Company News

Industry News

UK: Syngenta agrees to sell its malting barley seeds business

Germany & South Korea: Paulaner switches South Korea distribution to Heineken

Thailand: ThaiBev reports 7% fall in annual profit

USA, TX: Revolver Brewing to leave Granbury and move to Dallas-Fort Worth area

Our Malts

Our Hops

New Hops

Our Yeasts

Our Spices

Our Sugars

Our Caps

-

Kegcaps 74 mm, Red 102 Flatfitting A-type (700/box)

Add to cart

Kegcaps 74 mm, Red 102 Flatfitting A-type (700/box)

Add to cart

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/box)

Add to cart

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/box)

Add to cart

-

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Add to cart

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Add to cart

-

Kegcaps 64 mm, Yellow 4 Sankey S-type (EU) (1000/box)

Add to cart

Kegcaps 64 mm, Yellow 4 Sankey S-type (EU) (1000/box)

Add to cart

-

Kegcaps 69 mm, Green 147 Grundey G-type (850/box)

Add to cart

Kegcaps 69 mm, Green 147 Grundey G-type (850/box)

Add to cart

Beer Recipes

Certificates

Suggestion

Morocco: Government looking to increase revenue from taxes on alcohol and cigarettes this year

Morocco: Government looking to increase revenue from taxes on alcohol and cigarettes this year

The Moroccan government is banking on revenue taxes on alcohol and cigarettes to surpass MAD 16.4 billion ($1.58 billion), based on data from the 2025 Finance Bill, Morocco World News reported on October 21.

This year’s finance bill introduces measures to increase tax revenue aimed at supporting economic growth, including domestic taxes on alcohol, beer, and tobacco consumption.

The bill is projected to rise 14.49% in tax revenue, totaling MAD 657.8 billion (approximately $63.47 billion). This includes expected revenues of MAD 1.19 billion ($114.91 million) from alcohol, MAD 1.55 billion ($149.76 million) from beer, and MAD 13.7 billion ($1.32 billion) from cigarettes.

A similar strategy was applied in the 2024 Finance Bill, where higher taxes on alcoholic beverages were proposed to address fiscal deficits and growing demands on public resources.

The 2025 Finance Bill also anticipates revenue from taxes on other domestic products, with MAD 854 million ($82.42 million) expected from soda and soft drinks, MAD 60.5 million ($5.84 million) from sugary products, and MAD 19.56 billion ($1.89 billion) from energy products.

At a Council of Ministers meeting on Friday at the Royal Palace in Rabat, chaired by King Mohammed VI, key elements of the 2025 Finance Bill were discussed.

Minister of Economy and Finance, Nadia Fettah Alaoui, outlined the government’s budget strategy in the face of ongoing geopolitical and climate challenges.

The bill focuses on four priorities: strengthening social cohesion, boosting economic sovereignty, ensuring sustainable public finances, and laying the ground for future generations. It also continues social protection programs, including direct aid for nearly four million households.

Moreover, the government plans to increase the investment fund from MAD 245 billion ($23.63 billion) in 2022 to MAD 335 billion ($32.32 billion) in 2024.

Rabat - The Moroccan government is banking on revenue taxes on alcohol and cigarettes to surpass MAD 16.4 billion ($1.58 billion), based on data from the 2025 Finance Bill.

This year’s finance bill introduces measures to increase tax revenue aimed at supporting economic growth, including domestic taxes on alcohol, beer, and tobacco consumption.

The bill is projected to rise 14.49% in tax revenue, totaling MAD 657.8 billion (approximately $63.47 billion). This includes expected revenues of MAD 1.19 billion ($114.91 million) from alcohol, MAD 1.55 billion ($149.76 million) from beer, and MAD 13.7 billion ($1.32 billion) from cigarettes.

A similar strategy was applied in the 2024 Finance Bill, where higher taxes on alcoholic beverages were proposed to address fiscal deficits and growing demands on public resources.

The 2025 Finance Bill also anticipates revenue from taxes on other domestic products, with MAD 854 million ($82.42 million) expected from soda and soft drinks, MAD 60.5 million ($5.84 million) from sugary products, and MAD 19.56 billion ($1.89 billion) from energy products.

At a Council of Ministers meeting on October 18 at the Royal Palace in Rabat, chaired by King Mohammed VI, key elements of the 2025 Finance Bill were discussed.

Minister of Economy and Finance, Nadia Fettah Alaoui, outlined the government’s budget strategy in the face of ongoing geopolitical and climate challenges.

The bill focuses on four priorities: strengthening social cohesion, boosting economic sovereignty, ensuring sustainable public finances, and laying the ground for future generations. It also continues social protection programs, including direct aid for nearly four million households.

Moreover, the government plans to increase the investment fund from MAD 245 billion ($23.63 billion) in 2022 to MAD 335 billion ($32.32 billion) in 2024.

In terms of fiscal policy, the government is focused on restoring financial balance, reducing budget deficits, and bolstering economic resilience. The bill aims for a 4.6% growth rate and inflation limited to 2% by 2025, as Morocco strives to maintain macroeconomic stability.

Back

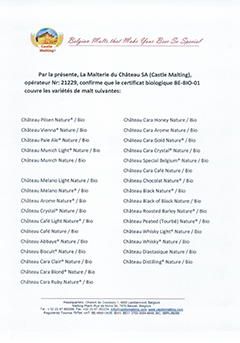

Liste produits BIO - Malterie du Château

Liste produits BIO - Malterie du Château

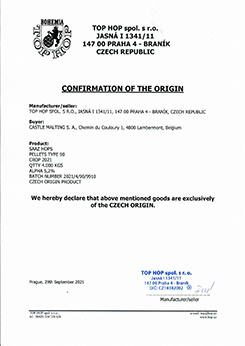

Top Hop - Confirmation of the Origin 2021

Top Hop - Confirmation of the Origin 2021

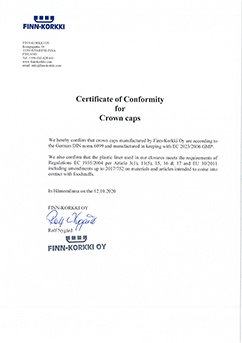

Crown Caps Finnkorkki Certificate of Conformity and Origin

Crown Caps Finnkorkki Certificate of Conformity and Origin

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

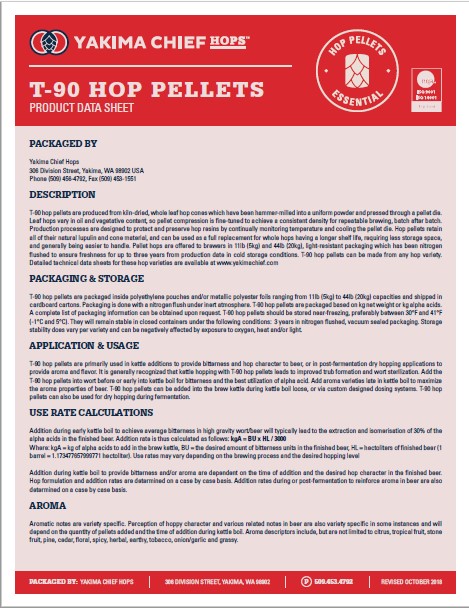

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet