Tu carrito

Noticias de Empresa

E-Malt news

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

USA, CA: Tent City Beer Company closes its doors for good

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Kegcaps 74 mm, Blancas Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Blancas Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Hong Kong: Trading in the shares of Kingway Brewery Holdings Ltd., which has been in talks on a possible takeover by Dutch giant Heineken NV, was suspended on Wednesday, 26 January 2005. Officials at both companies declined comment. The shares were halted pending the announcement of what may be price-sensitive information, the Hong Kong stock exchange said.

Reuters reported this week that Heineken was in talks to lift its 21 percent stake in Kingway to 50 percent in a step toward a possible takeover of the firm, which is controlled by the government of Guangdong province, one of China's wealthiest regions.

In recent years, global beermakers have flooded into China, where rising incomes have made the country the largest beer market in the world by volume. "Heineken is a latecomer and they need to catch up. Heineken already lags behind Anheuser-Busch, SAB Miller and InBev," said Fan Cheuk Wan, analyst at ABN Amro.

Shares of Kingway finished at HK$3.075 on Tuesday and have leapt by 40 percent since last Thursday on expectations that Heineken, the world's fourth-largest beer maker by sales, will boost its holding in the firm.

Kingway, which does not rank among China's ten largest brewers but is seen as an attractive takeover candidate because of its strong position in the southern boomtown of Shenzhen, has a market capitalization of US$550 million.

A source familiar with the situation told Reuters on Monday that the two companies were discussing a deal priced between HK$3.50 and HK$4.00 per Kingway share.

About a year ago, Heineken paid US$71 million, or HK$1.85 a share, for a 21 percent stake in Kingway. Under Hong Kong listing rules, an investor must make an offer for all of a company's shares if its holding reaches 30 percent.

Last year, Anheuser-Busch, the world's second-largest brewer by volume after InBev, took over China's Harbin Brewery Group Ltd. for US$692 million after a landmark takeover battle with arch-rival SABMiller.

Regresar

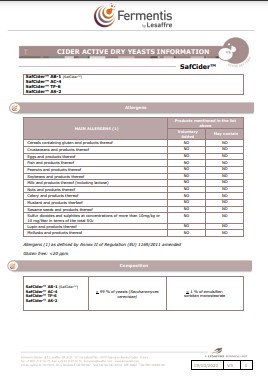

Fermentis - Cider Dry Yeast Information 2023

Fermentis - Cider Dry Yeast Information 2023

Crown Caps Finnkorkki Statement

Crown Caps Finnkorkki Statement

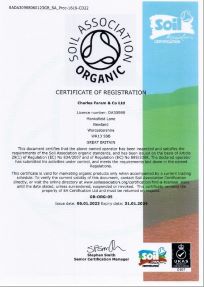

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

ChF Hops Organic certification, EN 2023-2024

ChF Hops Organic certification, EN 2023-2024

Fermentis - Brewing Yeasts Information ENG - SafSour LP-652, LB-1

Fermentis - Brewing Yeasts Information ENG - SafSour LP-652, LB-1