Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

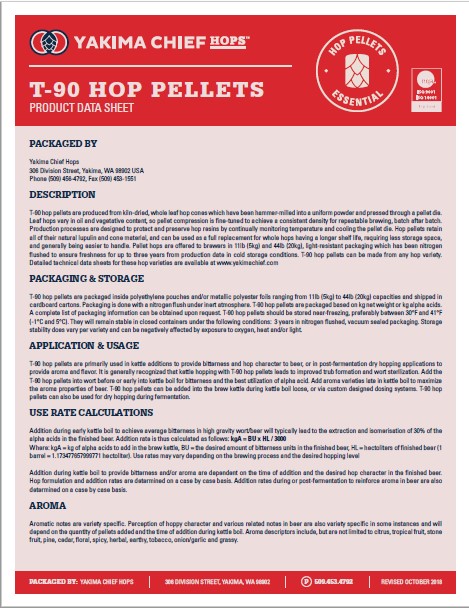

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

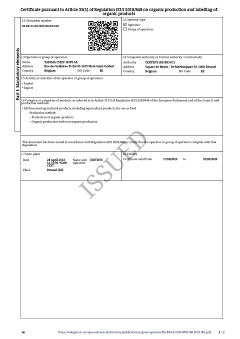

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

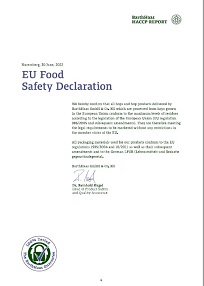

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

Brazil: Glass starting to look half full for Ambev - analysts

Brazil: Glass starting to look half full for Ambev - analysts

Three upgrades and a 14% return in two weeks are signs that the glass is starting to look half full for Ambev SA, Bloomberg reported on August 7.

The Brazilian unit of Anheuser-Busch InBev, the world’s largest brewer, has been on the rise since posting stronger-than-expected sales on July 25, while the country’s benchmark Ibovespa index has fallen almost 2%. Analysts and investors got excited as the company’s beer volume in Brazil grew in the second quarter, showing it gained back market share despite the country’s faltering economy.

Investments in new products are starting to bear fruit, Chief Financial Officer Fernando Tennenbaum said in a phone interview. “In the beginning of this year, just due to a slight increase in consumer confidence, the segment of generic low-priced beer started to fall and consumers started migrating back to Brahma and Skol,” which cost a little more. “This benefits us a lot,” he said.

Ambev, which also makes soft drinks, has been expanding its portfolio of beer brands in all its regions, but especially in Brazil. It’s offering more premium labels, such as Colorado and Wals, in the South and Southeast, with higher buying power, while also promoting regional brands, with more affordable prices, such as Magnifica and Nossa, in the Northeast, where unemployment is higher and incomes have been battered by a persistently weak economy.

“It should get easier from here,” Goldman Sachs analysts Luca Cipiccia and Galdino Falcao wrote in a July 26 report that kept an outperform rating on the stock, but raised the 12-month price target to 23 reais from 22. Among other factors, the first half of 2019 was more challenging due to a strong comparison with last year, which included the World Cup, they said.

“Ambev is back,” Credit Suisse analyst Antonio Gonzalez wrote in an Aug. 2 report. The perception of the company has changed from one facing structural volume issues the past couple of years, “to [a] multi-year growth story,” Gonzalez said, reiterating an outperform rating.

Since the latest financial results, Itau BBA double upgraded Ambev to a buy-equivalent rating, while JPMorgan raised Ambev to neutral and Barclays reaffirmed a constructive view on the company. Eleven Financial Research also upgraded Ambev to a buy, so that now Ambev has 5 buys, 12 holds and one sell, according to data compiled by Bloomberg.

Ambev fell 28% last year owing to renewed concern over competition and an erratic Brazilian economy affecting consumption.

“The market used to look at the half-empty glass,” said Fernando Siqueira, a portfolio manager at MZK Investimentos, whose second-largest position in Brazil is Ambev. “Earnings should improve from the second half of the year onward,” Siqueira said.

The second-quarter numbers showed the Sao Paulo-based brewer is regaining beer market share in Brazil, as its volume grew 2.9% while the rest of the market was little changed, Ambev’s Tennenbaum said on the quarterly call, citing data from Nielsen.

Regresar