Il tuo carrello

Notizie Aziendali

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

I nostri malti

I nostri luppoli

-

BELMA (USA) Pellets T90 (5KG)

Aggiungi al carrello

BELMA (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

CASCADE BIOLOGICO (AU) Pellets T90 (5KG)

Aggiungi al carrello

CASCADE BIOLOGICO (AU) Pellets T90 (5KG)

Aggiungi al carrello

-

MILLENIUM BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

MILLENIUM BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

CASHMERE BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

CASHMERE BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

GOLDINGS BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

GOLDINGS BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Tappi 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Giallo col. 2165 (10000/box)

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Giallo col. 2165 (10000/box)

Aggiungi al carrello

-

Tappi 26mm TFS-PVC Free, Red Neu col. 2151 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Red Neu col. 2151 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Rosso 102 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Rosso 102 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

Colombia: SABMiller intends to bid US$ 6 billion dollar for Grupo Empresarial Bavaria, the Colombian brewing firm controlled by the country's multi-billionaire Julio Mario Santo Domingo. The bid is expected to be made by SABMiller this week, according to UK’s media. As one of the largest drinks firms in South America, Grupo Empresarial Bavaria is seen as an ideal target for European and American drinks firms.

SABMiller boss Graham Mackay is likely to face stiff competition from Heineken of the Netherlands and Anheuser-Busch of the United States. To counter declining sales in home markets, European and American beer firms hope to boost their presence in Latin America, which has one of the world's fastest growing beer markets. Last year Belgium-based Interbrew, now called Inbev, acquired Brazilian beer brewer Ambev, South America's second largest brewer.

Last month Bavaria said that shareholders had informed the company’s management that they have been exploring a series of alternatives, which could include a merger or a search for a strategic partner. In January it was reported that SABMiller, Heineken and InBev had talks with Bavaria regarding a takeover.

Torna

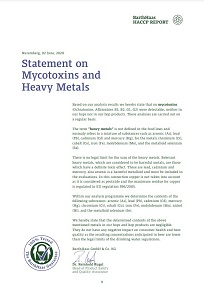

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

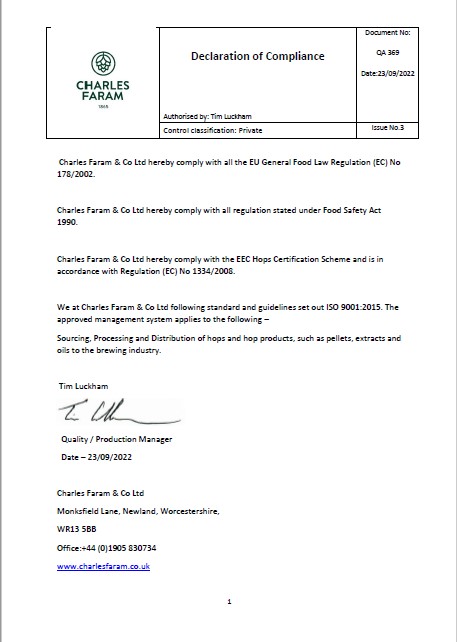

ChF Hops, Declaration of Compliance QA369, EN 2022

ChF Hops, Declaration of Compliance QA369, EN 2022

Malt Attestation GMP & HACCP 2024 (ENG) (FR)

Malt Attestation GMP & HACCP 2024 (ENG) (FR)

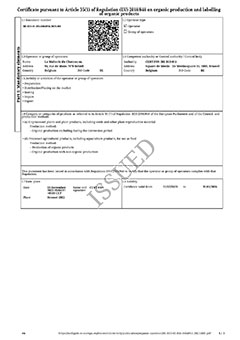

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

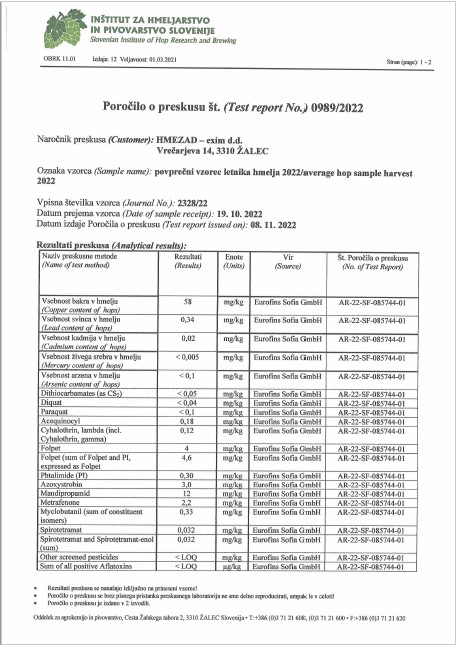

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022