Uw winkelwagen

Bedrijfsnieuws

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Onze mouten

Onze hoppen

New Hops

Onze gisten

Onze kruiden

Onze suikers

Onze kroonkurken

-

Kroonkurken 26mm TFS-PVC Free, Purple Opaque col. 2274 (10000/box)

Toevoegen aan kar

Kroonkurken 26mm TFS-PVC Free, Purple Opaque col. 2274 (10000/box)

Toevoegen aan kar

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

-

Kroonkurken 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Toevoegen aan kar

Kroonkurken 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Toevoegen aan kar

-

CC29mm TFS-PVC Free, Green with oxygen scav.(6500/box)

Toevoegen aan kar

CC29mm TFS-PVC Free, Green with oxygen scav.(6500/box)

Toevoegen aan kar

-

Kroonkurken 26mm TFS-PVC Free, Blue Neu col. 20120 (10000/box)

Toevoegen aan kar

Kroonkurken 26mm TFS-PVC Free, Blue Neu col. 20120 (10000/box)

Toevoegen aan kar

Bier Recepten

Certificaten

Suggestie

Thailand: Beer producers can be hit the hardest by recent taxes hike

Thailand: Beer producers can be hit the hardest by recent taxes hike

Thailand's recent hike in "sin taxes" could hit beer producers the hardest as it comes just before the funeral of the late king - when alcohol consumption is likely to slow down considerably, the Nikkei Asian Review reported on September 30.

Beer sales in Thailand are sensitive to price, economic conditions and the overall mood in the country, said a recently released Fitch Ratings report, citing declines in sales volumes of between 5% and 14% seen after various tax hikes over the past few years.

The government has been raising excise taxes on tobacco, alcohol and sugary drinks on health grounds. This time, the hike is expected to bring in an additional 12 billion baht ($360 million) to state coffers, with 5 billion baht - the largest portion - to come from beer.

As of Sept. 16, the excise tax brewers must pay was increased by 0.5 to 2.66 baht for beers ranging up from 320ml cans, which analysts calculate is a 1-5% increase in retail prices.

This is a minor jump compared with previous hikes. In 2009 the excise tax on beer went up 27%, said Andy Sim, senior vice president of equity research at DBS Bank.

However, Sim pointed out that investors may well be more concerned about the timing. The cremation ceremonies for King Bhumibol Adulyadej are scheduled for Oct. 25 to 29. The somber mood is expected to curb alcohol consumption, with fewer people eating out or having weddings, just as they did in the months after the much revered monarch's passing on Oct. 13 last year.

Singapore-listed Thai Beverage, the maker of Chang beer, has seen its share price fall 3.2% in the past month compared with a 1.7 % drop in the benchmark Straits Times Index.

The decline has partly been attributed to last month's announcement that the company would make a full-fledged entry into the fast-food industry through the acquisition of KFC outlets in Thailand. But investors are also factoring in uncertainties related to the tax hike and the cremation, said Sim. "Stock prices could pick up again early in 2018 when post-funeral consumption recovers," he said.

Fitch Ratings suggested in its report that some brewers may even be reluctant to pass on the cost to drinkers and could absorb the higher prices themselves rather than see a drop in sales.

The price of beer remains unchanged at major retailers such as CP All, the operator of 7-Eleven convenience stores in Thailand. A 330ml can of beer from a major brand such as Leo, Singha or Chang costs around 40 baht.

Industry observers say that it could take another few weeks for retail prices to change as stocks levied under the previous rate have yet to be sold.

This is the first time the sin tax has been applied to sugar content in non-alcoholic drinks, which will be the second largest contributor to state coffers from the hike, drawing an expected 2.5 billion baht.

The tax will target beverages such as sweetened green tea and coffee, fruit juices, energy drinks and carbonated drinks and full implementation is scheduled for late 2019.

The initial tax as of Sep. 16 ranges from 0.06-2.05 baht per product, depending on the sugar content and type of drink.

Players in the saturated green tea market could be hit hardest, according to analysts. Companies are already offering products at rock-bottom prices - as low as 10 baht for a 500-ml bottle.

Fitch said that the competition "limits producers' abilities to pass on cost increase to customers" although they can alter the sugar content to minimize the tax-cost increase during the two-year grace period.

Syrus Securities analyst Sureeporn Teewasuwet said that the tax hike will encourage companies to venture abroad for further growth. Ichitan, the second-largest tea drink maker, for example, currently generates 90% of its sales within Thailand. "There is no supporting factor of growth in Thailand and that is why Ichitan is seeking growth in Indonesia and neighboring countries like Cambodia, Laos and Vietnam," she said.

Back

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Belgosuc Sugar, Irradiation’ statement, 2020

Belgosuc Sugar, Irradiation’ statement, 2020

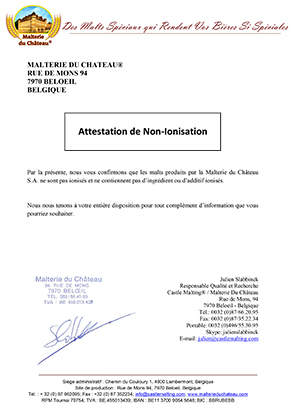

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

Top Hop - ISO Certificate 2021-2024

Top Hop - ISO Certificate 2021-2024

Hops, HVG, Organic Certificate 2024

Hops, HVG, Organic Certificate 2024