Tu carrito

Noticias de Empresa

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

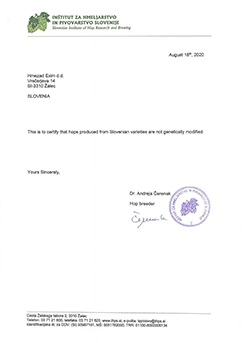

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

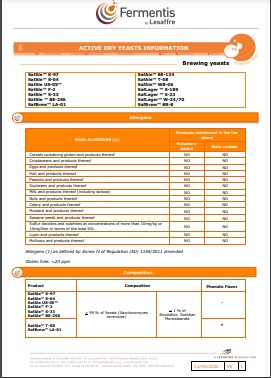

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

-

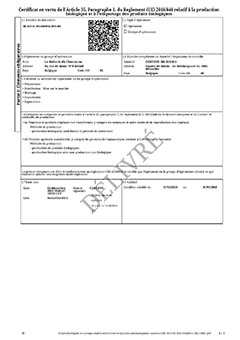

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Sugerencia

Australia: Australian barley prices feeling some downward pressure

Australia: Australian barley prices feeling some downward pressure

With harvesting advancing, barley prices are feeling some downward pressure, and for malting barley, Australia remains the cheapest origin globally, RMI Analytics said in their early November report.

Between the regions, the east-coast is holding a premium over Western Australia, despite the very good early yield and quality results in Queensland and New South Wales. A part of this price relationship relates to the expected poorer results in drought and frost impacted regions (as noted above). For east-coast maltsters, the flow of malting barley from crop’24 will differ from crop’23, due to the final quality result.

Both malting and feed barley prices are feeling increasing competitive pressure from Canada and Argentina (but less so from France). From an analytical perspective, RMI’s Barley Price Model continues to view price direction for Australia malting barley going forward to be upwards, particularly once harvest is completed and harvest pressure on prices subsides.

Regresar