Το καλάθι σας

Ειδήσεις Για Την Εταιρεία Μας

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Οι βύνες μας

Οι λυκίσκοι μας

New Hops

Η Μαγιά μας

Τα Μπαχαρικά μας

Η ζάχαρή μας

Τα Καπάκια μας

-

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/box)

Προσθέστε

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/box)

Προσθέστε

-

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/box)

Προσθέστε

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/box)

Προσθέστε

-

Kegcaps 64 mm, Red 150 Sankey S-type (EU) (1000/box)

Προσθέστε

Kegcaps 64 mm, Red 150 Sankey S-type (EU) (1000/box)

Προσθέστε

-

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Mustard yellow col. 20164 (10000/box)

Προσθέστε

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Mustard yellow col. 20164 (10000/box)

Προσθέστε

-

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/box)

Προσθέστε

ΚΑΠΑΚΙΑ 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/box)

Προσθέστε

ΠΙΣΤΟΠΟΙΗΤΙΚΑ

Πρόταση

Russia: Strong Russian beer sales helped East European brewer Baltic Beverages Holding AB (BBH) to a 23.1 % surge in fourth quarter volumes, and it forecast further strong growth, BBH posted on Tuesday, February 15. "Russia as a market offered us a positive surprise," BBH Managing Director Christian Ramm-Schmidt told a conference call. "We believe the underlying scenario still allows for healthy growth. In 2005, we estimate mid-single-digit growth in Russia."

Baltic Beverages Holding AB (BBH) is a 50:50 owned joint venture between Carlsberg A/S and Scottish & Newcastle plc. BBH operates 18 breweries in six countries in Eastern Europe, including Russia where it is the market leader with a 34% market share.

Sales volumes in Q4 were up 23.1%, and net sales up 20% in Euro and up 31% in USD. The Russian beer market grew by 11% in 2004 due to robust consumer demand and high levels of competitor activity particularly in the lower priced PET sector. BBH lost some share in the first half, but a strong sales-led recovery, with an increased investment in advertising, sales force and distribution in the second half of the year resulted in an increased full year market share of 34.2%, up 1.2% points.

EBITA for the year grew by 5% in Euro and 13% in US Dollars, held back by the increased ‘downstream’ costs, most notably a major increase in spend on advertising - up by EUR 45 million, equivalent to 2.5%points of net sales. EBITA margin at 20.0%, although still high by international standards, was 2.7%points lower than in 2003. Encouragingly, the margin trend improved through the year as higher volumes fed through to greater operational efficiency. For Q4, a seasonally low volume quarter EBITA margin was 15.3%, an increase of 0.9%points in comparison to the same period in 2003.

Russia: excellent growth in the second half: The completion of the Baltika sales and distribution network and increased advertising ensured a stronger performance in H2 leading to a market share gain of +1.2%points for the year taking market share to 34.2%. The share recovery was led by a powerful performance from Baltika. In December 2004, Taimuraz Bolloev, the President of Baltika announced his decision to retire from the Board of Baltika after 13 years. His personal contribution to the creation of Russia’s leading brewery was tremendous, and the BBH Board is extremely grateful to him.

Ukraine: number two position established in a challenging environment: BBH domestic beer volumes grew 16% in a market up 13%. Market share for the year was 22.1%, up 0.4%points. Pricing in Ukraine is very competitive and the additional costs of the new Kiev brewery led to a reduction in operating margins. In the final quarter of the year the political instability in the country had an additional effect on sales, causing BBH to be cautious for prospects in 2005.

Baltic countries: markets stimulated by EU entry: In the Baltic countries BBH is the market leader with 42% market share. BBH domestic beer volumes grew by 1.2% slightly behind market growth of 3.2%. The share loss was largely due to high levels of competitor activity in the low value PET sector. Estonia benefited from EU accession and significant cross-border trade with Finland, resulting in total volume growth of 4% for BBH Baltics.

Kazakhstan leadership position established: In the newest and fastest growing of BBH markets, Kazakhstan, BBH has established a strong position with a good brand portfolio, wide distribution network and capable management team. In 2004 BBH has an official market share of 23%, although with the inclusion of the unofficial Baltika imports BBH share reaches 27%, making it the market leader already only after just over a year of operations.

Christian Ramm-Schmidt, BBH Managing Director commented: ‘BBH’s results demonstrate the strength of our brands and business model, particularly in Russia where the second half performance was very strong, with domestic beer volumes growing by 22%. In Russia, BBH has an excellent brand portfolio, brewery network and sales and distribution system. There is a considerable opportunity to operate the five BBH businesses more closely together, giving them greater operating authority to offer even more value to customers and consumers. In line with the long held vision, initiatives are being taken to develop a shared brand portfolio and sales and supply-chain structure leveraging the common strengths of our Russian operations. In our other markets we expect continued good progress in the Baltics and in Kazakhstan, but we are cautious for the prospects for the Ukraine in 2005 following a difficult period over the last couple of years. Profits for the period were affected by increased investments in sales and market activities, but despite this EBITDA increased by 10% to EUR 388m. BBH generates strong cash flows which will enable it to continue investing in its key markets as well as beginning to provide dividend payments to its shareholders. Overall, BBH remains confident in the prospects for its markets and its businesses and believes that it is well positioned for continued growth in 2005.’

