Το καλάθι σας

Ειδήσεις Για Την Εταιρεία Μας

E-Malt news

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

World: Global hop harvest lower this year, Barth Haas say

USA, NM: Two Bosque Brewing locations in Albuquerque closing their doors

World: Global hop acreage down 5% in 2025

Οι βύνες μας

Οι λυκίσκοι μας

New Hops

Η Μαγιά μας

Τα Μπαχαρικά μας

Η ζάχαρή μας

Τα Καπάκια μας

-

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Προσθέστε

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Προσθέστε

-

Kegcaps 74 mm, Gold 116 Flatfitting A-type (700/box)

Προσθέστε

Kegcaps 74 mm, Gold 116 Flatfitting A-type (700/box)

Προσθέστε

-

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/box)

Προσθέστε

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/box)

Προσθέστε

-

Kegcaps 64 mm, Red 102 Sankey S-type (EU) (1000/box)

Προσθέστε

Kegcaps 64 mm, Red 102 Sankey S-type (EU) (1000/box)

Προσθέστε

-

Kegcaps 69 mm, Χρυσός 116 Grundey G-type (850/box)

Προσθέστε

Kegcaps 69 mm, Χρυσός 116 Grundey G-type (850/box)

Προσθέστε

ΠΙΣΤΟΠΟΙΗΤΙΚΑ

-

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

-

Belgosuc Sugar, Sustainability certificate 2023

Belgosuc Sugar, Sustainability certificate 2023

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

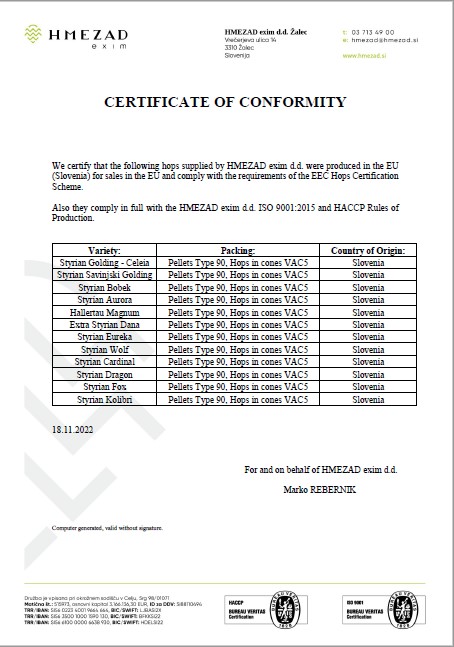

HMEZAD Hops - Certificate of conformity 2022

HMEZAD Hops - Certificate of conformity 2022

-

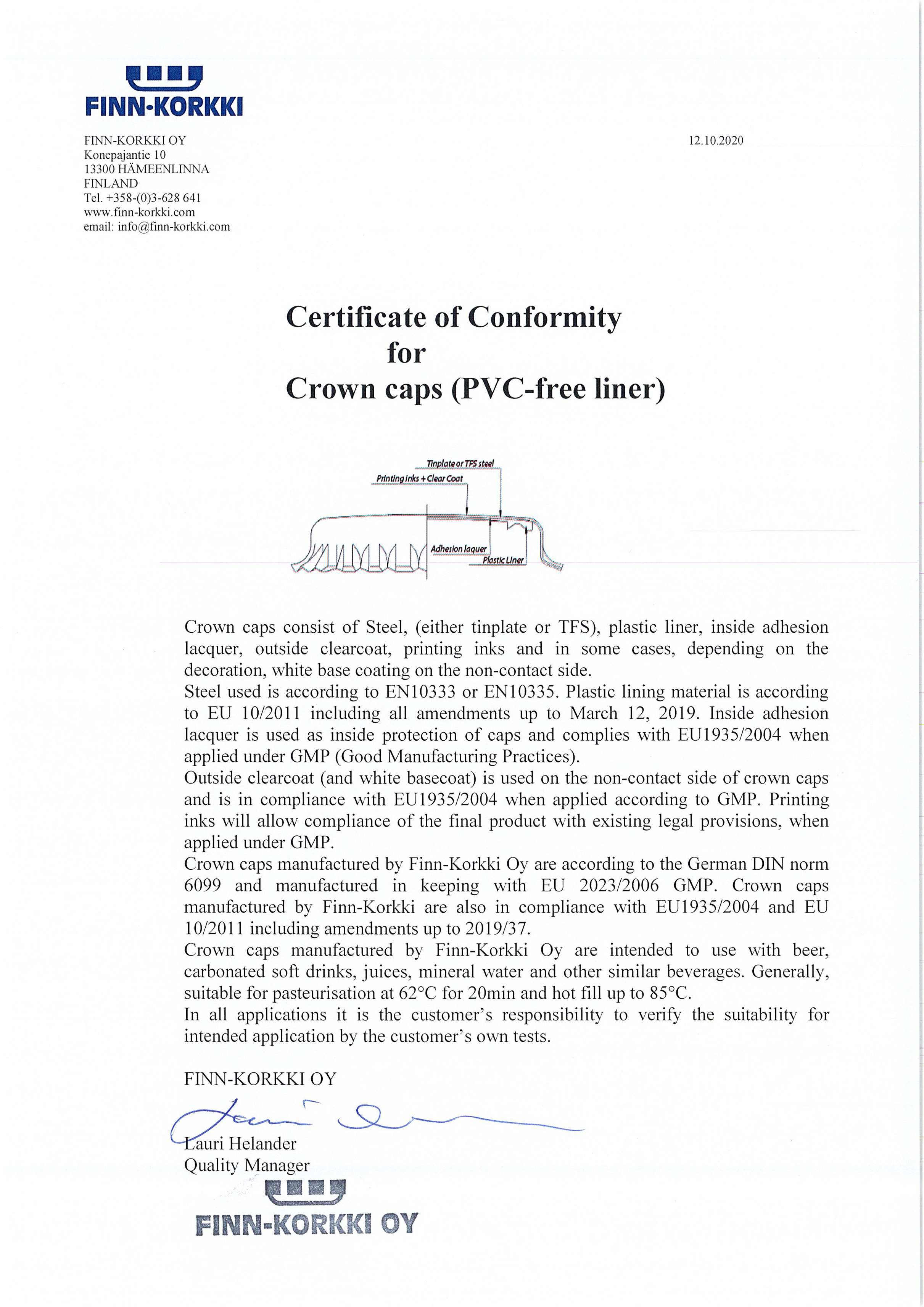

Crown Caps Finnkorkki PVC-free liner

