Το καλάθι σας

Ειδήσεις Για Την Εταιρεία Μας

E-Malt news

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

World: Global hop harvest lower this year, Barth Haas say

USA, NM: Two Bosque Brewing locations in Albuquerque closing their doors

World: Global hop acreage down 5% in 2025

Οι βύνες μας

Οι λυκίσκοι μας

New Hops

Η Μαγιά μας

Τα Μπαχαρικά μας

Η ζάχαρή μας

Τα Καπάκια μας

-

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Προσθέστε

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Προσθέστε

-

Kegcaps 74 mm, Gold 116 Flatfitting A-type (700/box)

Προσθέστε

Kegcaps 74 mm, Gold 116 Flatfitting A-type (700/box)

Προσθέστε

-

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/box)

Προσθέστε

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/box)

Προσθέστε

-

Kegcaps 64 mm, Red 102 Sankey S-type (EU) (1000/box)

Προσθέστε

Kegcaps 64 mm, Red 102 Sankey S-type (EU) (1000/box)

Προσθέστε

-

Kegcaps 69 mm, Χρυσός 116 Grundey G-type (850/box)

Προσθέστε

Kegcaps 69 mm, Χρυσός 116 Grundey G-type (850/box)

Προσθέστε

ΠΙΣΤΟΠΟΙΗΤΙΚΑ

-

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

-

Belgosuc Sugar, Sustainability certificate 2023

Belgosuc Sugar, Sustainability certificate 2023

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

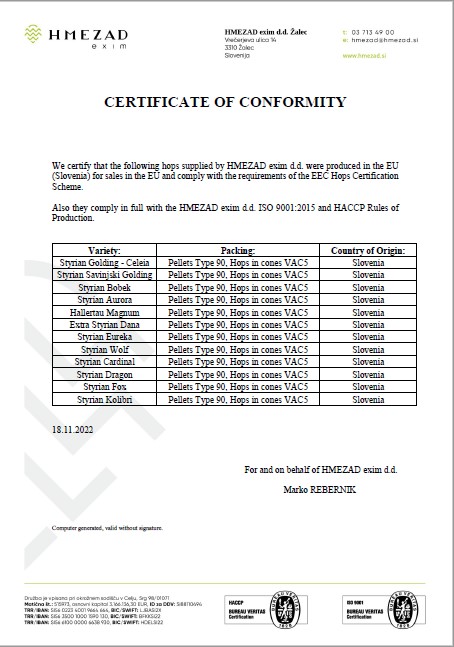

HMEZAD Hops - Certificate of conformity 2022

HMEZAD Hops - Certificate of conformity 2022

-

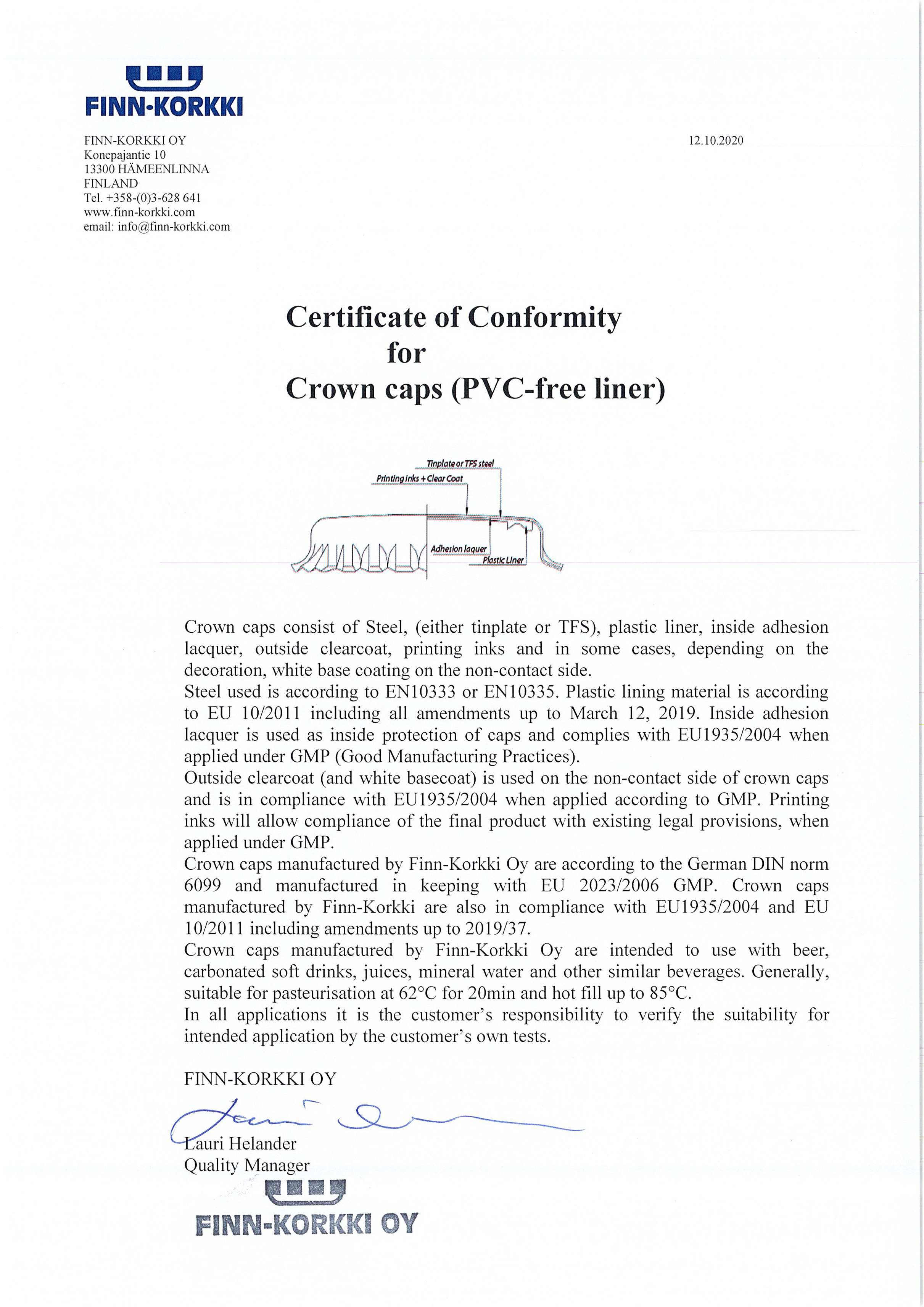

Crown Caps Finnkorkki PVC-free liner

Crown Caps Finnkorkki PVC-free liner

Πρόταση

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

Diageo announced on December 17 it had agreed to sell its 65% stake in East African Breweries to Japan's Asahi Group Holdings in a $2.3 billion transaction, as the UK spirits group continues to streamline its portfolio after a challenging two-year period.

