Tu carrito

Noticias de Empresa

E-Malt news

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

World: Global hop harvest lower this year, Barth Haas say

USA, NM: Two Bosque Brewing locations in Albuquerque closing their doors

World: Global hop acreage down 5% in 2025

Nuestras maltas

-

CHÂTEAU CARA GOLD NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA GOLD NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU CARA HONEY NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA HONEY NATURE (MALTA ORGÁNICA)

Añadir al carrito

-

MALT CHÂTEAU OAT NATURE® (MALTA ORGANICA DE AVENA)

Añadir al carrito

MALT CHÂTEAU OAT NATURE® (MALTA ORGANICA DE AVENA)

Añadir al carrito

-

CHÂTEAU CARA BLOND NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA BLOND NATURE (MALTA ORGÁNICA)

Añadir al carrito

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

CC26 mm, Rose with silver edge (10500/caja)

Añadir al carrito

CC26 mm, Rose with silver edge (10500/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

-

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

World: Barley crop forecast up 1.5 mln tonnes to 153.7 mln

World: Barley crop forecast up 1.5 mln tonnes to 153.7 mln

The forecast for global barley production 2025/26 is increased by an additional +1.5 mln tonnes, reaching a total of 153.7 mln tonnes, RMI Analytics said in their latest report.

The most significant increase came from Canada, contributing +0.7 mln tonnes, along with smaller gains reported from Russia, the EU-27, China, India, and Algeria. The result is the third largest barley supply in 12 years, with ending stocks rising further as overall demand growth lags significantly the increase in supply.

Global trade is expected to increase slightly during crop’25, as major production regions fulfil higher anticipated demand from major importers like China, north Africa, and the Middle East. Despite this demand boost, ending stocks are to increase by 4 mln tonnes in crop’25, the analysts believe.

Recent late-season increases in global barley production contribute to an already ample supply situation. In terms of malting barley selection rates, the quality is deemed to be average, with only minor quality variability to address.

The current barley market presents a mixed landscape. European prices are declining as the holidays approach, while other regions remain stable or even show signs of recovery. French malting barley prices are now the low-cost malting barley origin on a FOB basis. Meanwhile, Australian prices are on the rise, and Argentina and Canada are generally steady. The weak demand environment, compounded by both announced and rumoured malting closures in Europe, is significantly impacting the market. Feed barley values in Europe are also softening as 2025 closes out.

Regresar

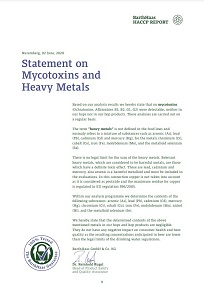

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

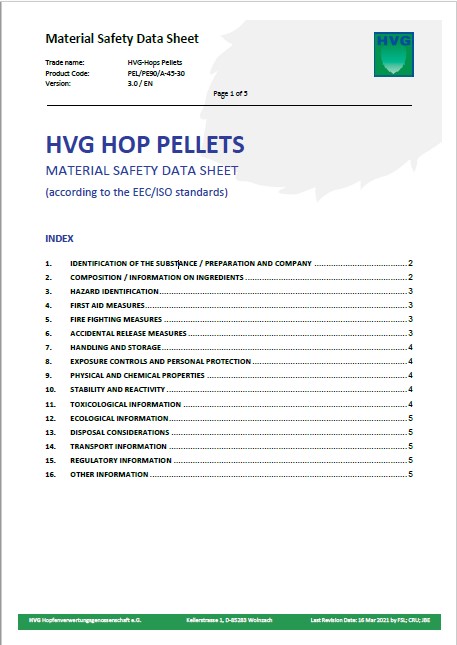

Hops, HVG, Material Safety Data Sheet 2023

Hops, HVG, Material Safety Data Sheet 2023

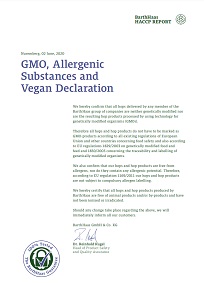

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Malt GMO-Free Certificate 2025

Malt GMO-Free Certificate 2025

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027