Tu carrito

Noticias de Empresa

E-Malt news

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

World: Global hop harvest lower this year, Barth Haas say

USA, NM: Two Bosque Brewing locations in Albuquerque closing their doors

World: Global hop acreage down 5% in 2025

Nuestras maltas

-

CHÂTEAU CARA GOLD NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA GOLD NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU CARA HONEY NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA HONEY NATURE (MALTA ORGÁNICA)

Añadir al carrito

-

MALT CHÂTEAU OAT NATURE® (MALTA ORGANICA DE AVENA)

Añadir al carrito

MALT CHÂTEAU OAT NATURE® (MALTA ORGANICA DE AVENA)

Añadir al carrito

-

CHÂTEAU CARA BLOND NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA BLOND NATURE (MALTA ORGÁNICA)

Añadir al carrito

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

CC26 mm, Rose with silver edge (10500/caja)

Añadir al carrito

CC26 mm, Rose with silver edge (10500/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

-

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Colombia: Heineken NV is looking at Colombia's biggest brewer Bavaria

Colombia: Heineken NV is looking at Colombia's biggest brewer Bavaria

Dutch brewer Heineken NV is looking at Colombia's biggest brewer Bavaria as part of plans to expand in Latin America, Heineken’s chief executive said on April 25. Asked in an interview with Reuters in Paris about speculation over a pending takeover by Heineken of Bavaria, outgoing chief executive Anthony Ruys said: "Yes, but we are looking at any brewer that is for sale…. Even though it's a big project, it doesn't necessarily mean it's impossible by definition."

Ruys said Heineken was in the process of gathering information about the brewer and he did not rule out that a type of partnership, along the lines of one that the firm has with Fraser & Neave, might be possible with Bavaria.

"If you see this kind of opportunity, then you would like to deepen your knowledge about it," he said. Asked if Heineken would consider buying Brazilian brewer Cervejarias Kaiser, he said: "It is a possibility."

Heineken last year took a 190 million euro ($248.3 million) charge on its small stake in Kaiser, reducing the value to zero, but said the write-down was unrelated to any decision about its future.

Kaiser's majority shareholder is Canada's Molson which merged in February with Adolph Coors to create Molson Coors Brewing Co.. Some analysts expect Molson to sell Kaiser and have tipped Heineken as a possible buyer.

"We're going to look at how things are going. We are going to look at what Molson and Coors want to do with it as well as what other options are open for Brazil and South America," Ruys said. He also said Heineken was still interested in raising its stake in China's Kingway Brewery Holdings but nothing was imminent.

Heineken, the world's fourth biggest brewer, said earlier this month Ruys will step down earlier than expected on Oct. 1 and be succeeded by Belgian Jean-Francois van Boxmeer.

Ruys declined to comment on current market conditions. Asked about analyst expectations that Heineken might close breweries in Europe in the next few years, he said the firm wanted to use capacity in a different way, rather than closing breweries outright.

Regresar

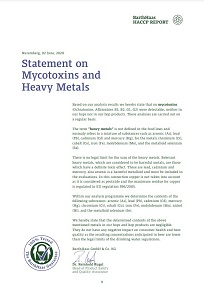

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

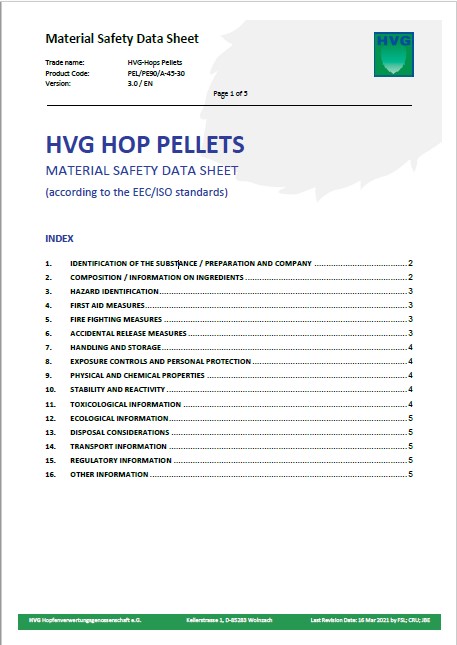

Hops, HVG, Material Safety Data Sheet 2023

Hops, HVG, Material Safety Data Sheet 2023

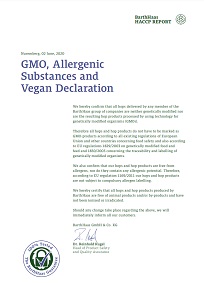

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Malt GMO-Free Certificate 2025

Malt GMO-Free Certificate 2025

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027