Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

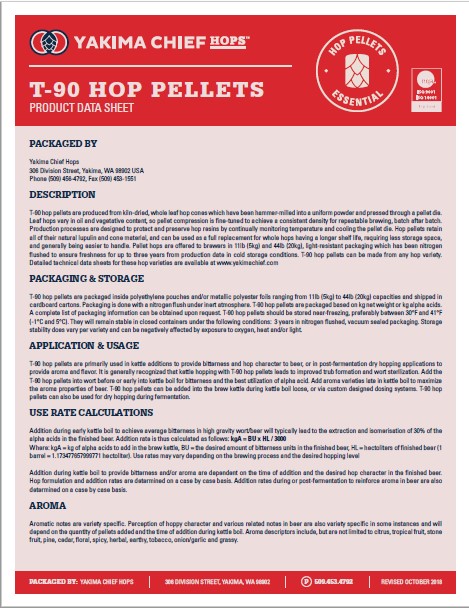

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

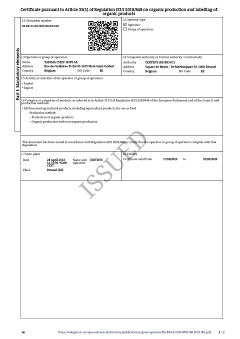

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

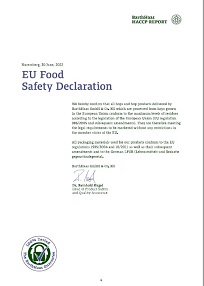

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

UK: Wolverhampton & Dudley's offer for Jennings Brothers was declared unconditional

UK: Wolverhampton & Dudley's offer for Jennings Brothers was declared unconditional

Jennings Brothers PLC announced that the Wolverhampton & Dudley Breweries PLC holds 76.01% in the company, representing 8,098,738 ordinary shares.

Wolverhampton & Dudley’s offer at 430 pence per share for smaller Lake District rival Jennings Brothers was declared unconditional last week.

The addition of Jennings' 128 tenanted pubs takes W&D's total to 2,275 - marginally ahead of the 2,100 pubs owned or operated by its Suffolk-based peer Greene King.

While both groups continue to sell ale brands with strong regional loyalties through their respective pub estates and elsewhere, a recent spate of acquisitions have seen the groups expand far beyond their respective "regional brewer" heartlands.

The £46m Jennings offer follows W&D's recent acquisitions of Burtonwood, for £155m, and Wizard Inns, for £90m.

Meanwhile, W&D chief executive Ralph Findlay said on May 20 the group's predominantly suburban pub estate had not been experiencing the same pressures from consumer spending declines to have hit many high street retail operators in recent weeks. "The sort of pubs we operate are not in the front line when it comes to responding to consumer sentiment ... We would expect our performance will continue to be strong."

The brewer announced underlying pre-tax profits for the 26 weeks to April 2 up 13.6% at £36m. Meanwhile, comparable sales were ahead by 3.1% at W&D's managed pub business Pathfinder, and by 3.2% at its tenanted division, the Union Pub Company.

The group's strong performance comes at the end of a week in which both Enterprise Inns and Mitchells & Butlers reported strong sales and few signs of declining spending across the pub trade. W&D said it had increased its premium ale sales volumes by 14%, with substantial increases in sales outside its own pub estate - albeit at a reduced margin.

Regresar