장바구니

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

우리몰트

우리 홉

New Hops

우리 효모

우리 향신료

우리슈가

우리 캡(Caps)

-

병마개 26mm TFS-PVC Free, (불투명) 보라색 col. 2274 (10000/박스)

카트 추가

병마개 26mm TFS-PVC Free, (불투명) 보라색 col. 2274 (10000/박스)

카트 추가

-

Kegcaps 69 mm, 검정색 91 102 Grundey G-type (850/box)

카트 추가

Kegcaps 69 mm, 검정색 91 102 Grundey G-type (850/box)

카트 추가

-

Kegcaps 64 mm, 베이지색 65 Sankey S-type (EU) (1000/box)

카트 추가

Kegcaps 64 mm, 베이지색 65 Sankey S-type (EU) (1000/box)

카트 추가

-

병마개 26mm TFS-PVC Free, 금색 Neu Matt col. 2981 (10000/박스)

카트 추가

병마개 26mm TFS-PVC Free, 금색 Neu Matt col. 2981 (10000/박스)

카트 추가

-

병마개 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/박스)

카트 추가

병마개 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/박스)

카트 추가

맥주&위스키 레시피

인증서

동의

World: InBev to seek acquisitions in Latin America and Asia

World: InBev to seek acquisitions in Latin America and Asia

Belgian InBev NV, the world’s leading beer maker, is to look for more acquisitions in Europe, Asia and Latin America to increase sales faster than rivals such as Anheuser-Busch Cos., Chief Executive Officer John Brock said, according to a publication of Bloomberg from September 28.

Brock is interested in buying smaller companies in China, Russia, Germany and Latin America, he told reporters today at InBev's headquarters in Leuven, Belgium. InBev may look for purchases in Peru, Ecuador, Venezuela, Mexico and Spain, as well in Vietnam, the Philippines and Thailand.

InBev has emerged as the world's biggest beermaker by volume from 17th-largest in 1990 through transactions including the $11.2 billion-purchase of AmBev, South America's biggest brewer, a year ago. The Belgian company, which changed its name from Interbrew last year, also is introducing Brahma, Stella Artois and Beck's, its three main brands, into new markets to stimulate growth.

“The old Interbrew was an acquisition machine, but now we're seeing targeted mergers and acquisitions as a critical component but not the only one,'' Brock said. Asked if he would consider making another large transaction, the CEO said “never say never.''

InBev's takeover of Sao Paulo-based AmBev gave the 639-year- old Belgian brewer a foothold in six of the world's seven fastest- growing beer markets. InBev expects Mexico, Vietnam and Thailand to be among the top 10 growth markets by 2015. The company exports beer to those countries, though it doesn't yet have operations there, Brock said.

In China, the world's largest beer market with a value of $21 billion, InBev wants to increase its market share from 10 percent by making acquisitions in the five provinces it currently operates in, according to the CEO. The company has 28 breweries and 18 joint ventures in China.

Beer consumption in the Asian country is growing by an average of 8 percent a year, according to Brent Willis, the president of InBev's operations in the Asia Pacific region.

``Consolidation costs in China are high as all the four major players want their share of the world's fastest-growing market and see it as the holy grail of growth,'' said Willis, who helped introduce the Kraft brand to China when he was a marketing executive at Kraft Foods Inc.

InBev needs to expand further in Russia, where it's the No. 2 beermaker, because production capacity may run short, Brock said. Russians will probably drink an average of 70 liters of beer each by the end of 2010, up from about 54 liters last year, according to UBS AG. The market has doubled in size since 1999, the bank has estimated.

Heineken NV, the country's third-biggest brewer, has made four acquisitions in Russia this year, turning the country into the Dutch company's biggest market by volume. “In Russia, there is not a single acquisition that Heineken did that we would have done,'' Brock said. “Heineken overpaid and has the wrong brands.''

Brock is relying on expansion and sales growth in emerging markets to remain less dependent than Heineken and Carlsberg A/S on shrinking Western countries. The strategy has paid off: InBev reported an 86 percent gain in first-half profit earlier this month, led by beer sales in Latin America, while Amsterdam-based Heineken posted an 8.2 percent decline in earnings for the same period.

Heineken makes about two-thirds of its sales in Europe and the U.S., compared with a third for its larger Belgian rival.

Europeans are buying cheaper beers from supermarket chains including Tesco Plc after Ireland, Italy and Norway banned smoking in pubs and as slower economic growth reduced consumer spending.

In the U.S., consumers are increasingly opting for spirits and wine over beer amid a revival in a fashion for cocktails and entertaining at home. InBev's beer volumes dropped 3.7 percent in Western Europe and 2.3 percent in North America in the first six months of this year.

뒤로

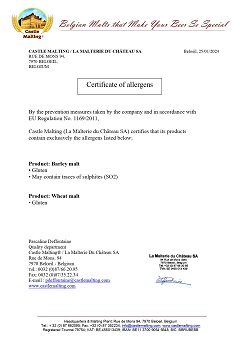

Malt Allergen Certificate for Barley and Wheat Malt (ENG)

Malt Allergen Certificate for Barley and Wheat Malt (ENG)

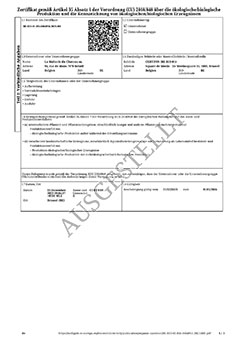

Bio-Zertifikat DE - Dezember 2023-März 2026

Bio-Zertifikat DE - Dezember 2023-März 2026

Top Hop - ISO Certificate 2021-2024

Top Hop - ISO Certificate 2021-2024

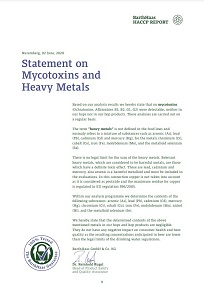

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

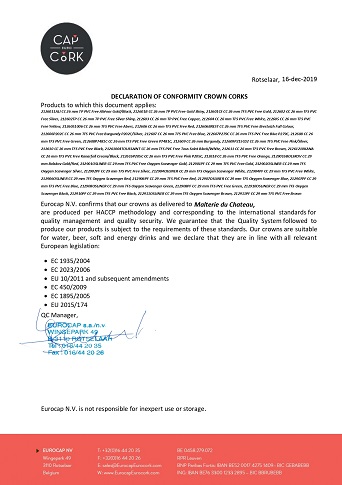

Crown Cork EUROCAP Conformity Certificate 2019

Crown Cork EUROCAP Conformity Certificate 2019