Noticias de Empresa

E-Malt news

UK: Syngenta agrees to sell its malting barley seeds business

Germany & South Korea: Paulaner switches South Korea distribution to Heineken

Thailand: ThaiBev reports 7% fall in annual profit

USA, TX: Revolver Brewing to leave Granbury and move to Dallas-Fort Worth area

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Azules 141 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Azules 141 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 74 mm, Blancas Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Blancas Flatfitting A-type (700/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Belgosuc Sugar, Irradiation’ statement, 2020

Belgosuc Sugar, Irradiation’ statement, 2020

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops, HVG, Organic Certificate 2024

Hops, HVG, Organic Certificate 2024

-

Fagron Spices, GMO-free Certificate 2022

Fagron Spices, GMO-free Certificate 2022

-

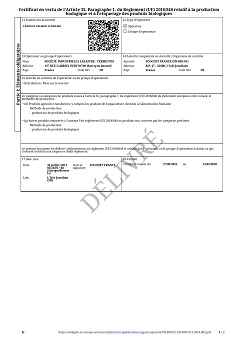

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

Sugerencia

Russia: Ivan Taranov Breweries published on March 17 a memorandum according to which it intends to sell a part of its shares to a foreign investor. Russian beer maker presented the second bonded loan. For the first time, the company acknowledged it needs a strategic investor for the business, according to Kommersant newspaper. The analysts single out two groups of investors as potential buyers. The first one comprises companies already rooted on Russian market but craving for expansion. They are SABMiller, Heineken, Sun Interbrew. The second group includes large national companies, for instance, the U.S. Coors, with no market share in Russia.

The size of the second bonded loan is 1.5 billion rubles. According to the investment memorandum, the funds will go to complete the project, which sets forth construction of a brewery in the Moscow Region. “PIT Group is considering, whether to enter into alliance with one of the transnational brewing companies,” PIT said in the memorandum, counting on forming an alliance in the nearest two years. PIT declined to comment on March 17. However, the analysts are certain such memorandum signals the company’s intention to dispose of the business.

Ivan Taranov Breweries’ Group (or PIT) was founded in 1998. It is controlled by Detroit Brewing and unites three breweries located in Kaliningrad, Khabarovsk and Orenburg. The market share is 4 % in terms of money. 2004 unit volume reached 290 million decalitres, turnover exceeded $200 million. The key brands are PIT, Doctor Diesel, Tree Medvedya (Three Bears). PIT also bottles Goesser, Red Bull, Bitburger, Bavaria.

According to the experts, today’s business of PIT costs around $350 million. The amount is small, even if the investor pays premium for the market share. “Naturally, they evaluate very high themselves,” said Marat Ibragimov from OFG. “But it doesn’t correspond to reality.”

In view of the above, it is clear why the PIT owners need two years to set up alliance. They will have to complete construction of a new brewery and step up production. Besides, the company will have to carry out inner restructuring to cut down its spending. For example, the juice leader Lebedyansky manifested exceptionally high efficiency before the IPO, Kommersant said.

Regresar