Tu carrito

Noticias de Empresa

E-Malt news

France: Beer and wine conglomerate Castel Group facing internal turmoil

UK: Spring barley area forecast to drop by 15% in 2026

Australia: Barley prices beginning to stabilize after four years of declines

EU: Early barley crop 2026 picture remains good, forecast for 2025 boosted by 0.2 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Rojas 102 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 102 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Marron 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Marron 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/caja)

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

UK: Young & Co.'s Brewery reported a 6 % rise in year profit

UK: Young & Co.'s Brewery reported a 6 % rise in year profit

Young & Co.'s Brewery, P.L.C., British brewer and pub owner, posted a 6 % rise in year profit on May 26 and bemoaned "never-ending" red tape for businesses.

Profit before tax and exceptional items was up 6 % to 9.6 million pounds in the year to April 2, 2005, said the group, which earlier this month announced plans to delist from the London Stock Exchange and shift to the junior AIM index, partly to reduce its tax burden, according to Reuters.

Operating profit rose 9.7 % at its managed pubs, boosted by a 14.5 percent increase in food sales. Volumes of its flagship Young's Bitter were up 9.5 percent, making it London's fourth biggest selling cask ale, and the tenth nationally.

"Stalling consumer confidence and ever increasing margin pressures, from rising staff and utility costs, never-ending red tape and this year the added costs from new licensing laws and increases in business rates, are all challenges we will have to face," Chairman John Young said in a statement.

"Accordingly, any sales and profit growth achieved this year will be well earned," he added, referring to the year to April 2006.

Young's said it was progressing with its review of controversial plans to commercially develop the site of its Ram Brewery in south London -- where ale has been brewed since 1581.

"As part of this review, discussions have been held over recent months with a number of commercial developers in order to gain their views of the site's potential and value," it said.

Young's shares were up 3 % to 1755 pence by 0945 GMT, valuing the group at around 121 million.

Regresar

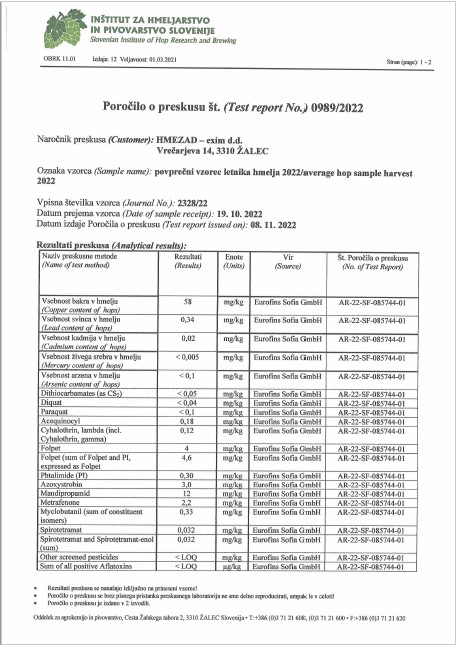

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

Organic Rice Husk Certificate ENG - 2023 - 2025

Organic Rice Husk Certificate ENG - 2023 - 2025

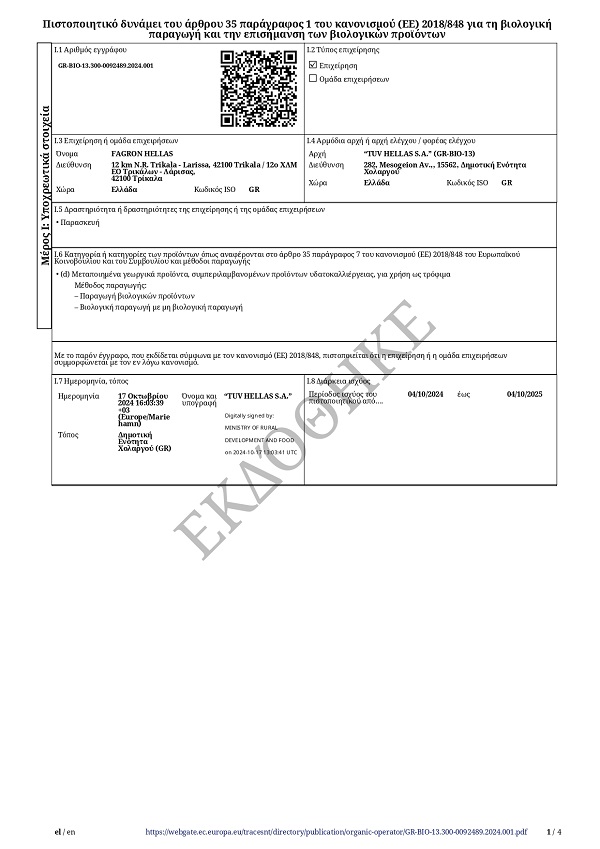

Fagron Spices, Organic Certificate 2024 - 2025

Fagron Spices, Organic Certificate 2024 - 2025

Crown Caps Finnkorkki Statement

Crown Caps Finnkorkki Statement

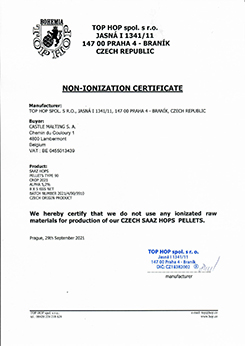

Top Hop - Non Ionization Certificate 2021

Top Hop - Non Ionization Certificate 2021