Crown Caps Finnkorkki PVC-free liner

Πρόταση

Nigeria: Nigerian brewers see 152% surge in finance costs due to naira devaluation

Nigeria: Nigerian brewers see 152% surge in finance costs due to naira devaluation

Nigerian beer makers have recorded a 152% surge in finance cost to N117.96 billion in the first half of 2023 due to the naira devaluation, BusinessDay NG reported on September 29.

The beer makers saw finance costs rise to N117.96 billion in H1 2023 from N46.81 billion in the corresponding period of 2023.

Guinness Nigeria recorded the highest increase of 2401.9 percent growth, Nigerian Breweries followed with a record of 260.8 percent growth, International Breweries reported 127.9 percent year-on-year growth while Champion Breweries recorded a 12.7 percent increase.

“The biggest problem for a lot of consumer goods firms are FX losses because a lot of them have USD liabilities to import raw materials on credit and as they have their debt as books they need to convert it to naira,” Ayorinde Akinloye, an investor relations analyst at Seplat Energy Plc, said.

He told BusinessDay that brewers had higher cost problems, an inflation environment, the impact of raw materials cost, price of goods, and other raw materials that they use have an impact on their cost and their profit.

“FX pressure is the biggest impact on their performance. Inflation and FX are the two problems because as inflation affects them they are also increasing prices,” he said.

Πίσω