Il tuo carrello

Notizie Aziendali

E-Malt news

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

I nostri malti

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Tappi 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Ricette per birra

Certificati

-

Malt Kosher Certificate July 2025-June 2026

Malt Kosher Certificate July 2025-June 2026

-

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

-

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

-

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

-

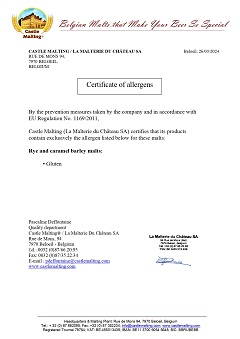

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Suggerimento

Japan & China: Asahi confirms intention to sell all or part of its 19.99% stake in Tsingtao Brewery

Japan & China: Asahi confirms intention to sell all or part of its 19.99% stake in Tsingtao Brewery

Japan's Asahi Group Holdings said on October 12 it is considering selling all or part of its 19.99 percent stake in Tsingtao Brewery Co Ltd, its latest divestment from China's beer industry as it seeks growth in Europe and other Asian markets, The New York Times reported.

Asahi's decision to sell the stake, which it acquired in 2009 for around $666.50 million, follows its announcement in June to sell its 20 percent stake in Chinese brewer Tingyi-Asahi Beverages Holding Co Ltd for $612 million.

Tsingtao said Asahi holds 270.1 million of its Hong Kong listed H-shares. At Thursday's closing price, the stake would be valued at nearly HK$8.5 billion (£976 million).

The maker of Japan's best-selling beer, Asahi Super Dry, has been intensifying its focus on Europe, scooping up a group of eastern European beer brands from Anheuser-Busch InBev for 7.3 billion euros late last year.

That move gave the company around 9 percent of the European beer market, excluding Russia.

"We are engaging in efforts to 'restructure our business portfolio with a focus on asset efficiency,' to assess whether each business contributes to sustainable enhancement of corporate value," Asahi said in a statement.

The company has said that it would restructure its operations in Southeast Asia and China, regions which are facing increased competition as the market consolidates just as growth slows.

It did not identify a potential buyer or selling price for the stake.

Tsingtao's shares in Hong Kong ended down 2.3 percent before the announcement, and have struggled for traction over the past 12 months.

China is the world's largest beer market by sales, but profits have been harder to come by amid fierce competition between local brewers and global beer giants AB InBev, Heineken NV and Carlsberg.

Torna