Tu carrito

Noticias de Empresa

E-Malt news

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2439 (10000/caja)

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2439 (10000/caja)

Añadir al carrito

-

Kegcaps 74 mm, Azules 141 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Azules 141 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

USA: Boston Beer upped to overweight

USA: Boston Beer upped to overweight

Shares in Boston Beer Co. rose as much as 7.6% on June 10 after an analyst upgraded the brewer, citing valuation and an attractive risk-versus-reward profile.

Boston Beer, maker of Samuel Adams brand beers, saw its stock rally 6.6%, or $1.41 to $22.92 recently. Shares traded as high as $23.14 earlier in the session.

Prudential Equity analyst Jeffrey Kanter, who upped the brewer to overweight from neutral, said the company's valuation is not as rich as it looks, thanks to the amount of cash Boston Beer has on its books. That cash affords management "shareholder friendly options," said Kanter in a note to clients.

Additionally, if the major brewers are successful in bringing drinkers back to the beer market, Boston Beer should benefit first, the analyst said.

"[The] risk/reward reminds us of 'heads we win, tails we tie,' which is a profile we typically like," said Kanter, who raised his price target to $26 from $24.

Regresar

Hmezad Hops, Certificate ISO 9001:2015 (2025)

Hmezad Hops, Certificate ISO 9001:2015 (2025)

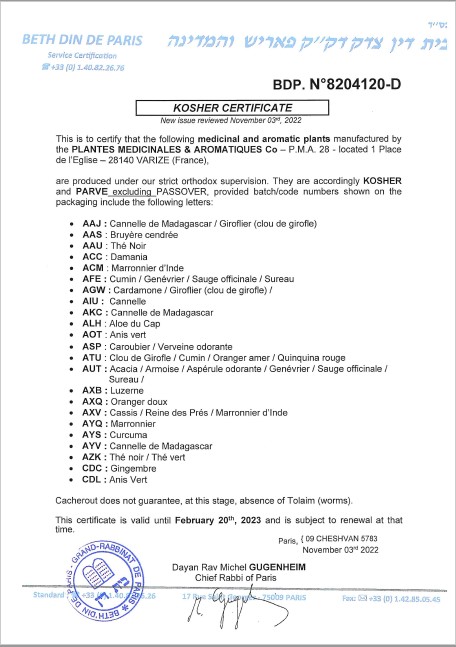

Fagron Spices, Kosher Certificate 2023

Fagron Spices, Kosher Certificate 2023

Hollands Hophuis Certificate Non-NANO materials 2023

Hollands Hophuis Certificate Non-NANO materials 2023

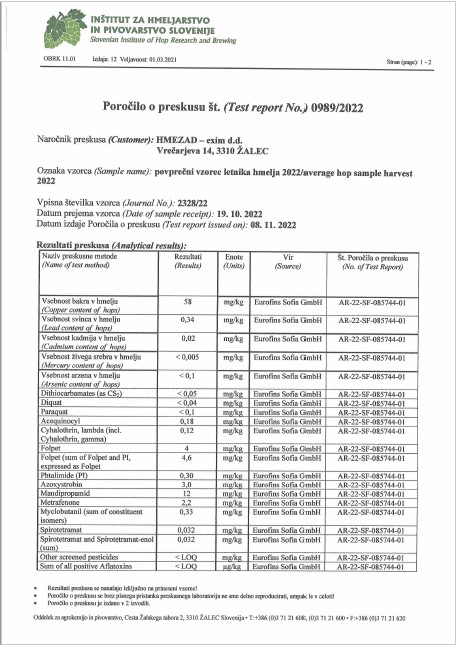

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

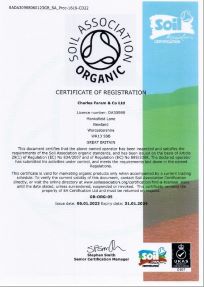

ChF Hops Organic certification, EN 2023-2024

ChF Hops Organic certification, EN 2023-2024