Tu carrito

Noticias de Empresa

E-Malt news

Ireland: Drinks Ireland research shows sector is vital to local economies

USA, AL: Red Clay Brewing Co. to end operations in March

USA, MO: Minglewood Brewery to close for good on January 18

Brazil: Brazil becomes second-largest market for Johnie Walker whiskey

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Amarillas with oxygen scav.(6500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Amarillas with oxygen scav.(6500/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

-

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Verdes (10000/caja)

Añadir al carrito

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Verdes (10000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

World: Beer output and malt demand expected to continue to grow

World: Beer output and malt demand expected to continue to grow

Beer output and malt demand are expected to continue their rise, in spite of all present problems; most of all in Asia, Latin America and Africa. The sectors craft, premium and pure malt beer will gain larger market shares, H. M. Gauger GmbH said in their October report.

Malt supplies are still restricted by war in Eastern Europe, do recover after better crops in North America and a surprising flow of Chinese shipments in spite of their barley supply problems; their exports in January-August are estimated at 250,000 tonnes. Maltsters in the export and import countries work with their maximum capacities. But initially a big short remains, it is most visible in the EU, Africa and Southeast Asia.

For 2023 a few hundred thousand tonne remain to be bought. Brewers continue to negotiate long-term agreements, also reserve malting capacities without fixing malting margins. The large brewer groups push their suppliers to increase malting capacities or plan to invest themselves in new installations.

Preferred locations of new industries are outside Europe, in Latin America, where large capacities in Brazil and Mexico are already under construction, Southeast Asia and Australia. Some new constructions take place in the EU as well, in Finland, Austria and Italy, but they will replace older inefficient factories.

Conclusion: Unless the worst economic and political fears become reality, malt is and will be a premium item for some years to come.

