Το καλάθι σας

Ειδήσεις Για Την Εταιρεία Μας

E-Malt news

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

World: Global hop harvest lower this year, Barth Haas say

USA, NM: Two Bosque Brewing locations in Albuquerque closing their doors

World: Global hop acreage down 5% in 2025

Οι βύνες μας

Οι λυκίσκοι μας

New Hops

Η Μαγιά μας

Τα Μπαχαρικά μας

Η ζάχαρή μας

Τα Καπάκια μας

-

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Προσθέστε

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Προσθέστε

-

Kegcaps 74 mm, Gold 116 Flatfitting A-type (700/box)

Προσθέστε

Kegcaps 74 mm, Gold 116 Flatfitting A-type (700/box)

Προσθέστε

-

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/box)

Προσθέστε

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/box)

Προσθέστε

-

Kegcaps 64 mm, Red 102 Sankey S-type (EU) (1000/box)

Προσθέστε

Kegcaps 64 mm, Red 102 Sankey S-type (EU) (1000/box)

Προσθέστε

-

Kegcaps 69 mm, Χρυσός 116 Grundey G-type (850/box)

Προσθέστε

Kegcaps 69 mm, Χρυσός 116 Grundey G-type (850/box)

Προσθέστε

ΠΙΣΤΟΠΟΙΗΤΙΚΑ

-

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

-

Belgosuc Sugar, Sustainability certificate 2023

Belgosuc Sugar, Sustainability certificate 2023

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

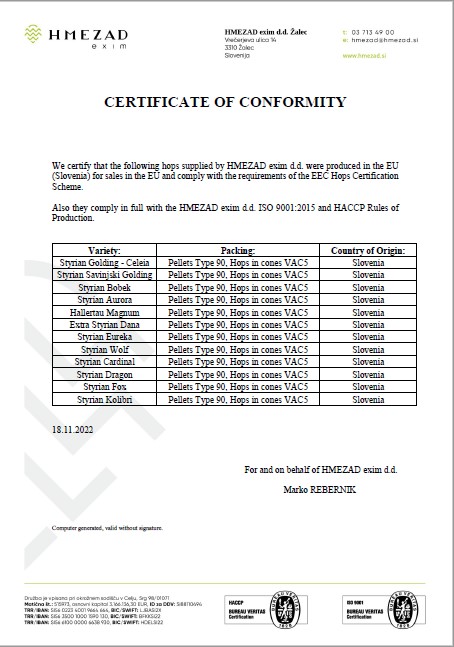

HMEZAD Hops - Certificate of conformity 2022

HMEZAD Hops - Certificate of conformity 2022

-

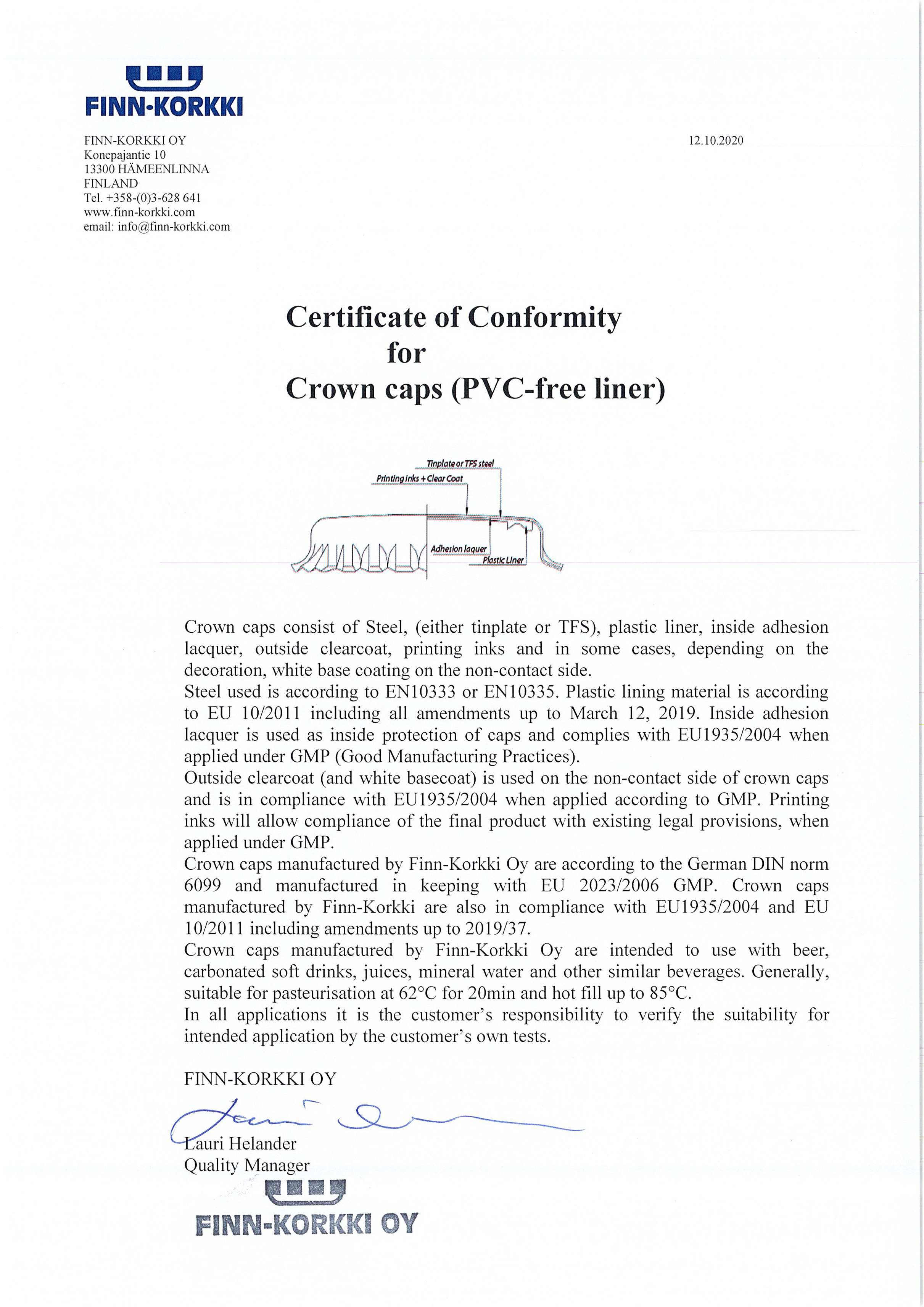

Crown Caps Finnkorkki PVC-free liner

Crown Caps Finnkorkki PVC-free liner

Πρόταση

Brazil: Ambev shares trading lower as quarterly sales miss analysts estimates

Brazil: Ambev shares trading lower as quarterly sales miss analysts estimates

