Tu carrito

Noticias de Empresa

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

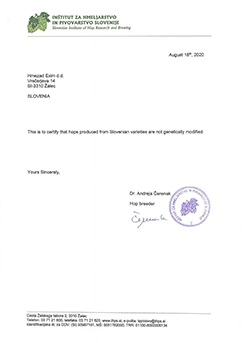

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

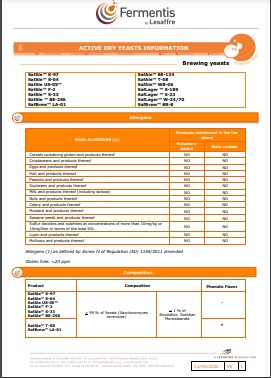

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

-

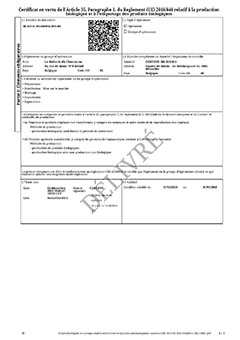

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Sugerencia

The Philippines: San Miguel may be facing valuation issues due to consolidation of its drinks and food businesses

The Philippines: San Miguel may be facing valuation issues due to consolidation of its drinks and food businesses

San Miguel has an alcohol problem. The Philippine conglomerate run by billionaire Ramon Ang is consolidating its beer and liquor businesses with its Manila-listed producer of meat, poultry and feed. A complex share swap suggests the enlarged San Miguel Pure Foods would be worth some $9.1 billion. It trades at a discount, however, the Global Times reported on February 6.

The sprawling parent company decided, with advice from adviser ING Bank, that the newly conceived consumer group warranted a hefty premium. It determined that Pure Foods shares would be fairly valued at nearly 793 pesos ($15.4) apiece for the deal instead of the 308 where they were trading. That meant issuing 4.2 billion shares, with a notional value of 336 billion pesos, to buy 51 percent of unlisted San Miguel Brewery and 76 percent of Ginebra San Miguel from San Miguel Corp.

Investors have been warming to the valuation, with Pure Foods stock roughly doubling since the combination was announced in November. That's understandable. The resulting group is something of a hybrid of Universal Robina, a $7.4 billion local rival, and Thai Beverage, the owner of Chang beer and SangSom rum. They trade on an average multiple of a little over 20 times estimated 2017 earnings. Assuming all three San Miguel businesses grew at the same pace for the year as they did in the first nine months, Pure Foods would be worth $7.4 billion, about 6 percent more than the current theoretical post-deal value.

That, however, leaves a $1.7 billion chasm from the company's own valuation. Some of that is probably down to limited trading in the shares. After the merger, San Miguel's control will rise from 85 percent to 96 percent, though not for long. New rules require at least a 15 percent free-float by the end of the year. And Ang has said he's aiming to sell 30 percent.

A more widely owned and easily tradable stock could help. At the same time, fund managers should learn more about any cost savings, and about the brewery, which is an unlisted joint venture with little disclosure. Pure Foods has thrived selling liver pastes and other fare. Now San Miguel will have to be persuasive about a different kind of spread - its subsidiary's valuation gap.

Regresar