Notizie Aziendali

E-Malt news

USA, NY: Malta�s Unified Beerworks to close its doors for good at the end of December

Argentina: Barley yield prospects look promising

Australia: Barley crop forecast up 0.3 mln tonnes due to better harvest results in Western Australia, New South Wales

USA, CO: Sanitas Brewing Company to close the doors of all its three locations

I nostri malti

I nostri luppoli

-

CASCADE (FR) Pellets T90 (5kg)

Aggiungi al carrello

CASCADE (FR) Pellets T90 (5kg)

Aggiungi al carrello

-

CHALLENGER BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

CHALLENGER BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

-

HALLERTAU TRADITION BIOLOGICO (DE) Pellets T90 (5KG)

Aggiungi al carrello

HALLERTAU TRADITION BIOLOGICO (DE) Pellets T90 (5KG)

Aggiungi al carrello

-

CASCADE (FR) Hauts-de-France Pellets T90 (5kg)

Aggiungi al carrello

CASCADE (FR) Hauts-de-France Pellets T90 (5kg)

Aggiungi al carrello

-

GOLDINGS BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

GOLDINGS BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Kegcaps 69 mm, Rosso 102 Grundey G-type (850/box)

Aggiungi al carrello

Kegcaps 69 mm, Rosso 102 Grundey G-type (850/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/box)

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Oro 116 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Oro 116 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

Australia: Lion Nathan is trying to get the support of Adelaide private school

Australia: Lion Nathan is trying to get the support of Adelaide private school

Lion Nathan has requested an urgent meeting with Adelaide private school Prince Alfred College over its A$18.2 million stake in Coopers Brewery Ltd., The Advertise News published on September 29. Lion is trying to get the school, and its crucial 5.2 % stake, on side before an extraordinary meeting on October 20 when shareholders will vote to strip Lion of its share purchase rights.

A key weapon in Lion's arsenal will be the fact that if the college indicates it will support Lion's A$352 million hostile takeover bid, it will receive the $18.2 million within one month.

At 5.5 % interest, Prince Alfred College will forgo at least A$83,000 a month if it does not accept the offer. That compares with the $63,096 in dividend payments it would have received for its 70,106 shares in 2003-04 - the last year for which an annual report is available. If Lion's takeover bid fails, the school must return the principal, but not the interest. A resolution to the takeover issue could take as little as a month but is likely to stretch for much longer.

If Lion was to up its bid, to, for example, A$300 a share, the school will be paid the difference. This comes at a time when the school has A$15 million in capital works planned over the next five years. The school's strategic plan says: "To progress the plan a major commitment from the Prince Alfred College Foundation is required".

The school's fundraising foundation is attempting to raise A$3.7 million over five years to build a gymnasium and library and continue restoring the main building.

Lion chief executive Rob Murray is understood to have written to the school requesting a meeting with the school council. The school is understood to have been given the shares as a bequest from a former Coopers family member. School business director David Stewart did not return calls yesterday.

To remove Lion Nathan's right to buy shares, Coopers needs 75 % of shareholders present on October 20 to support a resolution to that effect. Such a move will severely limit shareholders' ability to sell shares.

Torna

Belgosuc, Sugar Certification Allergens 2022 - Belgosuc(English)

Belgosuc, Sugar Certification Allergens 2022 - Belgosuc(English)

Malt Kosher Certificate July 2024-June 2025

Malt Kosher Certificate July 2024-June 2025

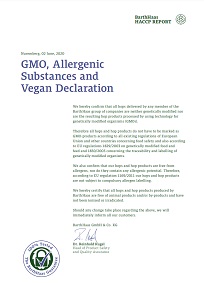

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

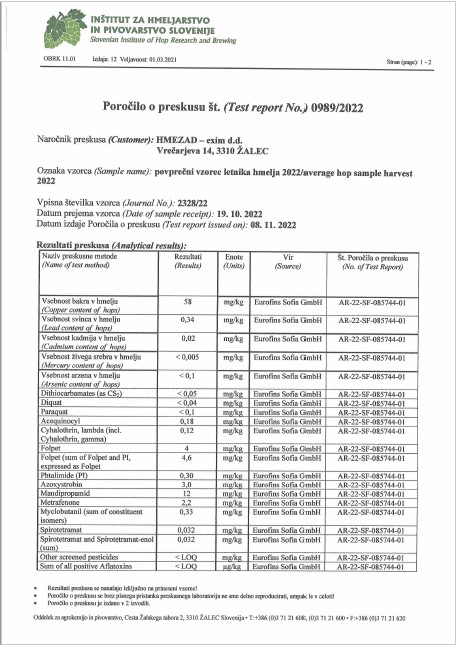

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

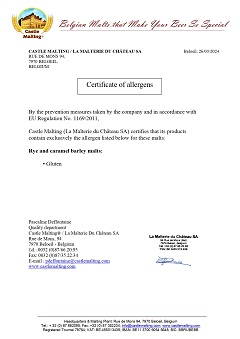

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)