Il tuo carrello

Notizie Aziendali

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

I nostri malti

I nostri luppoli

-

BELMA (USA) Pellets T90 (5KG)

Aggiungi al carrello

BELMA (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

CASCADE BIOLOGICO (AU) Pellets T90 (5KG)

Aggiungi al carrello

CASCADE BIOLOGICO (AU) Pellets T90 (5KG)

Aggiungi al carrello

-

MILLENIUM BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

MILLENIUM BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

CASHMERE BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

CASHMERE BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

GOLDINGS BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

GOLDINGS BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Tappi 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Giallo col. 2165 (10000/box)

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Giallo col. 2165 (10000/box)

Aggiungi al carrello

-

Tappi 26mm TFS-PVC Free, Red Neu col. 2151 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Red Neu col. 2151 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Rosso 102 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Rosso 102 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

World: Five malting groups dominate global commercial malting capacity

World: Five malting groups dominate global commercial malting capacity

Global commercial malting capacity consists of five malting groups, each controlling 1 mln tonnes or more of malt output, plus a long tail of independent commercial maltsters, RMI Analytics said in their latest report.

From a market share perspective, the commercial industry is led by Boortmalt, at just over 3 mln tonnes, followed by Soufflet (2.33 mln), Malteurop (2.29 mln), United Malt Group (1.4 mln), and Supertime (1.18 mln tonnes). All of these malting groups have a global footprint, except Supertime, which is solely China-based.

The regional malting capacity breakdown is led by Western Europe, at 7.48 mln tonnes. Taking into account Central and Eastern Europe places the wider European total at nearly 11 mln tonnes (including Russia and Ukraine). In total, European capacity stands at nearly 11 mln tonnes – 52% of all commercial capacity and 41% of all malting capacity, including vertical brewer/distiller holdings.

Asia Pacific is next at 24%, dominated by China, followed by North America, Latin America, Australia, and Africa.

