Новини компанії

E-Malt news

France: State of soft wheat and winter barley crop slightly down

UK: First report on winter crops shows very good prospects for winter wheat, barley, oats and oilseed rape

Africa: SCADS beer formally enters African market

Brazil: Dispute between Heineken and Ambev gains new momentum

Наш солод

Наш хміль

New Hops

Наші дріжджі

Наші спеції

Наш цукор

Наші кришки

-

Кришки для кег 69 мм, Білий 86 Grundey G-тип (850/Коробка)

Додати до кошика

Кришки для кег 69 мм, Білий 86 Grundey G-тип (850/Коробка)

Додати до кошика

-

Crown Caps 26 mm TFS-PVC Free, Жовті col. 2165 (10000/Коробка)

Додати до кошика

Crown Caps 26 mm TFS-PVC Free, Жовті col. 2165 (10000/Коробка)

Додати до кошика

-

Кришки 26mm TFS-PVC Free, Mustard yellow col. 20164 (10000/Коробка)

Додати до кошика

Кришки 26mm TFS-PVC Free, Mustard yellow col. 20164 (10000/Коробка)

Додати до кошика

-

CC29mm TFS-PVC Free, Жовті with oxygen scav.(6500/Коробка)

Додати до кошика

CC29mm TFS-PVC Free, Жовті with oxygen scav.(6500/Коробка)

Додати до кошика

-

Кришки для кег 69 мм, Зелені 147 Grundey G-тип (850/Коробка)

Додати до кошика

Кришки для кег 69 мм, Зелені 147 Grundey G-тип (850/Коробка)

Додати до кошика

Рецепти пива

Сертифікати

Suggestion

Nigeria: Nigerian brewers regaining momentum after two years of mounting losses

Nigeria: Nigerian brewers regaining momentum after two years of mounting losses

Beer makers, like other consumer goods producers, have experienced two years of mounting losses due to the steep devaluation of the naira and the removal of fuel subsidies, which have inflated prices and exerted pressure on profitability, Business Day reported on December 1.

However, the brewers are regaining momentum, with four of the listed firms posting a combined profit of N171.64 billion in the nine months of 2025, marking a turnaround for a sector that booked N317.07 billion in losses in the same period last year.

The combined adoption of a series of corporate actions, including capital raise through rights issue, divestment, and strategic acquisition, and transitioning into a new majority shareholder, has been the strategic shift to safeguard operations, enhance efficiency, and reposition the industry for long-term growth.

International Breweries Plc turned to a rights issue offering after it ended the first quarter of 2024 with negative shareholders’ funds of N347.5 billion. The brewer opened a N588 billion issue involving 161 billion shares. The issue was 87.75 percent subscribed, generating N516.2 billion for the company in new capital.

Proceeds of the offering were used to offset existing liabilities, particularly a $379 million convertible loan from parent company AB InBev, originally used to refinance a N424 million facility from Citibank Abu Dhabi.

AB InBev’s full subscription to the issue effectively converted the loan to equity, improving the company’s balance sheet health, albeit with no fresh capital injection.

That strategic shift saw the company rebound into profitability in the period ended September 2025, posting N57.82 billion in net income, compared to a N112.81 billion loss in the previous period last year.

In its quest to sustain growth and improve operational efficiency, Nigerian Breweries, the country’s most valuable brewer, turned to a rights issue, which it completed in October 2024, totalling N599.10 billion priced at N26.50 per share, with a subscription level of 91.59 percent, demonstrating strong investor confidence.

A total of 22.61 billion ordinary shares were offered on an 11-for-5 basis to shareholders as of July 12, 2024. Concurrently, the company acquired the remaining 20 percent stake in Distell Wines and Spirits Nigeria Ltd (DWSN), further deepening its presence in the wines, spirits, and RTD segment with brands like Chamdor, 4th Street, and Savanna.

Those moves saw the company bounce back with net income for the nine months ended September returning to positive territory of N85.50 billion compared to the N149.50 billion losses incurred the previous year.

Champion Breweries is the smallest among the listed brewers, but its strong operational management excluded it from the sweeping losses that hit the brewers at the end of last year.

