Tu carrito

Noticias de Empresa

E-Malt news

Ireland: Drinks Ireland research shows sector is vital to local economies

USA, AL: Red Clay Brewing Co. to end operations in March

USA, MO: Minglewood Brewery to close for good on January 18

Brazil: Brazil becomes second-largest market for Johnie Walker whiskey

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Amarillas with oxygen scav.(6500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Amarillas with oxygen scav.(6500/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

-

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Verdes (10000/caja)

Añadir al carrito

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Verdes (10000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

USA: Boston Beer Co. shares jump 7% after strong 2Q results, financial analysts maintain ‘overweight’ rating

USA: Boston Beer Co. shares jump 7% after strong 2Q results, financial analysts maintain ‘overweight’ rating

Boston Beer Co. Inc. shares rose 7 percent to an all-time high on Wednesday, a day after the brewer of Samuel Adams beer reported better than expected quarterly profit and raised its full-year earnings outlook, Reuters unveiled August 09.

The news prompted Prudential Equity Group to raise its price target on the stock to $33 from $30, citing the better than expected volume growth and pricing increases that boosted quarterly net income by 55 percent. Accordingly, analysts at Prudential Financial maintained August 09 their "overweight" rating on The Boston Beer Company, while raising their estimates for the company.

The Boston-based brewer said it now expects full-year earnings of $1.16 to $1.31, excluding stock option expenses expected to range from 6 cents to 11 cents per share. It had earlier forecast a range of $1.10 to $1.18, excluding items.

Boston Beer's shares were up $2.00 at $31.00 August 09 in early afternoon trading on the New York Stock Exchange.

Regresar

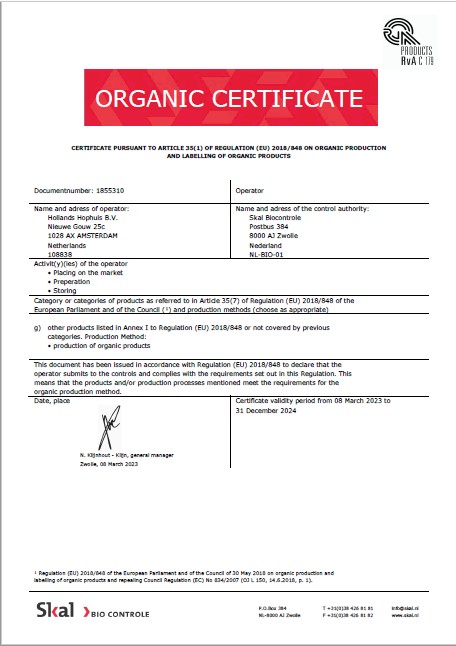

Hollands Hophuis, Organic Production and Labelling 2023-2024

Hollands Hophuis, Organic Production and Labelling 2023-2024

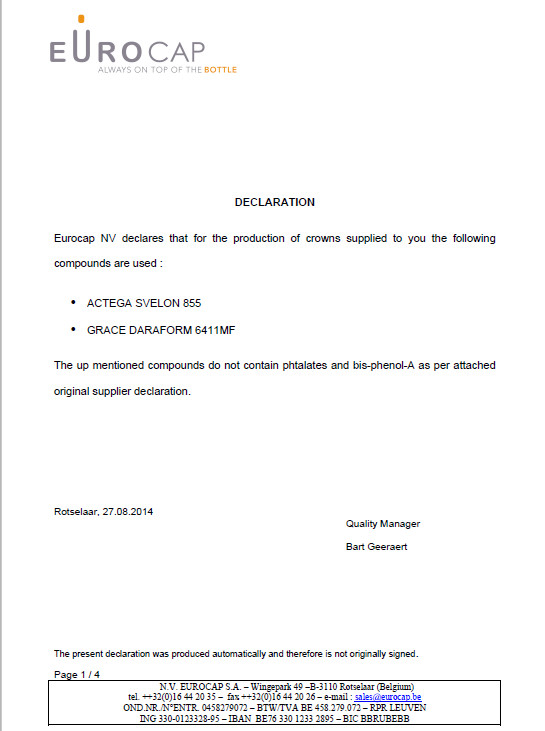

Crown Caps EUROCAP Bisphenol EN

Crown Caps EUROCAP Bisphenol EN

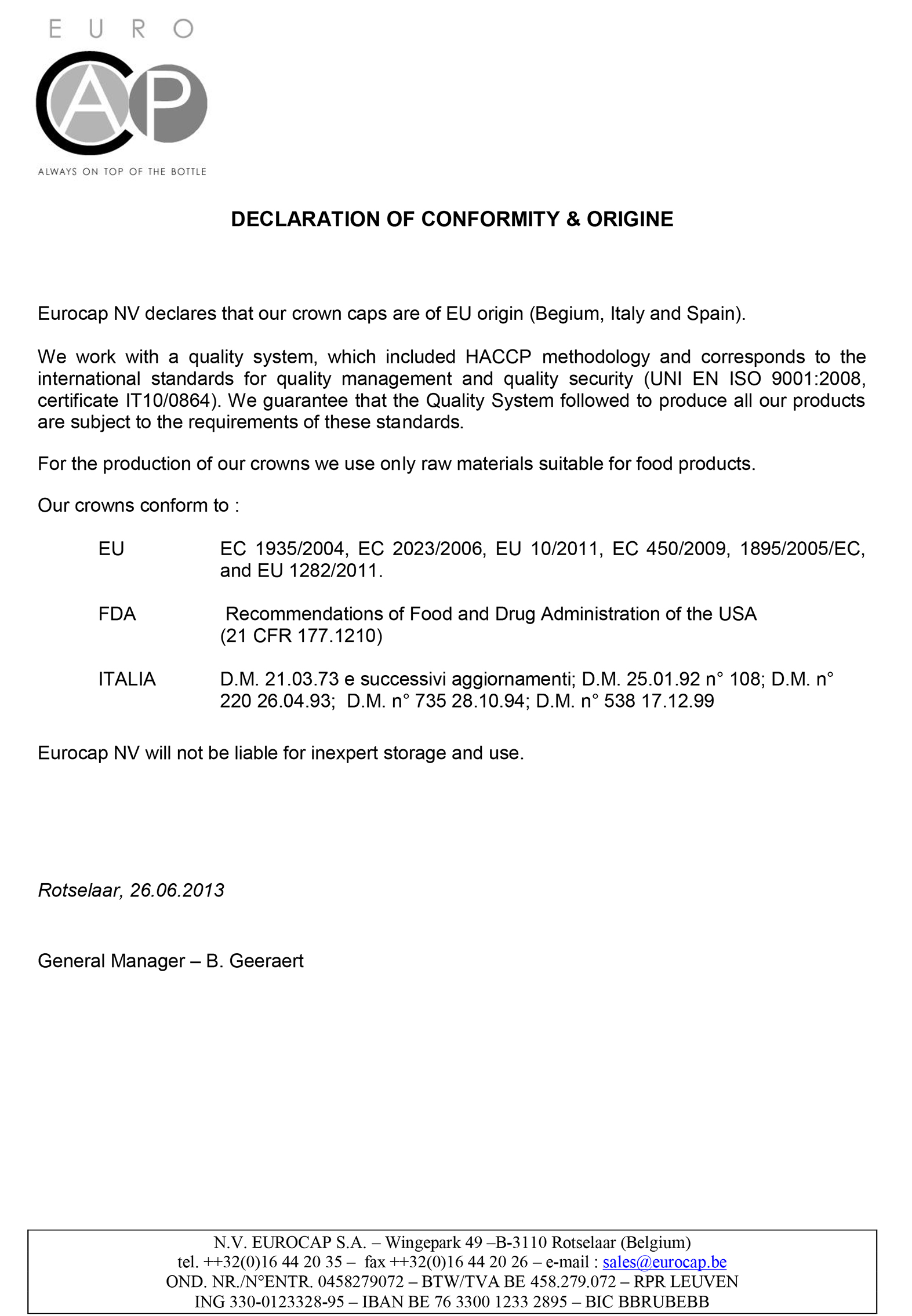

Crown Caps EUROCAP Conformity and Origin Certificate

Crown Caps EUROCAP Conformity and Origin Certificate

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

ChF Hops, Declaration of Compliance QA369, EN 2022

ChF Hops, Declaration of Compliance QA369, EN 2022