Notizie Aziendali

E-Malt news

UK: Syngenta agrees to sell its malting barley seeds business

Germany & South Korea: Paulaner switches South Korea distribution to Heineken

Thailand: ThaiBev reports 7% fall in annual profit

USA, TX: Revolver Brewing to leave Granbury and move to Dallas-Fort Worth area

I nostri malti

I nostri luppoli

-

HALLERTAU NORTHERN BREWER (DE) Pellets T90 (5KG)

Aggiungi al carrello

HALLERTAU NORTHERN BREWER (DE) Pellets T90 (5KG)

Aggiungi al carrello

-

NELSON SAUVIN BIOLOGICO (NZ) Pellets T90 (5KG)

Aggiungi al carrello

NELSON SAUVIN BIOLOGICO (NZ) Pellets T90 (5KG)

Aggiungi al carrello

-

RIWAKA (NZ) Pellets T90 (5KG)

Aggiungi al carrello

RIWAKA (NZ) Pellets T90 (5KG)

Aggiungi al carrello

-

AFRICAN QUEEN (ZA) Pellets T90 (5KG)

Aggiungi al carrello

AFRICAN QUEEN (ZA) Pellets T90 (5KG)

Aggiungi al carrello

-

NELSON SAUVIN (NZ) Pellets T90 (5KG)

Aggiungi al carrello

NELSON SAUVIN (NZ) Pellets T90 (5KG)

Aggiungi al carrello

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Crown Caps 26 mm TFS-PVC Free, Nero col. 2439 (10000/box)

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Nero col. 2439 (10000/box)

Aggiungi al carrello

-

Crown Caps 29mm TP-PVC Free, Gold NEU col. 4310 (6500/box)

Aggiungi al carrello

Crown Caps 29mm TP-PVC Free, Gold NEU col. 4310 (6500/box)

Aggiungi al carrello

-

Tappi 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Giallo 4 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Giallo 4 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Verde (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Verde (10000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

North America: Dramatic increase in global barley prices could bring Canada back into export game

North America: Dramatic increase in global barley prices could bring Canada back into export game

As previously reported, Canada and the US barley prices have been tracking on an import parity pricing basis for several months. The global price shock triggered by the events in Ukraine is having a swift and dramatic impact on barley prices in North America, RMI Analytics said in their early March report.

For malting barley, the theoretical pricing approaches USD500/tonne and with no trade. It is expected that the dramatic increase in prices brings Canada back into the export game with the new crop, but, as mentioned, harvest is not until August and shipment availability is only around October-November 2022. Relief from Canada on a global basis should only be expected mostly in 2023 as the lineup for other crops (wheat, canola) will also be great in Q4 2022.

For feed barley, the current market is also moving up sharply with higher US corn futures making imported corn more expensive. Local feed barley in southern Alberta is CAD450/tonne, and US corn CAD460. A month ago, US corn was trading at a CAD25 discount to local barley but presently at a CAD10 premium, a dramatic and quick turnaround.

Torna

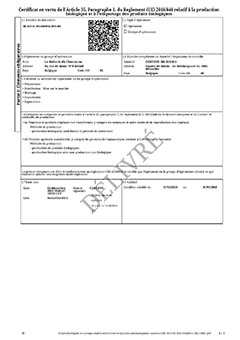

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

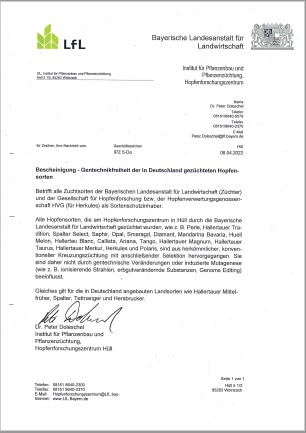

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN

Malt Attestation GMP & HACCP 2024 (ENG) (FR)

Malt Attestation GMP & HACCP 2024 (ENG) (FR)

Hops Hopfenveredlung St.Johann, Certificate ISO 9001:2015 2022-2025

Hops Hopfenveredlung St.Johann, Certificate ISO 9001:2015 2022-2025

Charles Faram Hops, TACCP Plan QA379, EN 2022

Charles Faram Hops, TACCP Plan QA379, EN 2022