Major events that have shaped the Uyo-based manufacturer include Heineken B.V. divestment of its 86.50 percent stake in Champion Breweries Plc in February 2024 to EnjoyCorp Limited, a player in the food, beverage, and hospitality space.

The transaction, executed through Raysun Nigeria Limited, marked Heineken’s full exit from Champion Breweries.

In August 2025, the company announced an agreement to acquire the Bullet range of ready-to-drink (RTD) alcoholic and energy beverages from Sun Mark International Limited.

That acquisition move led to the commencement of rights issue of 994,221,766 ordinary shares of N0.50 at N16.00 per share in November 2025. This represents the first phase of a two-step capital raise, to be followed by a planned Public Offer.

The company’s nine-month performance tells a tremendous growth story as the beer maker grew its profit by over 953 percent to N2.04 billion from N21.49 million a year ago.

Since Tolaram Group acquired Diageo’s 58.02 percent stake in Guinness Nigeria Plc, in a landmark deal that made it the new majority shareholder, following regulatory approval, the company’s growth trajectory has been on an upward trend.

The acquisition, which took effect on September 30, 2024, includes long-term license and royalty agreements for the continued production and sale of Diageo’s flagship brands in Nigeria.

As of its 15-month financial statement ending September 30, 2025, the company posted a net profit of N26.28 billion compared to a N54.76 billion loss in the prior period.

The performance of the brewers paints a picture of resilience and innovation amid a still volatile economy. Though there has been an improved macroeconomic condition with inflation trending downward for the seventh straight month, the naira appreciating by about 12 percent, and the central bank easing the monetary asymmetric corridor to allow for credit extension, input costs remain high, piling pressure on the bottom line.

Назад

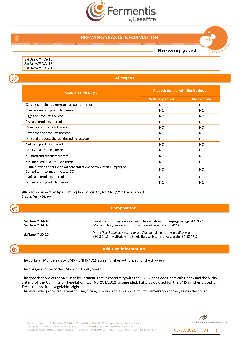

Fermentis - Brewing Yeasts Information ENG - HA-18,_DA-16, LD-20

Fermentis - Brewing Yeasts Information ENG - HA-18,_DA-16, LD-20

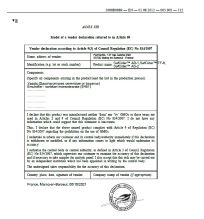

Fermentis Yeast- Non GMO declaration SafCider range

Fermentis Yeast- Non GMO declaration SafCider range

Crown Caps Finnkorkki Statement

Crown Caps Finnkorkki Statement

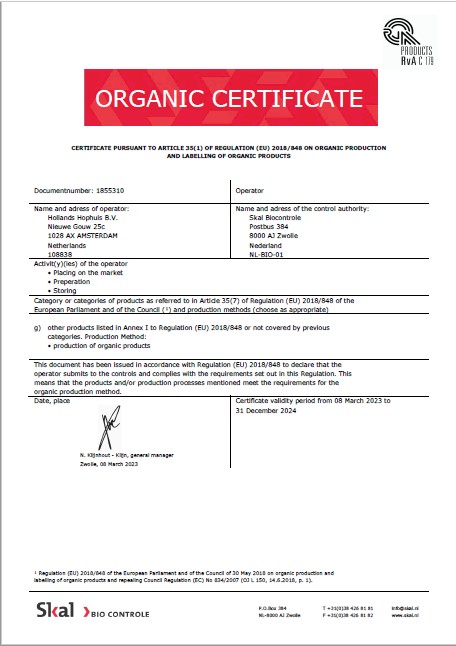

Hollands Hophuis, Organic Production and Labelling 2023-2024

Hollands Hophuis, Organic Production and Labelling 2023-2024

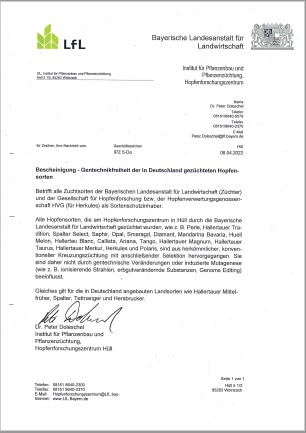

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN