Notizie Aziendali

E-Malt news

Australia: Bumper barley and wheat harvests predicted for MY 2025-26 in Australia

South Korea: Terra beer sets record for sales in South Korea

Canada: CMBTC releases its 2026�27 Recommended Barley Varieties List

UK: Whisky sector chasing hopes of an upturn

I nostri malti

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

-

Kegcaps 69 mm, Rosso 102 Grundey G-type (850/box)

Aggiungi al carrello

Kegcaps 69 mm, Rosso 102 Grundey G-type (850/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Rosso 1485 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Rosso 1485 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Gialli with oxygen scav.(6500/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Gialli with oxygen scav.(6500/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

EU & UK: Barley prices see some movement due to increasing concern about dryness in France

EU & UK: Barley prices see some movement due to increasing concern about dryness in France

European barley prices have undergone some significant movement over the past two weeks, as increasing market concern about dryness in France left the market with limited selling interest. As much-need rain arrived, sellers are turning up again but buyers are stepping away, RMI Analytics reported.

Paris wheat futures have continued a long-term downtrend after a brief rally higher but are now turning bearish again with arrival of rain this week across much of France. If there is any open demand in 2023, it relates to the transition period between crop years (July-September 2023), but otherwise crop 2022 activity is mostly finished and prices are mostly indicative. For crop 2023, a sizeable quantity of feed barley traded to China for September-October 2023 at reported prices of USD325-330/tonne CNF China, with a large proportion likely to be sourced from France.

The UK and Denmark price movements are down and in alignment with French values. The Danish crop result in 2022, with low proteins, created a discount for Denmark over the UK and this discount continues into crop 2023 as the trade appears to be working to retain or regain market share in continental and export trade, making Denmark the low price European origin.

Torna

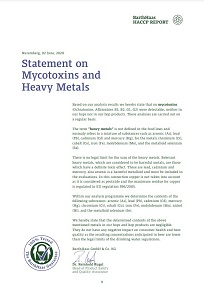

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Belgosuc sugar, Management System Certificate 2022 (English)

Belgosuc sugar, Management System Certificate 2022 (English)

Malt Kosher Certificate July 2024-June 2025

Malt Kosher Certificate July 2024-June 2025

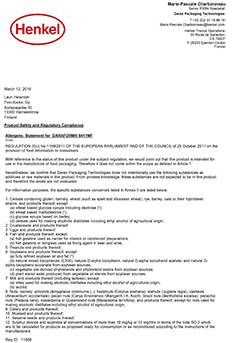

Crown Caps Finnkorkki Product Safety & Regulatory Compliance

Crown Caps Finnkorkki Product Safety & Regulatory Compliance

Fermentis - Yeast Kosher Certificates 2023

Fermentis - Yeast Kosher Certificates 2023