Il tuo carrello

Notizie Aziendali

E-Malt news

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

I nostri malti

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Kegcaps 69 mm, Giallo 4 Grundey G-type (850/box)

Aggiungi al carrello

Kegcaps 69 mm, Giallo 4 Grundey G-type (850/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Verde with oxygen scav.(6500/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Verde with oxygen scav.(6500/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/box)

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Giallo 4 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Giallo 4 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

USA: Boston Beer upped to overweight

USA: Boston Beer upped to overweight

Shares in Boston Beer Co. rose as much as 7.6% on June 10 after an analyst upgraded the brewer, citing valuation and an attractive risk-versus-reward profile.

Boston Beer, maker of Samuel Adams brand beers, saw its stock rally 6.6%, or $1.41 to $22.92 recently. Shares traded as high as $23.14 earlier in the session.

Prudential Equity analyst Jeffrey Kanter, who upped the brewer to overweight from neutral, said the company's valuation is not as rich as it looks, thanks to the amount of cash Boston Beer has on its books. That cash affords management "shareholder friendly options," said Kanter in a note to clients.

Additionally, if the major brewers are successful in bringing drinkers back to the beer market, Boston Beer should benefit first, the analyst said.

"[The] risk/reward reminds us of 'heads we win, tails we tie,' which is a profile we typically like," said Kanter, who raised his price target to $26 from $24.

Torna

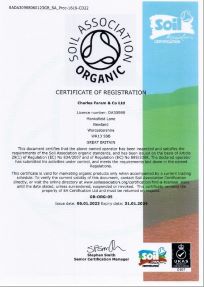

ChF Hops Organic certification, EN 2023-2024

ChF Hops Organic certification, EN 2023-2024

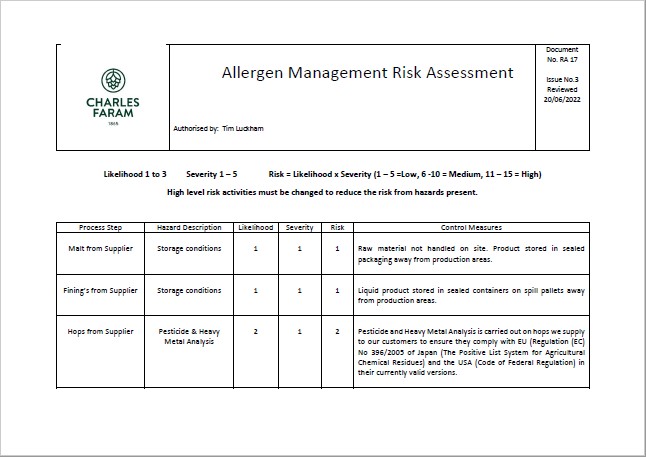

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

Hops, HVG, Organic Certificate 2024

Hops, HVG, Organic Certificate 2024

Belgosuc sugar, Management System Certificate 2022 (English)

Belgosuc sugar, Management System Certificate 2022 (English)

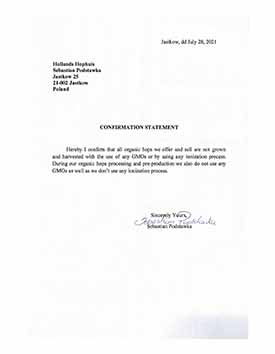

Hollands Hophuis, Confirmation Statement Organic Hops 2021

Hollands Hophuis, Confirmation Statement Organic Hops 2021