BBH, 50-50 owned by Denmark's Carlsberg and Britain's Scottish & Newcastle (S&N), said growth was also good in Kazakhstan and the Baltic states, but it was cautious about prospects for Ukraine in 2005. BBH total sales volumes were of 3699 ML in the second half of the year, up 18%: BBH Russia up 19%; BBH Ukraine up 17%; BBH Baltics up 4%; BBH Kazakhstan, up 67%.

It said it had lost some share of the Russian market in the first half of 2004, but stronger second-half sales pushed its market share to 34.2 percent for the year, up 1.2 percentage points from 2003. "In the first half business was a bit sluggish," S&N chairman of international beer John Nicolson told Reuters. "But then the sales team really delivered for us."

S&N and Carlsberg see BBH as a major area of growth as they both operate in mature western European beer markets, while Russia -- the world's fifth-biggest beer market after China, the United States, Germany and Brazil -- is one of the fastest growing beer drinking nations in the world.

The group described Ukraine as a "challenging environment" and said elections in November had hit beer sales. "Politics did stop people in their tracks," said Nicolson. "Things were happening that were dramatically more important than beer. But we think it's a good place to be." He said Ukraine's beer consumption was expected to outpace that of France in 2-3 years.

S&N shares closed up 0.71 percent at 459-3/4 pence, while Carlsberg shares were up 1.4 percent at 290 crowns. Jyske Bank analyst Anette Nikolajsen said: "Carlsberg shares are slightly up and the only explanation is the 100 million euro dividend."

Analyst Sandy Soames at Cazenove in London was also upbeat about the results. "This would require about a one percent upgrade to forecasts of S&N's and Carlsberg's earnings per share," he said.

BBH, whose key asset is a majority stake in Russia's biggest brewer Baltika, said Russian sales grew 15 % by volume and its overall sales were up 18 percent by volume for the year. Ramm-Schmidt said the company was entering a new era, with greater focus on fine-tuning its brands. "I always said let's run as fast as possible and leave the fine-tuning for later," he said. "But now it will mainly be organic growth."

BBH's fourth-quarter sales rose 31 percent to $381 million, and earnings before interest, tax, depreciation and amortization (EBITDA) increased 36 percent to $94 million in the October-December quarter. It said it paid a dividend of 100 million euros ($130 million) to its two shareholders.

Πίσω

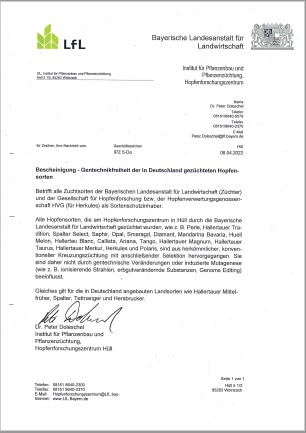

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN

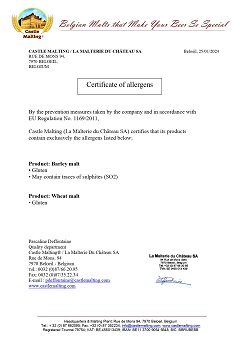

Malt Allergen Certificate for Barley and Wheat Malt (ENG)

Malt Allergen Certificate for Barley and Wheat Malt (ENG)

Hops Hopfenveredlung St.Johann, Certificate ISO 9001:2015 2022-2025

Hops Hopfenveredlung St.Johann, Certificate ISO 9001:2015 2022-2025

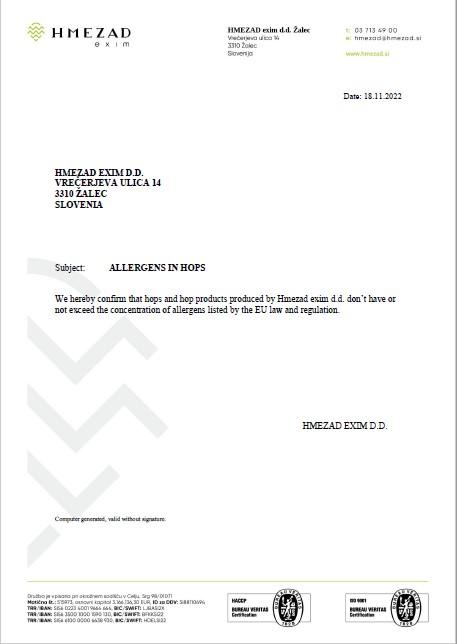

HMEZAD Hops - Certificate allergens in hops 2022

HMEZAD Hops - Certificate allergens in hops 2022

ChF Hops GMO-free Certificate

ChF Hops GMO-free Certificate