Torna

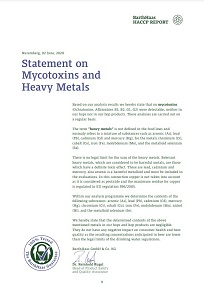

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

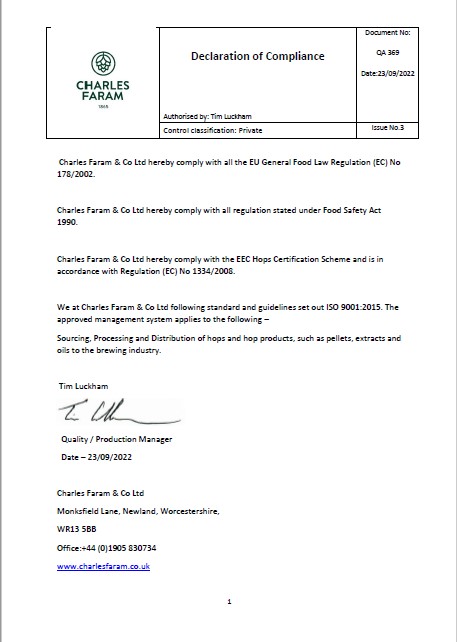

ChF Hops, Declaration of Compliance QA369, EN 2022

ChF Hops, Declaration of Compliance QA369, EN 2022

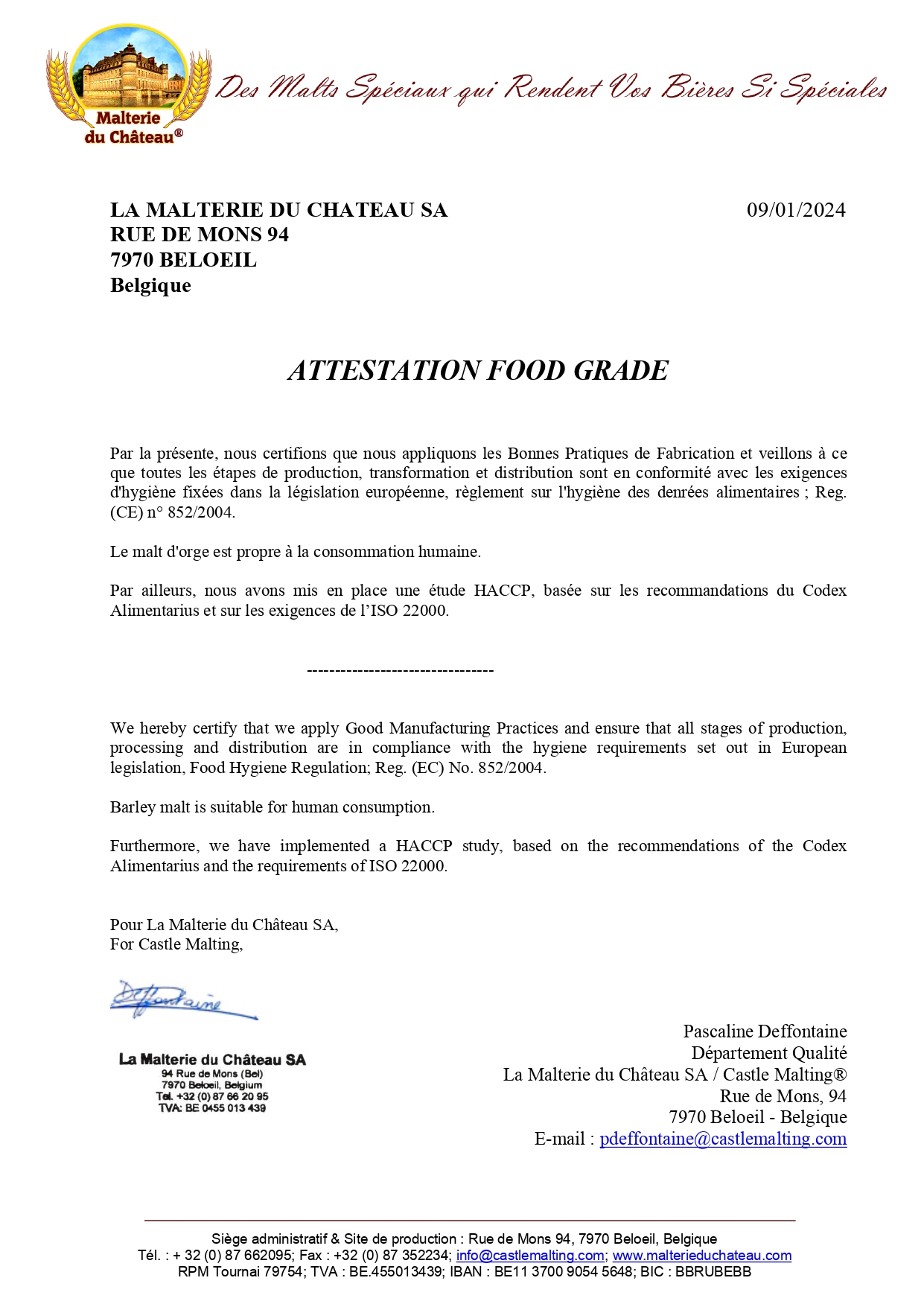

Malt Attestation GMP & HACCP 2024 (ENG) (FR)

Malt Attestation GMP & HACCP 2024 (ENG) (FR)

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

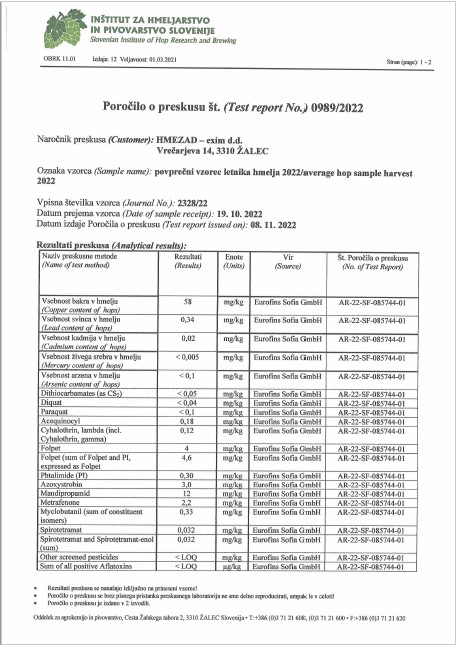

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022