Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

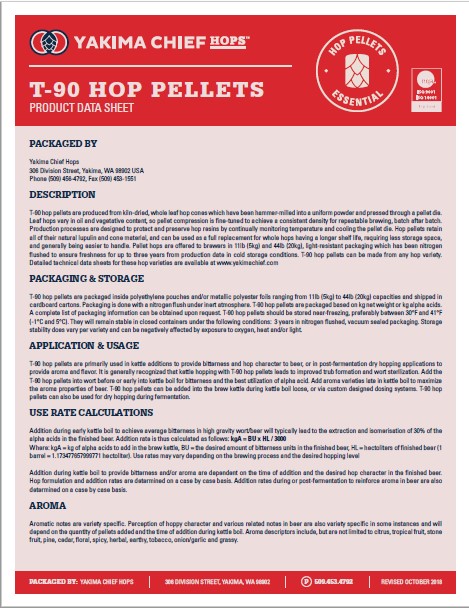

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

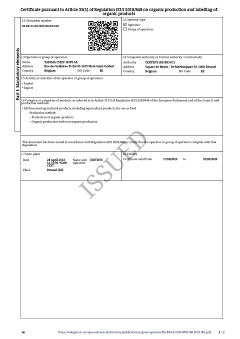

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

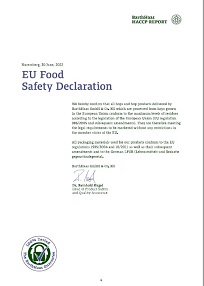

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

Russia: Brewer Yarpivo is growing twice as fast as the rest of the Russian beer market, which itself has been expanding at an annual rate of 7%. Angela Drujinina uncovers the strategy behind the success, Beverage Daily reported in a statement on December 14.

In 2003, Yarpivo reported annual sales growth of 14.2 per cent, an impressive increase even within a sector that has seen significant growth at the expense of more traditional spirits. A company representative told CEE-foodindustry.com that the company plans to continue rolling out its multi-faceted strategy, which has resulted in both sales and profit increases.

A major factor, according to the Yarpivo, has been the firm’s policy of cooperation with distributors. A strategy of giving certain discounts and credits has enabled the firm to achieve significant efficiencies along the supply chain.

Beer packaging has also been redesigned, with a glass bottle being introduced along with new labels for Yarpivo, Volga and Slavno brands. In addition, the Yarpivo brand is now available in one-litre plastic bottles and a new brand of Irish Red ale has been introduced to target the premium market segment.

Applied together, these strategies enabled Yarpivo to increase its profit in the first nine months of 2004 by 2 per cent or RUR98 million (€2.6m) compared to the same period last year

But the company has another clever strategy up its sleeve. It has begun bottling a seasonal beer brand called Novogodnee (New Year’s), which shows how the company is attempted to tap into consumer trends and achieve differentiation within an increasingly crowded market.

And as with the Irish Red ale brand, it also shows how Yarpivo is targeting the premium beer sector. Novogodnee is a lager of high density, brewed to a special recipe that requires a longer time to mature. The beer is brewed only once a year, specifically for New Year celebrations.

The officially declared aim behind the launch of Novogodnee is “to congratulate the real beer lovers with a unique brew”. But of course, Yarpivo hopes that this will prove a very profitable form of celebration. In December 2003, Novogodnee beer sales made up 2 per cent of the company’s monthly sales.

Yarpivo was the first company to introduce the tradition of brewing and selling seasonal New Year beer, and is thus in a good position to capitalise on a potentially lucrative new sector.

The Yarpivo group, which comprises the Yarpivo brewing company and Voronezh brewery, is one of the biggest players in the Russian beer market. In 2003 Yarpivo’s market share was 7.6 per cent, with profit after tax of $49.6 million. The entire Russian beer market is worth around $5.2 billion.

Regresar