Regresar

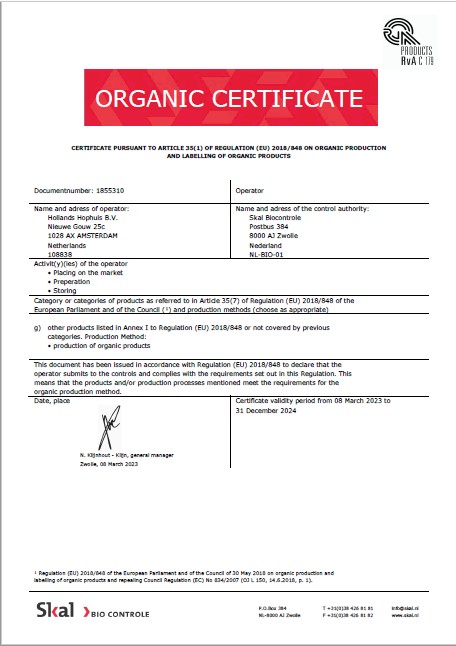

Hollands Hophuis, Organic Production and Labelling 2023-2024

Hollands Hophuis, Organic Production and Labelling 2023-2024

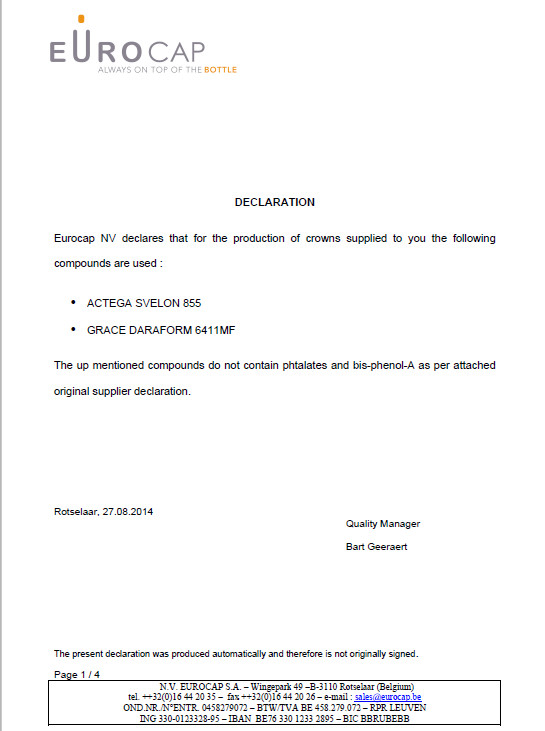

Crown Caps EUROCAP Bisphenol EN

Crown Caps EUROCAP Bisphenol EN

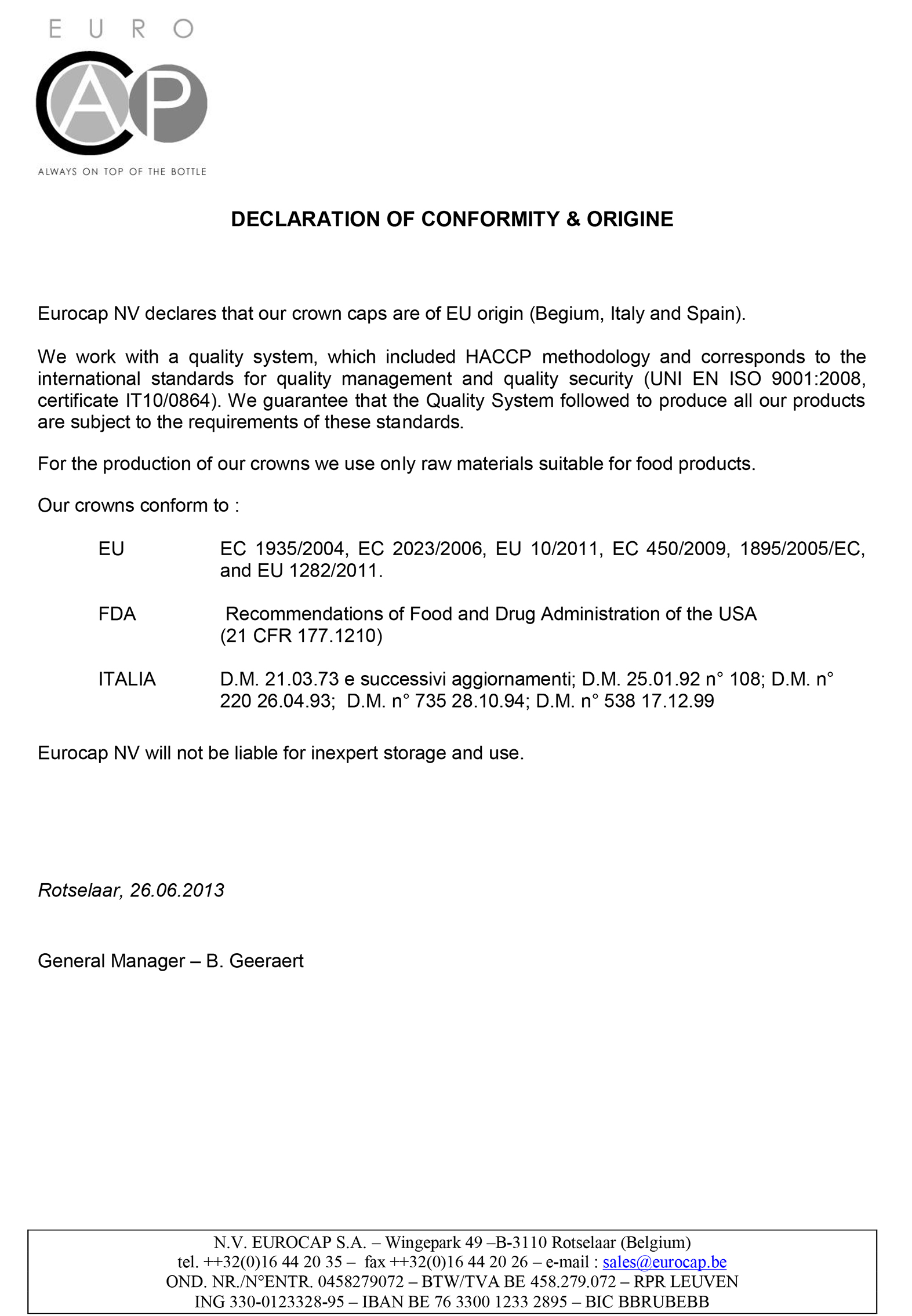

Crown Caps EUROCAP Conformity and Origin Certificate

Crown Caps EUROCAP Conformity and Origin Certificate

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

ChF Hops, Declaration of Compliance QA369, EN 2022

ChF Hops, Declaration of Compliance QA369, EN 2022