Ambev shares are trading lower on October 31.

The company reported third quarter earnings per share of 4 cents, in line with the street view. Quarterly sales of $3.983 billion missed the analyst consensus estimate of $4.082 billion.

Consolidated volumes declined by 0.6%, but when excluding Argentina, there was a growth of 1.3%.

In Brazil, volumes increased by 1.3%, with beer sales growing by 0.6% and non-alcoholic beverages (NAB) rising by 3.4%. In Brazil’s beer segment, premium and super premium brands saw volume growth in the low twenties, driven by Corona, Spaten, and Original. Core plus brands grew by low teens, with the Budweiser family leading the way, while core brands Brahma and Antarctica each recorded high single-digit increases in volume.

In Central America and the Caribbean (CAC), volumes decreased by 0.5%, although the Dominican Republic saw a midsingle-digit increase. Additionally, soft industry conditions in Argentina and Canada contributed to volume declines of 7.7% in Latin America South (LAS) and 1.4% in Canada.

In the quarter under review, the company’s cash cost of goods sold (COGS) increased in low-single digits, primarily due to inflation and diminished benefits from commodity price hedges, while cash selling, general, and administrative expenses (SG&A) rose in mid-single digits because of increased investments in brand support and higher administrative costs linked to elevated variable compensation accruals.

“Looking ahead, we remain focused on executing our commercial strategy and are confident in our preparedness for the Summer season in South America, with healthier brands and sustained all-time-high NPS levels,” Ambev said.

Πίσω