Your cart

Company News

Industry News

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Our Malts

Our Hops

New Hops

Our Yeasts

Our Spices

Our Sugars

Our Caps

-

Crown Caps 26mm TFS-PVC Free, Red Neu col. 2151 (10000/box)

Add to cart

Crown Caps 26mm TFS-PVC Free, Red Neu col. 2151 (10000/box)

Add to cart

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/box)

Add to cart

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/box)

Add to cart

-

CC29mm TFS-PVC Free, Yellow with oxygen scav.(6500/box)

Add to cart

CC29mm TFS-PVC Free, Yellow with oxygen scav.(6500/box)

Add to cart

-

Kegcaps 69 mm, Gold 116 Grundey G-type (850/box)

Add to cart

Kegcaps 69 mm, Gold 116 Grundey G-type (850/box)

Add to cart

-

Crown Caps 26mm TFS-PVC Free, Bordeaux Red col. 20025 (10000/box)

Add to cart

Crown Caps 26mm TFS-PVC Free, Bordeaux Red col. 20025 (10000/box)

Add to cart

Beer Recipes

Certificates

Suggestion

South Korea: Non-alcoholic beer market growing at blistering pace since outbreak of Covid

South Korea: Non-alcoholic beer market growing at blistering pace since outbreak of Covid

Since the outbreak of the coronavirus, South Korea’s non-alcoholic beer market has been growing at a blistering pace thanks to an increase in the number of health-conscious consumers and the growth of the drinking-at-home culture, the Korea BizWire reported on January 18.

Hite Jinro Co., the country’s second-largest beverage company, had been selling between 6 and 7 million cans of its non-alcoholic beer ‘Hite Zero 0.00’ since it was released in 2012.

Annual sales, however, surpassed the 10 million can mark in 2020 and more than doubled last year.

The size of the nation’s non-alcoholic beer market stood at about 20 billion won (US$16.8 million), equivalent to less than 1 percent of the size of the nation’s overall beer market.

Nonetheless, non-alcoholic beer has a strong growth rate.

Sales of non-alcoholic beer at major convenience store chains such as GS25, CU and 7-Eleven grew by 814 percent, 460 percent and 501 percent, respectively, last year compared to a year before.

According to the Korea Customs Service, the nation’s imports of non-alcoholic beers amounted to US$7.58 million last year, a more than twofold increase from $2.93 million a year ago and a more than fivefold jump compared to the 2019 figure.

Industry experts said that the primary factor behind the expansion of the non-alcoholic beer market is the growing health-conscious trend.

In addition, non-alcoholic beer is also popular among dieters looking for beer alternatives and weak drinkers placed in a situation where they need to drink.

Back

Top Hop - ISO Certificate 2021-2024

Top Hop - ISO Certificate 2021-2024

Barth Haas Hops: Organic Certificate 2024-2026

Barth Haas Hops: Organic Certificate 2024-2026

Certificate Bio Cambie Hop VOF 2024-2025

Certificate Bio Cambie Hop VOF 2024-2025

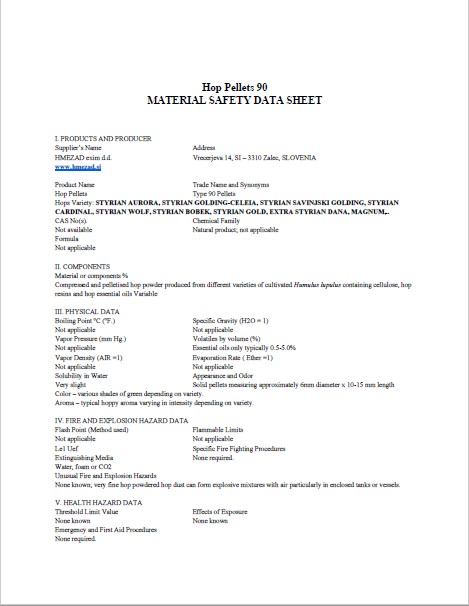

HMEZAD Hops - Material Safety data sheet 2022

HMEZAD Hops - Material Safety data sheet 2022

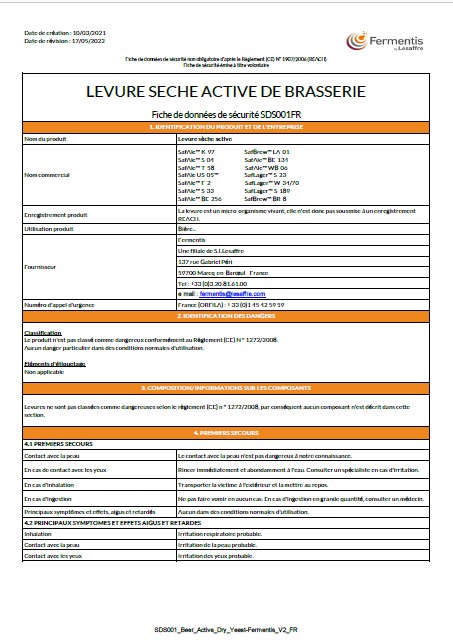

Fermentis - SDS001 Beer Active Dry Yeast Fermentis FR

Fermentis - SDS001 Beer Active Dry Yeast Fermentis FR