The deal also includes Diageo's majority holding in UDVK, a Kenya-based spirits producer and importer, following a strategic review of East African Breweries that had involved appointing banks.

Management appears to be accelerating a turnaround effort after demand pressure weakened its premiumisation strategy, which had been built around encouraging consumers to trade up to higher-priced spirits.

The transaction fits into a broader pattern of asset disposals across Africa in recent years, including exits from Seychelles Breweries and Nigeria, as well as the sale of an 80% stake in Guinness Ghana Breweries to Castel Group in January, alongside earlier divestments in Cameroon and Ethiopia.

Investors reacted cautiously positively, with Diageo shares rising as much as 2.6% in London, even though the stock remains down by roughly a third this year. East African Breweries shares were little changed in Nairobi after earlier gains of up to 9.9%.

The deal also comes ahead of a leadership transition, with former Tesco chief Dave Lewis set to take over as chief executive in January following Debra Crew's departure earlier this year.

For Asahi, the acquisition could mark a strategic expansion into Africa as growth opportunities at home become more limited. Over the past decade, the brewer has spent at least 2.3 trillion yen on overseas assets, including operations acquired from SABMiller and AB InBev, as well as businesses in Australia and the UK.

Asahi said the investment could provide a platform in East Africa, particularly Kenya, where longer-term growth is expected from economic and population expansion.

East African Breweries is expected to remain listed in Kenya, Uganda and Tanzania, with the transaction targeted to complete in the second half of 2026, subject to regulatory approvals.

Πίσω