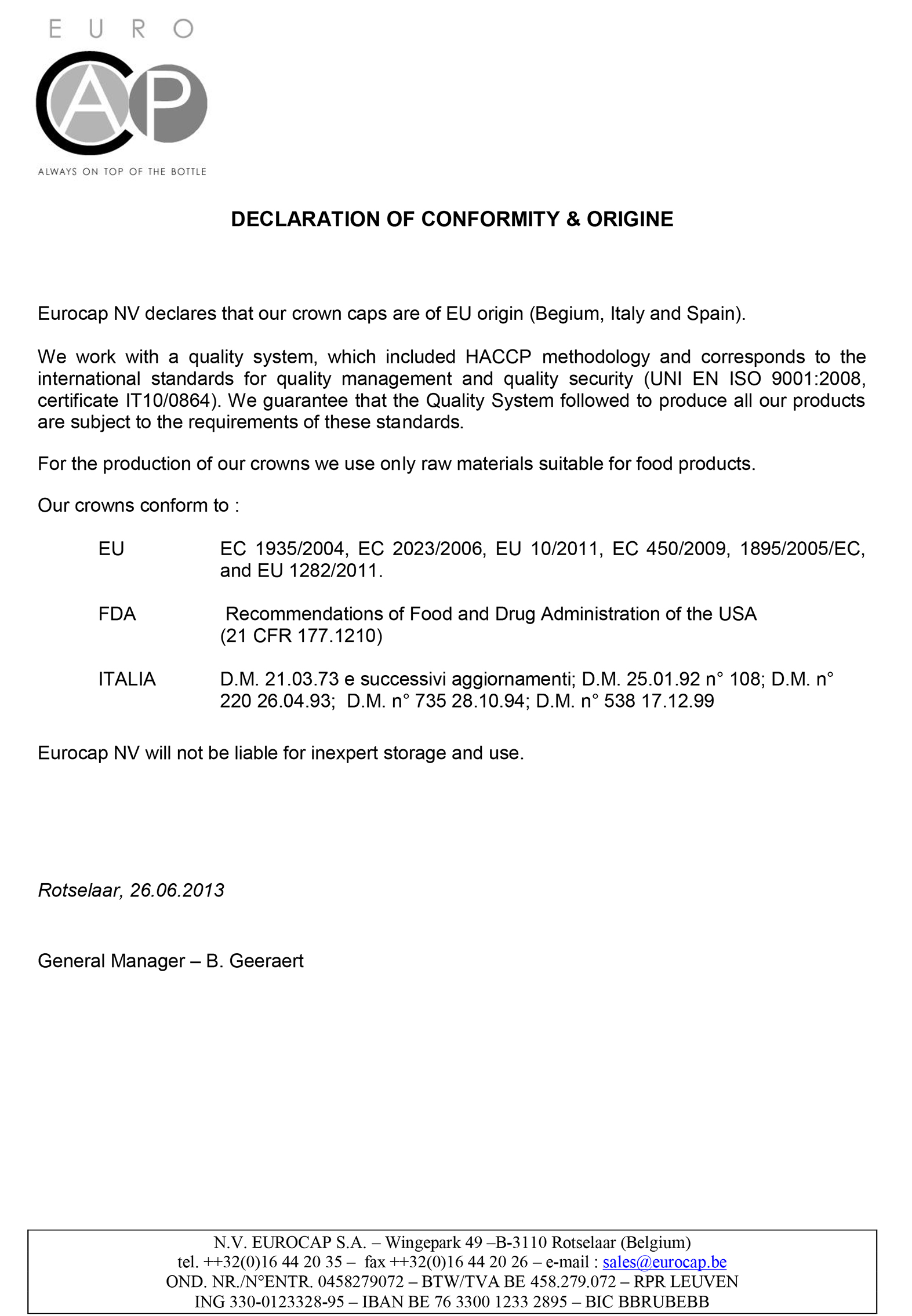

Crown Caps EUROCAP Conformity and Origin Certificate

Crown Caps EUROCAP Conformity and Origin Certificate

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

ChF Hops, Declaration of Compliance QA369, EN 2022

ChF Hops, Declaration of Compliance QA369, EN 2022