Tu carrito

Noticias de Empresa

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

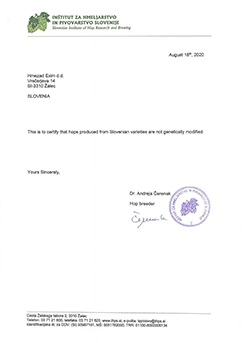

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

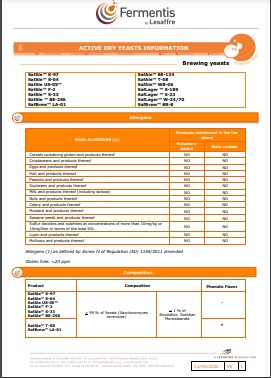

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

-

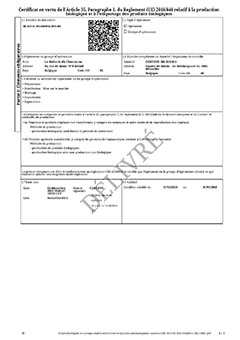

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Sugerencia

Japan & China: Asahi planning to dive back in China market

Japan & China: Asahi planning to dive back in China market

Japan’s Asahi Group Holdings has plans to dive back into the China market as it looks to revive investments in the world’s largest beer market, CNBC reported on May 30.

“We’ve been struggling hard since the first half of the 1990s. We made a very large investment in China, but had to pull out of it a few years ago,” its chief executive Atsushi Katsuki told CNBC’s Martin Soong.

“But at long last, we’re now able to put the right strategy for the Chinese market.”

The company divested from China years ago due to the lack of “premiumized products” and “very low” prices at that time, Katsuki said.

In 2017, Asahi announced it would sell its nearly 20% stake in China’s Tsingtao Brewery to Fosun Group and its subsidiaries.

“But with the entry of the international brands and also craft beer, the premium segment in China is now really taking off and growing substantially.”

“Asahi Super Dry has the largest sales already from the China market now and it’s growing double digits every year, so we want to continue to really invest into this premium market,” he added.

Katsuki said that although China sales top all other markets, the U.S. beer market is “far and away the best market in the world.”

“The ideas that we can really extract from the U.S. market in conjunction with the capabilities that we can offer from our research and development side, could be very conducive to the wellbeing of our consumers,” he told CNBC.

Asahi Super Dry and Italian beer Peroni are some of the company’s core beverage brands.

Asahi has 19 production facilities around Europe, and has been hit by rising inflation in the region.

Europe’s headline inflation came in at 7% last month, and Katsuki said he expects it to “stay at a high plateau” in the coming months.

High energy prices have been pushing up the cost of the Asahi’s glass bottles since glass production involves a high amount of energy.

“So the fact that energy prices are increasing could really cause an impact on glasses, and we expect the conversion cost could still go up,” Katsuki said.

Asahi Group saw its revenue grow by 7.9% year-on-year in the first quarter of the year, and revenue on actual currency basis grew by 12% year-on-year.

“Although many uncertainties remain in the operating environment, especially in how global inflation may play out, we’re confident in the resilience and growth potential of our businesses,” Katsuki said in the earnings release in May.

Shares of Asahi Group Holdings are up more than 29% year-to-date.

Regresar