Tu carrito

Noticias de Empresa

E-Malt news

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2439 (10000/caja)

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2439 (10000/caja)

Añadir al carrito

-

Kegcaps 74 mm, Azules 141 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Azules 141 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Nigeria: International Breweries� after-tax loss deepens due to growth in expenditure in January-September this year

Nigeria: International Breweries� after-tax loss deepens due to growth in expenditure in January-September this year

International Breweries has seen its after-tax loss deepen to N112.8 billion due to the growth in expenditure in nine months of 2024, BusinessDay analysis shows.

The firm’s after-tax loss widened to N112.8 billion in the nine months of 2024 from N28.56 billion loss in the same period of 2023, reflecting a four-fold jump within the period.

Further analysis reveals that other expenses surged to N147.6 billion from N36.2 billion in the same period of 2023, as cost of sales grew to N248.6 billion from N126.4 billion.

The firm’s net finance cost also surged to N29.2 billion from N11.1 billion. Revenue jumped to N343.4 billion from N183.8 billion during the reviewed period.

Obi Achebe, chairman of the board of directors at International Breweries Plc, said in a statement that the repayment of the company’s foreign exchange-denominated loans would propel the firm back to the path of sustainable profitability.

According to a recent statement by the brewer, Achebe also commended the company’s progress, particularly after its rights issue, which enabled the repayment of its forex-denominated loan, which had impacted the company over the years.

“The elimination of our FX exposure will improve IBPLC’s cash flows and will support the company’s return to profitability. The offer was supported by our core shareholder, Anheuser-Busch InBev who followed their rights in full. This is a strong indication of AB InBev’s commitment and belief in the Nigerian market opportunity and overall Nigerian economy,” Achebe said.

“We are proud of the strides we have made in strengthening our business foundation and positioning for sustainable growth. The repayment of our outstanding $379.9 million loan, enabled by our parent company, AB InBev has bolstered our financial position. This recapitalisation not only strengthens our balance sheet but also sets the stage for long-term profitability and growth. We are now better equipped to drive innovation, improve operational efficiency, and seize new opportunities.”

International Breweries opened its N588 billion rights issue programme on May 21, 2024, where the brewer seeks to issue 161,172,395,100 new ordinary shares of 2 kobo each at an offer price of N3.65 per share.

According to the rights issue circular, the terms include six new ordinary shares for every share held by existing shareholders. The programme is expected to run until June 10, 2024.

A statement from the brewer, which is a part of AB InBev, disclosed that non-shareholders could acquire traded rights on the floor of the Nigerian Exchange through stockbrokers.

“We are committed to creating sustainable value for our shareholders while fortifying our position in the Nigerian beverage industry. Together, we will continue to brew success, deliver long-term value for our shareholders, and create a future with more cheers,” David Tomlinson, finance director of International Breweries, said.

The firm stated that the tradability of the rights on the floor of the Nigerian Exchange ensures liquidity and accessibility for shareholders throughout the offer.

In August, the Nigerian Exchange Limited (NGX) approved International Breweries’ free float compliance extension request of two years ending July 30, 2024.

This was contained in a disclosure on approval of the free float compliance extension signed by Muyiwa Ayojimi, the company secretary.

In 2016, Anheuser-Busch InBev (AB InBev) acquired SABMiller, then the world’s second-largest brewer.

This acquisition included all of SABMiller’s Nigerian subsidiaries: Intafact Beverages Limited in Onitsha; International Breweries Plc in Ilesha; and Pabod Breweries Limited in Port Harcourt.

The three breweries were merged into one under the International Breweries label in 2017, with AB InBev being the majority shareholder.

Before the merger, International Breweries (Ilesha) had been a relatively profitable business, as it posted a net income of N1.03 billion for the fiscal year ending March 31, 2017.

As part of the merger, the operational capacity as well as liabilities of the three businesses were merged into one, thus pushing the business into a region of net losses.

period of 2023, as cost of sales grew to N248.6 billion from N126.4 billion.

The firm’s net finance cost also surged to N29.2 billion from N11.1 billion. Revenue jumped to N343.4 billion from N183.8 billion during the reviewed period.

Obi Achebe, chairman of the board of directors at International Breweries Plc, said in a statement that the repayment of the company’s foreign exchange-denominated loans would propel the firm back to the path of sustainable profitability.

According to a recent statement by the brewer, Achebe also commended the company’s progress, particularly after its rights issue, which enabled the repayment of its forex-denominated loan, which had impacted the company over the years.

“The elimination of our FX exposure will improve IBPLC’s cash flows and will support the company’s return to profitability. The offer was supported by our core shareholder, Anheuser-Busch InBev who followed their rights in full. This is a strong indication of AB InBev’s commitment and belief in the Nigerian market opportunity and overall Nigerian economy,” Achebe said.

