Tu carrito

Noticias de Empresa

E-Malt news

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

USA, CA: Tent City Beer Company closes its doors for good

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Kegcaps 74 mm, Blancas Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Blancas Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

India: Mallya strengthens presence in Europe by biding to acquire Taittinger

India: Mallya strengthens presence in Europe by biding to acquire Taittinger

Aiming to reduce the gap between his group and the world's largest spirit company Diageo, UB group chief Mr Vijay Mallya said May 23 that he has made a bid to acquire European brewery Taittinger for nearly Rs 3,000 crore.

Mr Mallya, whose UB Group emerged as the second-largest spirits producer in the world, said that he has also zeroed in on a South African winery that would give an edge to his group in the African continent.

He said the acquisitions would give him a crucial network and distribution channel in these continents where he had a restricted presence.

"Taittinger has got a huge distribution channel in France, all over Europe... I can sell United Spirit products using that distribution channel," Mr Mallya said, adding the valuation was close to around Rs 3,000 crore.

About Six bidders had been shortlisted for Taittinger buyout and market sources have said Mr Mallya's bid was the highest.

US-based Starwood Capital which had acquired Taittinger last year, plans to sell the company, globally selling around 4.5 billion bottles of champagne and wine a year.

About the South African acquisition, Mr Mallya said he had studied the market and zeroed in on a winery there.

"The South African acquisition makes a lot of sense as we know the market there. We have a big brewery company. We know the distribution network and this acquisition will be an added advantage to me," Mr Mallya said, adding discussions were going on.

Regresar

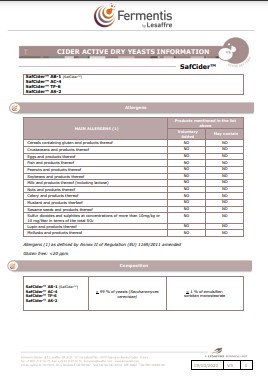

Fermentis - Cider Dry Yeast Information 2023

Fermentis - Cider Dry Yeast Information 2023

Crown Caps Finnkorkki Statement

Crown Caps Finnkorkki Statement

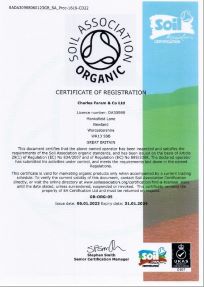

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

ChF Hops Organic certification, EN 2023-2024

ChF Hops Organic certification, EN 2023-2024

Fermentis - Brewing Yeasts Information ENG - SafSour LP-652, LB-1

Fermentis - Brewing Yeasts Information ENG - SafSour LP-652, LB-1