Il tuo carrello

Notizie Aziendali

E-Malt news

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

I nostri malti

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Tappi 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Ricette per birra

Certificati

-

Malt Kosher Certificate July 2025-June 2026

Malt Kosher Certificate July 2025-June 2026

-

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

-

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

-

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

-

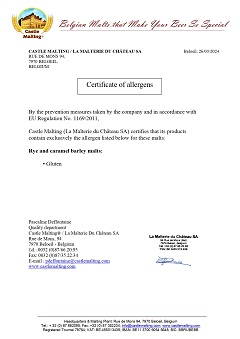

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Suggerimento

EU: There is no room for savings or speculation in the malting industry

EU: There is no room for savings or speculation in the malting industry

The malt calculation in the EU leaves little room for savings or speculation. The price of energy has gone up by 30 % on average since a year ago. Freight cost has increased, mainly for road transport.

Forecasts for spring barley acreages are down in the major malting barley regions, by 5 % or less in the Czech Republic, Denmark and the U.K., but around 10 % in France, Germany and Sweden. It can be said, of course, that barley needs for malting will be down by the same amounts.

Planting is late everywhere, but March snowfall and rains provided for good moisture reserves. A number of reasons can be cited for the lower malting barley acreage, one important reason is the disenchantment of farmers with their revenues from malting barley crops.

Low barley prices are an obvious consequence of the pressure on malt markets. If this situation continued, it could one day lead to a real supply crisis, the more so as there are new alternative outlets for grain crops.

Torna