“We are proud of the strides we have made in strengthening our business foundation and positioning for sustainable growth. The repayment of our outstanding $379.9 million loan, enabled by our parent company, AB InBev has bolstered our financial position. This recapitalisation not only strengthens our balance sheet but also sets the stage for long-term profitability and growth. We are now better equipped to drive innovation, improve operational efficiency, and seize new opportunities.”

International Breweries opened its N588 billion rights issue programme on May 21, 2024, where the brewer seeks to issue 161,172,395,100 new ordinary shares of 2 kobo each at an offer price of N3.65 per share.

According to the rights issue circular, the terms include six new ordinary shares for every share held by existing shareholders. The programme is expected to run until June 10, 2024.

A statement from the brewer, which is a part of AB InBev, disclosed that non-shareholders could acquire traded rights on the floor of the Nigerian Exchange through stockbrokers.

“We are committed to creating sustainable value for our shareholders while fortifying our position in the Nigerian beverage industry. Together, we will continue to brew success, deliver long-term value for our shareholders, and create a future with more cheers,” David Tomlinson, finance director of International Breweries, said.

The firm stated that the tradability of the rights on the floor of the Nigerian Exchange ensures liquidity and accessibility for shareholders throughout the offer.

In August, the Nigerian Exchange Limited (NGX) approved International Breweries’ free float compliance extension request of two years ending July 30, 2024.

This was contained in a disclosure on approval of the free float compliance extension signed by Muyiwa Ayojimi, the company secretary.

In 2016, Anheuser-Busch InBev (AB InBev) acquired SABMiller, then the world’s second-largest brewer.

This acquisition included all of SABMiller’s Nigerian subsidiaries: Intafact Beverages Limited in Onitsha; International Breweries Plc in Ilesha; and Pabod Breweries Limited in Port Harcourt.

The three breweries were merged into one under the International Breweries label in 2017, with AB InBev being the majority shareholder.

Before the merger, International Breweries (Ilesha) had been a relatively profitable business, as it posted a net income of N1.03 billion for the fiscal year ending March 31, 2017.

As part of the merger, the operational capacity as well as liabilities of the three businesses were merged into one, thus pushing the business into a region of net losses.

Regresar

Hmezad Hops, Certificate ISO 9001:2015 (2025)

Hmezad Hops, Certificate ISO 9001:2015 (2025)

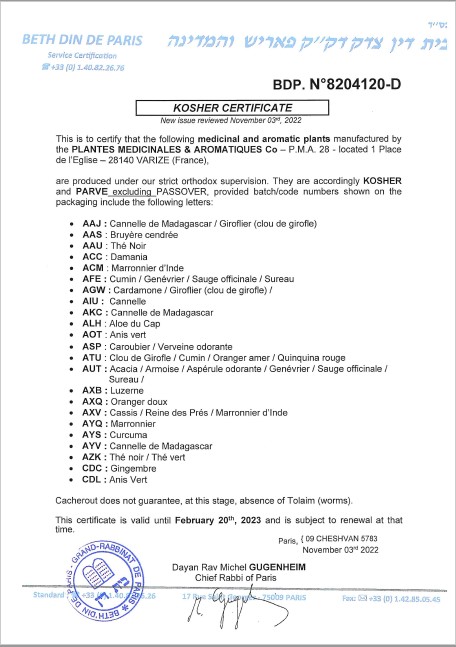

Fagron Spices, Kosher Certificate 2023

Fagron Spices, Kosher Certificate 2023

Hollands Hophuis Certificate Non-NANO materials 2023

Hollands Hophuis Certificate Non-NANO materials 2023

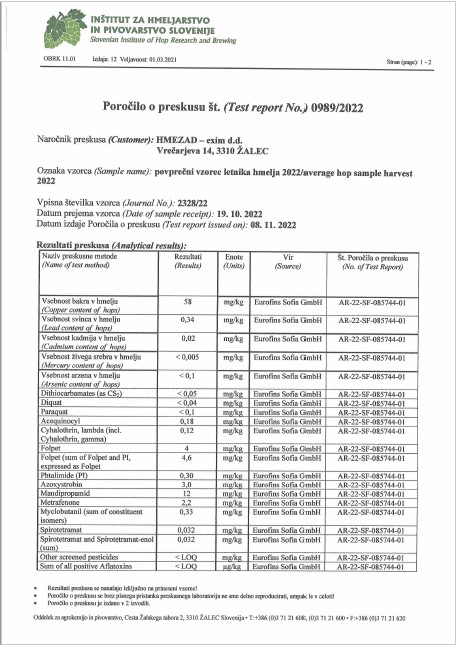

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

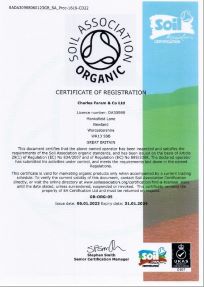

ChF Hops Organic certification, EN 2023-2024

ChF Hops Organic certification, EN 2023-2024